Criminals will exploit the most vulnerable in society for significant financial gain. According to Nasdaq’s Global Financial Crime Report, in 2023, $346.7B of illicit funds was linked to human trafficking activity – although this number is likely only a fraction of the true scope of this unconscionable crime.

FinCEN’s Financial Trend Analysis (FTA) examined BSA reports from January 2020 to December 2021, exploring the use of convertible virtual currency (CVC) to facilitate suspected online child sexual exploitation (OCSE), child sexual abuse material (CSAM), and human trafficking.

BSA Reports Show Increases in Human Trafficking and OCSE Involving CVC

FinCEN revealed shocking insights, with the total number of OCSE-and human trafficking-related BSA reports involving CVC increasing from 336 to 1,975 in the examined time frame. As well, there was an 23% increase in human trafficking related BSA reports from 2020 to 2021. Over the same period, FinCEN found that not only the volume of BSA reports significantly increased, but the value of reported suspicious activity also grew substantially, from $133M to $278M.

One type of CVC particularly prevalent in FinCEN’s report was Bitcoin, overwhelmingly used in 93% of reports examined. From the data provided, FinCEN identified over 1,800 unique bitcoin wallet addresses related to suspected human trafficking offenses.

FinCEN Identifies Four Main Typologies

In their analysis, FinCEN identified four primary money laundering typologies related to the use of CVC to facilitate human trafficking, OCSE, and CSAM. These include:

- Darknet Marketplaces that distribute CSAM, comprised of anonymized websites only accessible with specific software, such as The Onion Router (Tor) network.

- Peer-to-Peer (P2P) Exchanges, where fiat currencies are exchanged for CVC, or one CVC for another.

- CVC Mixers, which work to conceal the illicit destination of funds from the virtual asset service providers to convert fiat currency into CVC.

- CVC Kiosks, similar to ATMs, where individuals can exchange fiat currency for CVC, CVC for fiat currency, or one CVC for another.

Considerations for Financial Institutions

CVC has become the currency of choice for illicit activity, allowing criminals to obfuscate the source of funds. Preventing criminals from exploiting the anonymity of CVC is essential for financial institution, evident with FinCEN’s inclusion of this issue into their priorities for anti-money laundering and countering the financing of terrorism.

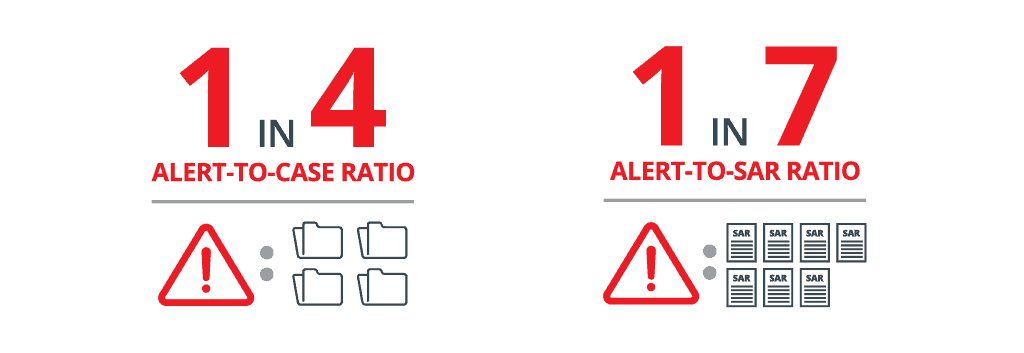

Verafin is committed to helping investigators with our expert human trafficking analytics, which significantly reduce false positive alerts by analyzing a wide range of data to create a more accurate picture of true risk. Our analytics had exceptional results – our Human Trafficking – Victim agent produces an Alert-to-Case ratio of 1 in 4, and an Alert-to-SAR ratio of 1 in 7. As well, our OFAC sensitivity matching analytics deliver a near 100% match rate.

Knowledge is power in preventing and detecting human trafficking. Financial institutions can play an important role by providing actionable information to law enforcement. Verafin’s anti-financial crime platform helps institutions submit Suspicious Activity Reports (SARs) quickly and efficiently by automating tasks associated with generating, completing, and filing these reports.

To learn more about how Verafin can help your financial institution fight this complex and heinous crime, download our eBook: Human Trafficking: Know the Behavior, Uncover the Crime