Everyone wants the opportunity for a better life. However, some people are limited by conditions beyond their control – from ongoing conflict to economic uncertainty – making them vulnerable to exploitation.

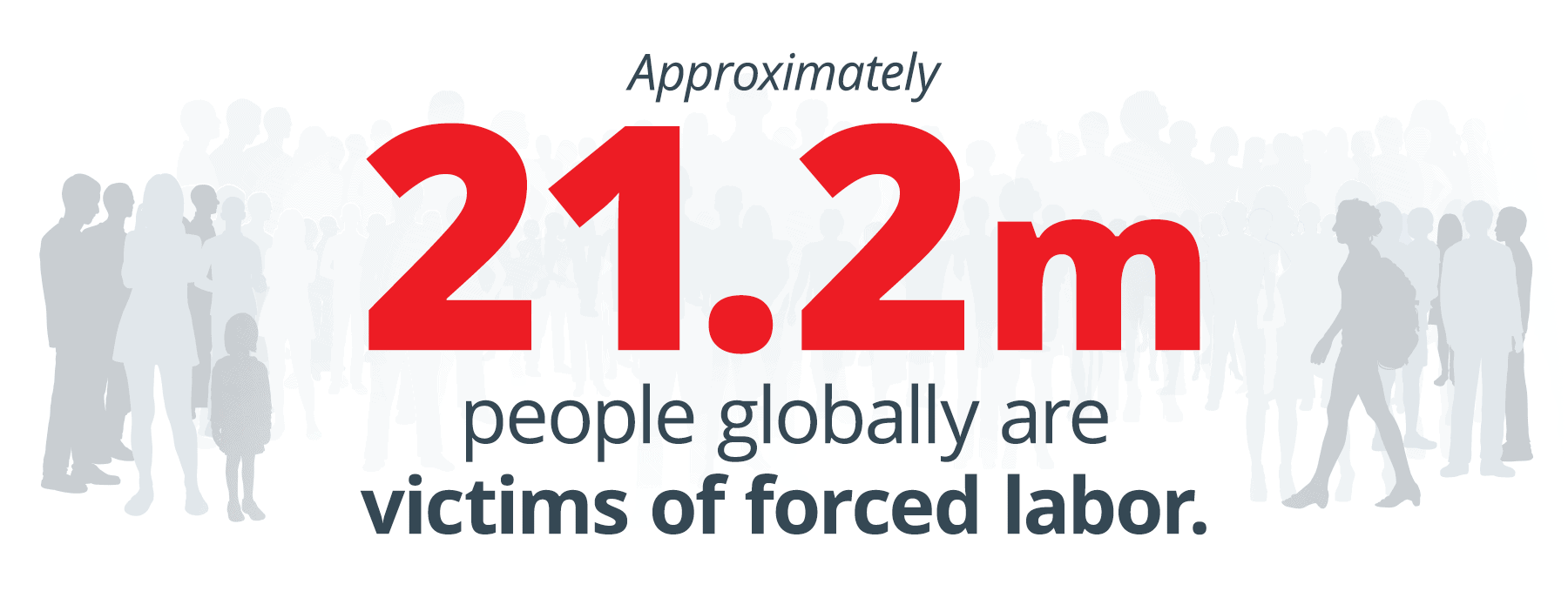

According to the U.S. Department of State, approximately 21.2 million people globally are victims of forced labor at any given time. The victims of forced labor are frequently exploited by the private sector or through state-imposed (nation) programs.

Those victimized and forced into labor situations have similar stories – seeking a better life in a new country, they were recruited under false pretenses for employment. Once relocated and isolated, traffickers capitalized on their vulnerability.

Those victimized and forced into labor situations have similar stories – seeking a better life in a new country, they were recruited under false pretenses for employment. Once relocated and isolated, traffickers capitalized on their vulnerability.

The Role of Financial Institutions in Combatting Forced Labor

Financial institutions have a unique advantage to help uncover forced labor situations by understanding customer behavior. During the onboarding process, front-line staff should note:

- If their new customer appears to be there independently, or at the will of another individual.

- Are they able to communicate with staff or are there language barriers requiring a third-party to speak for them?

- If they are new to the country, what is their country of origin and immigration or visitor status?

- Are they currently employed and in what type of business?

- What are their housing accommodations and is it the same as their place of employment?

“For predators and human traffickers, war is not a tragedy. It is an opportunity. And women and children are the targets.”

– Antonio Guterres, Secretary-General of the United Nations

For existing customers, financial institutions can look for several key indicators within a customer’s banking profile and transaction records to uncover the story of an individual caught in a forced labor situation:

- Forced labor impacts people broadly across age and gender – 47% are adult females, 39% adult males and 14% are children.

- Service industry and manual labor jobs are higher risk areas of employment, as they do not often require higher levels of education or English as a requirement.

- Accounts will often be new and have limited transactions. In fact, despite a regular paycheck, typical day-to-day transactions associated with food, rent, bills, and entertainment will likely be absent.

- The customer’s account balance will average near zero – when paychecks are deposited, they are instantly drawn down.

- Online profiles linked to social media will likely be absent.

- There may be large ticket items linked to their accounts, such as loans or bills, that are not in line with their other transaction habits.

While no one piece of evidence can tell the story of human trafficking on its own, cumulatively, layers of evidence can be considered in context to give investigators a broader picture and insight into an individual’s circumstance.

Financial institutions have the power to uncover and bring to light the victims and perpetrators of this crime, with the hope of empowering people to become survivors and bring justice to the criminals involved.

This special blog series has focused on three of the primary forms of human trafficking – domestic sex trafficking, international sex trafficking and forced labor – and where financial institutions can have the most significant and immediate impact. To learn more, download a copy of our eBook aimed at helping bank investigators in their fight against this crime: Human Trafficking: Know the Behavior, Uncover the Crime.