“$350 billion dollars from human trafficking. Imagine how many victims had to suffer — sweat, blood, and tears — for $350 billion dollars.”

– Timea Nagy, Human Trafficking Activist & Survivor

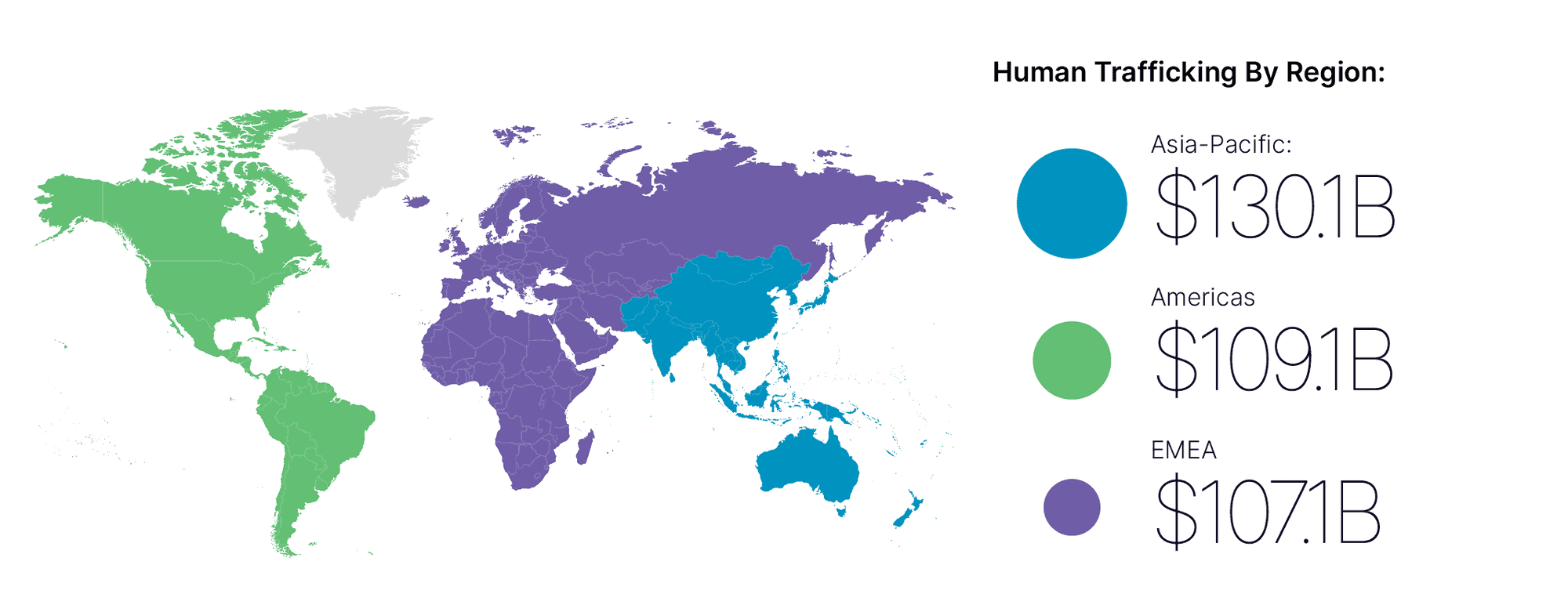

Human trafficking is a global humanitarian crisis. At any moment, tens of millions of people are coerced into labor or sex work. In 2023, according to the Nasdaq 2024 Global Financial Crime Report, $346.7 billion in illicit funds were linked to this heinous crime — with amounts far greater likely going undetected. Touching every region on earth, human trafficking is among the most heinous crimes imaginable, and it can happen to anyone.

Unmeasurable: The Human Impact

Unmeasurable: The Human Impact

“One of the most striking behaviors to look for in a victim of human trafficking is not the presence of a life being lived, but the absence of one. The trafficker takes everything they have. But it doesn’t have to be that way.”

– Timea Nagy, Human Trafficking Activist & Survivor

Traffickers commodify innocent people for illicit gain, resulting in the exploitation of millions of victims annually and massive profits for their traffickers. Many victims suffer in plain sight but are never identified by authorities — escaping on their own with scars that last a lifetime. In the Nasdaq report, Timea Nagy, a survivor of human trafficking, described how the experience traded her freedom for thousands of dollars in criminal profits and years of trauma.

Modern Slavery

Human trafficking is modern slavery. From labor traffickers forcing victims to work in destitute, to domestic sex traffickers targeting citizens in their own neighborhoods and international sex traffickers recruiting victims from overseas, profit is prioritized above all else. The human impact of this injustice cannot be understated — and financial institutions are part of the solution.

Tips For Financial Institutions

The financial system can play a key role in identifying trafficking activity, providing intelligence to law enforcement, and aiding prosecution of traffickers. With human trafficking a pervasive problem, these tips can help your institution fight back.

- Watch for Warning Signs

Ensure your institution and staff are mindful of known indicators for human trafficking can lead to intervention at the earliest opportunity. This can include a third party attempting to fill out paperwork or insisting on speaking on behalf of the customer, or a customer showing signs of poor hygiene, malnourishment, fatigue, physical and/or sexual abuse, physical restraint, confinement, or torture. - Implement Improved Technology

Leveraging modern technology, including artificial intelligence, financial institutions can examine large volumes of transactions to identify behavioral patterns that signal potential human trafficking activity. An anti-financial crime solution that leverages big data intelligence in a cloud environment can help your institution effectively identify potential victims and front companies. - Follow the Money

Following the money can help expedite a victim’s escape from slavery, prevent further trauma, and disrupt criminals that commoditize human beings for profit. By deploying a financial crime management solution that enables advanced visualization of relationships, your institution can uncover important connections in human trafficking investigations that may lead to the discovery of organized crime rings and additional accounts tied to trafficking activity.

Financial institutions have a critical role to play in ending human trafficking — a humanitarian crisis and key driver for money laundering. As an industry, we must work together to be part of the solution.

The Scale of Financial Crime Blog Series

Read the rest of the Scale of Financial Crime series — 5-minute blogs with key insights from the 2024 Global Financial Crime Report and tips for your financial institution to respond.

[Part 1] A $3.1 Trillion Financial Crime Epidemic

A quick overview of the world’s multi-trillion-dollar epidemic and its human impacts.

[Part 2] Romance Scams: A Heartless Reality

As romance scams cause billions in losses, the emotional toll is immeasurable.

[Part 3] Elder Fraud: Prevalent & Preventable

Elder fraud is drastically underreported — and still a $77.7 billion global issue.

[Part 4] Business Email Compromise: A Global Menace

BEC is a $6.7 billion problem where victims lose more than money.

[Industry Commentary] Turning the Tide: Expert Insights on $3.1T in Financial Crime

Dive deeper into the Global Financial Crime Report with perspectives from industry experts.