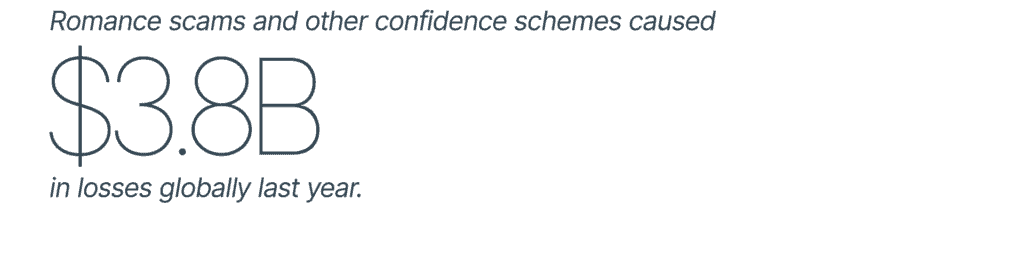

Through lies and deceit, fraudsters will wholly dedicate themselves to gaining a victim’s trust and then abuse it for financial gain. Romance scams epitomize this tactic. Among the world’s fastest growing frauds, romance scams and other confidence schemes caused $3.8 billion in losses globally last year according to the Nasdaq 2024 Global Financial Crime Report. Despite representing a fraction of the global losses attributed to consumer scams, at less than 9%, the toll inflicted by romance scams is immense — no statistics can capture the mental anguish and emotional consequences felt by its victims.

Unmeasurable: The Human Impact

Unmeasurable: The Human Impact

“Losing the money was obviously devastating. But what’s worse is what it does to your heart, your trust.”

– Debby Montgomery Johnson, Fraud Awareness & Victim Support Advocate

Romance scammers dedicate themselves to cultivating fictitious relationships with their victims, often making contact through online dating sites or social media. Although initially based on emotional connection, the relationship becomes defined by escalating requests for funds, typically ending in considerable monetary losses and immeasurable heartbreak for the victim. These scams often undermine a victim’s entire support system, and victims may be wholly convinced that their relationship with the fraudster is genuine, making intervention highly challenging. In some cases, they act as unwitting money mules, moving funds for the fraudsters — without realizing they are laundering the profits of other crimes. After discovering the relationship was a deception, people may struggle to come forward due to grief, social stigma and feelings of violation and self-blame that are common among victims of fraud — the aftermath can result in severe psychological distress and even physical harm.

Tips for Financial Institutions

Working directly with customers, financial institutions are a crucial frontline defense against romance scams and other fraud schemes. With romance scams on the rise, your institution can help empower victims and enhance prevention.

- Practice Vigilance & Tactful Inquiry

Monitoring for signs that a customer is under the influence of a romance scammer can help uncover instances of potential exploitation at the earliest opportunity, leading to intervention that may be essential in protecting victims. These signs can be behavioral, such as a customer mentioning an overseas relationship with an individual they have never met, or financial, such as a client uncharacteristically using lines of credit or pulling from investments. Victims may also attempt to send large payments using wires or cryptocurrency — transaction channels that are often irrevocable and favored in romance scams. Tactful inquiry and open questioning are crucial, as victims may be reluctant to cooperate due to social stigma and manipulation by the fraudster. - Implement Effective Fraud Controls

An effective financial crime management solution is paramount to prevent the financial and emotional consequences of romance scams. By deploying a solution that combines real-time analysis with consortium analytics to profile the sending and receiving accounts, financial institutions can interdict to stop suspicious payments before the funds are sent. - Empower Recovery

Romance scams can lead to financial ruin for victims who are often persuaded to transfer funds until ultimately they have nothing more to give. Financial institutions have an essential role in helping survivors rebuild their financial future by supporting their re-entry to the banking system.

The impact of romance scams is far reaching and lasting — emotionally and financially. As the scale of this threat deepens, so must our commitment as an industry to take decisive action.

The Scale of Financial Crime Blog Series

Read the rest of the Scale of Financial Crime series — 5-minute blogs with key insights from the 2024 Global Financial Crime Report and tips for your financial institution to respond.

[Part 1] A $3.1 Trillion Financial Crime Epidemic

A quick overview of the world’s multi-trillion-dollar epidemic and its human impacts.

[Part 3] Elder Fraud: Prevalent & Preventable

Elder fraud is drastically underreported — and still a $77.7 billion global issue.

[Part 4] Business Email Compromise: A Global Menace

BEC is a $6.7 billion problem where victims lose more than money.

[Part 5] Human Trafficking: A Humanitarian Crisis

Human trafficking is a $346.7 billion criminal enterprise where profit is above all else.

[Industry Commentary] Turning the Tide: Expert Insights on $3.1T in Financial Crime

Dive deeper into the Global Financial Crime Report with perspectives from industry experts.