The Russian invasion of Ukraine and the subsequent escalation of the Russian-Ukrainian war has been met with condemnation and resulted in severe economic sanctions from governments across the globe.

Sanctions are crucial to enforce foreign policy objectives and deter criminal activity globally, but implementing sanctions programs can be complex and presents risk to financial institutions. In the U.S., the Office of Foreign Assets Control (OFAC) is responsible for administering and enforcing economic and trade sanctions to align with national security goals, including Directives from Executive Orders relating to the Government of the Russian Federation. As the United States and other governments continue to impose economic sanctions against Russia, it is critical for financial institutions to keep pace with evolving sanctions orders. Maintaining an effective sanctions screening program that meets the growing complexities of sanctions compliance can help protect your institution from compliance risk and limit the funding of nefarious and illicit activity.

“Since 2000, the number of individuals and entities on America’s sanctions list has increased by more than tenfold, to 10,000.”

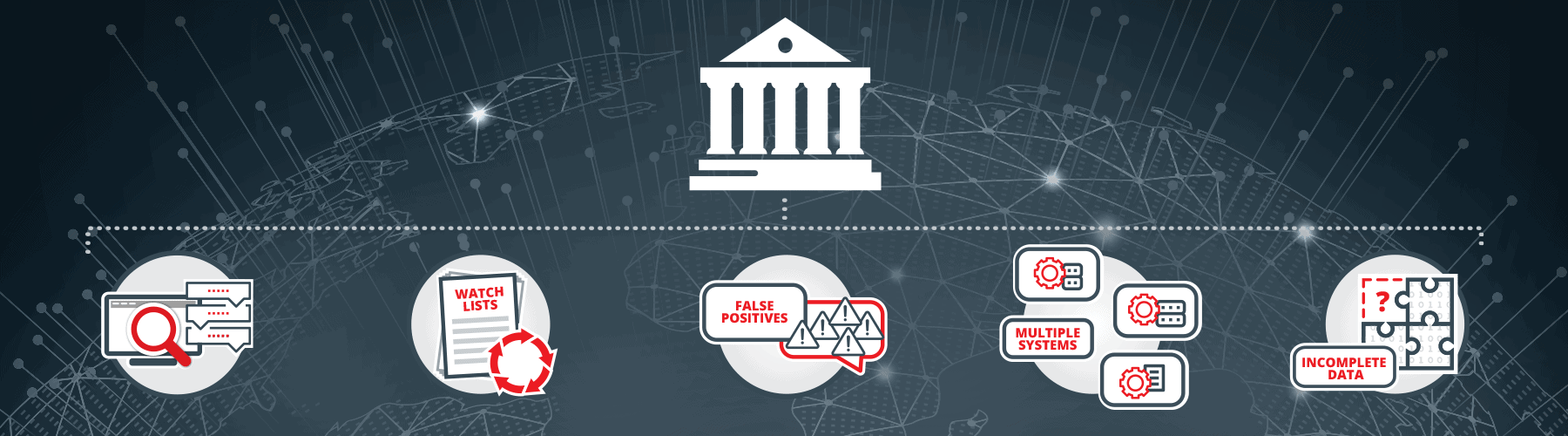

Challenges of Sanctions Screening for Financial Institutions

Financial institutions face increasing demands to identify and mitigate sanctions risks in the current geopolitical environment – presenting problems for financial institutions relying on legacy and disparate systems used across different channels. Broad and disparate approaches to sanctions management have culminated in the following challenges for institutions:

- Significant volumes of false positive alerts

- Inaccurate and incomplete data sets

- Outdated systems, technologies and watch lists

- Disparate screening and management systems

What is the Risk to Your Institution?

It is critical that financial institutions detect and report sanctions-related activities. Financial institutions have an obligation to block prohibited transactions, report such transactions to OFAC, and report additional information regarding potentially suspicious activity through SAR filings to FinCEN. This includes attempted transactions to sanctioned entities and regions or possible sanctions evasion tactics.

A strong risk-based compliance program is essential for institutions as “federal banking agencies evaluate OFAC compliance programs to ensure that all banks subject to their supervision comply with the sanctions.” Failing to report suspicious sanctions-related activity in a timely manner can result in civil and regulatory penalties for financial institutions, reputational damage, or unsatisfactory regulatory examinations. From 2011-2021, OFAC reached settlements related to apparent sanctions violations amounting to over $4.71B USD.

“OFAC strongly encourages organizations subject to U.S. jurisdictions to employ a risk-based approach to sanctions compliance by developing, implementing, and routinely updating a sanctions compliance program.”

Efficient and Effective Sanctions Screening and Management

Institutions should consider consolidated sanctions screening and management solutions to increase the efficiency and effectiveness of their sanctions compliance program. Verafin can help your compliance team efficiently investigate sanctions risks and report potentially suspicious activity — all in one place — so your team can effectively manage the growing complexities of today’s sanctions risks.

Verafin monitors customer transactions for potentially sanctioned or suspicious activities, presenting you with risk-rated evidence in high-quality alerts. With targeted sanctions screening analytics, automated watch list updates and integrated Case Management, Verafin:

- Reduces false positive alerts

- Strengthens audits and examinations

- Quickly adapts to changing regulations

The Russian-Ukrainian war has had a fundamental impact on the geopolitical climate of the world – among the consequences are a humanitarian crisis in Ukraine and upheaval for the global economy. Financial institutions play an important role – by maintaining an effective sanctions compliance program, your institution can meet the growing complexities of sanctions management and prevent the funding of nefarious crimes around the world.