Focusing on striking revelations from the recently released Nasdaq 2024 Global Financial Crime Report, Verafin hosted an expert panel presentation on the implications of over $3.1 trillion in illicit money that flowed through the financial system in 2023.

This special blog explores key highlights from this conversation between industry experts Brendan Brothers, Nasdaq; Jim Richards, RegTech Consulting LLC; Timea Nagy, Industry Expert and Advisor; and, Daniel Tannebaum, Oliver Wyman, on the human impacts of financial crime, the challenges of technology enabled fraud, and the need for collaboration to bridge the gap as financial institutions respond to the mounting pressures of financial crime.

Click to watch our on-demand webinar.

The Human Side of Financial Crime

Financial crime does not happen in a vacuum. Beyond ledgers and spreadsheets, financial transactions moving through bank accounts, compliance checkboxes, and reports being filed, it has life changing effects on the lives of victims. Understanding the impact of these crimes on people is crucial — the experiences of survivors provide context to investigators’ work and underscores the importance of their role in prevention.

“When a bank investigator can understand, through my story, and the story of other survivors, that when you file a report, you could potentially save somebody from lifelong trauma,” stated Timea Nagy. “It’s important to be able to communicate that we are not just a number, behind those names and brackets and files, there are human beings – flesh and blood – with stories, kids, and years of trauma that could be prevented.”

With unfathomable figures attached to some of the most serious crimes in 2023 – human trafficking $346.7 billion; elder fraud $77.7 billion; terrorist financing $11.5 billion – the global epidemic of financial crime is vast and overwhelming. These numbers often overshadow the heavy toll of this injustice on everyday people — and as the financial industry fights back, remaining focused on these broader impacts is crucial.

“I think the problem is that the human impact is not considered in policies and programs like it should be,” noted Jim Richards. “It might be in the front, or even in the back of the minds of the people that are fighting financial crimes, but it is not in the minds of most institutions, and it’s certainly not in the minds of the regulators. We know that, because the word compliance tells us that the focus is on complying with laws and regulations and not on fighting financial crime and helping people that are impacted. We need to be fighting financial crime and focusing on the victims.”

Technology: The Challenges of Change

As the financial industry progresses with new technology and advancements in payment and transaction options, it is met with conflicting challenges such as balancing a frictionless customer experience focused on the immediacy of funds with threats from authorized push payment scams and the faster fraud that this rapidity enables.

“The speed of faster payments does create some significant complexities, not just for fraud, but for compliance,” observed Daniel Tannebaum. “With the rise of P2P payment networks, these transactions are generally not reversible, so the challenging nature of these networks, the speed, has really created additional opportunities for criminals to seize upon people that may not think about checking the information of the person instructing them to move money.”

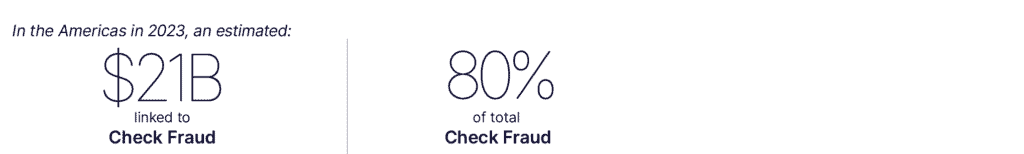

While consumers and the industry are focusing on real-time and faster payment channels, it is the persistent growth and impact of check fraud that led to the Department of the Treasury highlighting this topic in the recent 2024 National Money Laundering Risk Assessment.

“Check fraud really took off in 2003 with the electronification of paper checks,” explained Jim Richards. “That led to a spike in check fraud and it remains a huge problem. In the 2024 National Money Laundering Risk Assessment, check fraud was the number one threat that they listed. It’s a special focus in this year’s report.”

With over $21 billion linked to check fraud in the Americas in 2023, accounting for 80% of check fraud globally, fraudsters will take the path of least resistance to commit their crimes and exploit weaknesses within the financial system.

Moving the Needle on Financial Crime

Financial crime is a $3.1 trillion worldwide epidemic. Faced with such a monumental challenge, the task at hand – to detect and prevent many of society’s most insidious crimes – can seem overwhelming for financial institutions acting on their own. Utilizing opportunities for collaboration across the industry enables a collective approach to push back against criminal activity — and the benefits are increasingly clear.

“I think we are making great progress,” stated Jim Richards. “It’s not always obvious from Tuesday to Wednesday, or from 2022 to 2024, but if you look overall… the ability to form consortiums, the ability to share intelligence and share information, the great partnerships that we are having with law enforcement that we never had before — we are making progress.”

As the United States works to create a more fluid and integrated financial system that allows for a more collective approach to financial crime prevention, governments, financial institutions, and regulatory bodies around the world are demonstrating the power of effective partnerships in stopping crime.

“It’s an evolution. When you look at other jurisdictions around the world, where law enforcement, the private sector, the regulators, everyone is singing from the same hymn book to try and identify these issues – you are seeing these issues addressed,” commented Daniel Tannebaum. “These threats only get purged from an economy when there is that collective action. In the U.S. there’s a huge focus on trying to enhance that, but there’s a lot of hurdles to get there. But I do think we’ve moved further along, globally, by having some of these consortium approaches around the world, and they have been proven to work.”

These threats only get purged from an economy when there is that collective action.

– Daniel Tannebaum, Oliver Wyman

At the very heart of financial crime are the people impacted, and those trying to prevent it and fight back. Having the right tools, the ability to access information, and effective training, although fundamental, are no panacea alone. A broad commitment across the entire industry, from government, regulators and institutions to work in unison and fully and holistically respond to the mounting challenge of financial crime is necessary to end this humanitarian crisis.

“What I’ve learned, is technology is only as good as your people, and your people are only good as your policies,” noted Timea Nagy. “We can have really good technology, but not understand what we’re looking for. Really good investigators, but not have the resources or the money to use the technology. When financial institutions have the right technology, the right solutions, and a very dedicated team that is trained, they don’t just check the boxes and the results speak for themselves.”

Collaboration across the industry and within institutions is essential in the fight against financial crime. By focusing on the human impact of crime, regulatory bodies, law enforcement, and financial institutions can collectively shape their policies, procedures, and guidance to the benefit of all society. It is in working together that, as an industry, we can turn the tide on financial crime.

To listen to the full discussion and a deeper exploration of these insights, watch the complete panel recording here: The Scale and Impact of $3 Trillion in Financial Crime.

The Scale of Financial Crime Blog Series

Read the the Scale of Financial Crime series — 5-minute blogs with key insights from the 2024 Global Financial Crime Report and tips for your financial institution to respond.

[Part 1] A $3.1 Trillion Financial Crime Epidemic

A quick overview of the world’s multi-trillion-dollar epidemic and its human impacts.

[Part 2] Romance Scams: A Heartless Reality

As romance scams cause billions in losses, the emotional toll is immeasurable.

[Part 3] Elder Fraud: Prevalent & Preventable

Elder fraud is drastically underreported — and still a $77.7 billion global issue.

[Part 4] Business Email Compromise: A Global Menace

BEC is a $6.7 billion problem where victims lose more than money.

[Part 5] Human Trafficking: A Humanitarian Crisis

Human trafficking is a $346.7 billion criminal enterprise where profit is above all else.

Event Panelists

DANIEL TANNEBAUM

Partner, Global Anti-Financial Crime Practice Leader, Risk & Public Policy at Oliver Wyman

Senior Fellow at the Atlantic Council

Daniel Tannebaum is a Partner at Oliver Wyman where he leads the Global Anti-Financial Crime Practice. He has advised institutions on AML and Sanctions matters in over 30 countries across the Americas, EMEA and APAC. He’s led the design of target operating models, program governance frameworks, policies and procedures, and communication strategies for over a dozen global financial institutions. Formerly he served at the Federal Reserve Bank of New York and the Office of Foreign Assets Control, U.S. Department of the Treasury. Dan is a highly sought-after speaker on financial crimes issues and is often quoted in print publications and is a regular guest on business television and radio. He is also a Senior Fellow with the Atlantic Council.

TIMEA NAGY

Industry Expert and Advisor

Founder, Timea’s Cause

Timea is an award-winning human rights activist, United Nations advisor, and best-selling author. Her journey as a survivor of sex trafficking has led her to become a leading voice and change-maker in the national and global movement against this heinous crime. In 2009, Timea founded Walk with Me, a non-profit organization that has helped over 300 victims and assisted over 500 human trafficking-related investigations throughout Canada. Her efforts have been widely recognized, including by Queen Elizabeth II and the Prime Minister of Canada, and her work has reached hundreds of thousands of people, sectors such as the financial industry and law enforcement, and social media giants such as Facebook and Airbnb. Timea’s memoir, Out of the Shadows, became an instant bestseller the week of its publishing date — nationwide.

JIM RICHARDS

Founder and Principal, RegTech Consulting LLC

Former Executive Vice-President and Director of Financial Crimes Risk Management, Wells Fargo

Senior Strategic Advisor, Verafin

Jim Richards is the Principal and Founder of RegTech Consulting, a private consultancy aimed at developing the next generation of BSA/AML and financial crimes professionals, technologies, and programs.

Prior to founding RegTech Consulting, Jim worked for almost 13 years at Wells Fargo & Co. as the BSA Officer and Global Head of Financial Crimes Risk Management. He was a founding member of the Association of Certified Anti-Money Laundering Specialists (ACAMS) Advisory Board, a three-time member of the Treasury Department’s BSA Advisory Group (BSAAG), and the author of Transnational Criminal Organizations, Cybercrime, and Money Laundering. Jim is currently working with Verafin in a role as Senior Strategic Advisor.

BRENDAN BROTHERS

EVP, Head of Anti-Financial Crime, Nasdaq

Co-Founder, Verafin

Brendan, a Software Engineer and co-founder of Verafin, has used his expertise to support all aspects of the company since its inception in 2003. With his specialized knowledge of robotics, behavior-based analytics, and probabilistic networks, combined with nearly 20 years of deep-domain expertise in anti-financial crime, Brendan is considered an industry expert and thought leader on innovative approaches to combat fraud and money laundering.

Brendan serves as EVP and Head of Nasdaq’s Anti-Financial Crime (AFC) business, which provides anti-financial crime management solutions used by thousands of banks, exchange operators, and other financial institutions. With a strategic approach, he guides AFC teams towards a shared vision to protect all the world’s financial interactions.