Wire fraudsters are uncompromising, often targeting seniors with cruel elder abuse tactics from romance and investment scams to grandparent schemes. Since our previous blog on elder financial abuse, surging inflation and rising interest rates have strained senior’s modest budgets, leaving seniors vulnerable. Amid other exacerbating factors, from pandemic isolation measures to the rise of digital banking, seniors are facing an increased risk of falling victim to wire fraud scams.

Our anti-financial crime experts at Verafin recently published an unprecedented Wire Fraud Benchmarking Report, offering insights into wire fraud trends from a massive consortium-based data set in the Verafin Cloud. This major analysis shows wire fraudsters continuing to target seniors (people aged 55 or older) at alarming rates; the financial industry must remain informed of emerging trends and implement robust controls to protect this vulnerable group.

Seniors Clearly Targeted

Our analysis found that fraudsters have a clear preference for seniors, targeting them more often and for higher amounts. According to our Benchmarking Report, elderly persons were preferred victims compared to people in younger age brackets, accounting for 65% of occurrences and 66% of attempted wire fraud value in Q3 2021.

In absolute terms, the value of attempted wire fraud against seniors was significant and increased across all six analyzed quarters – an indicator of risk to financial institutions and their customers as wire fraudsters focus their efforts on this vulnerable segment.

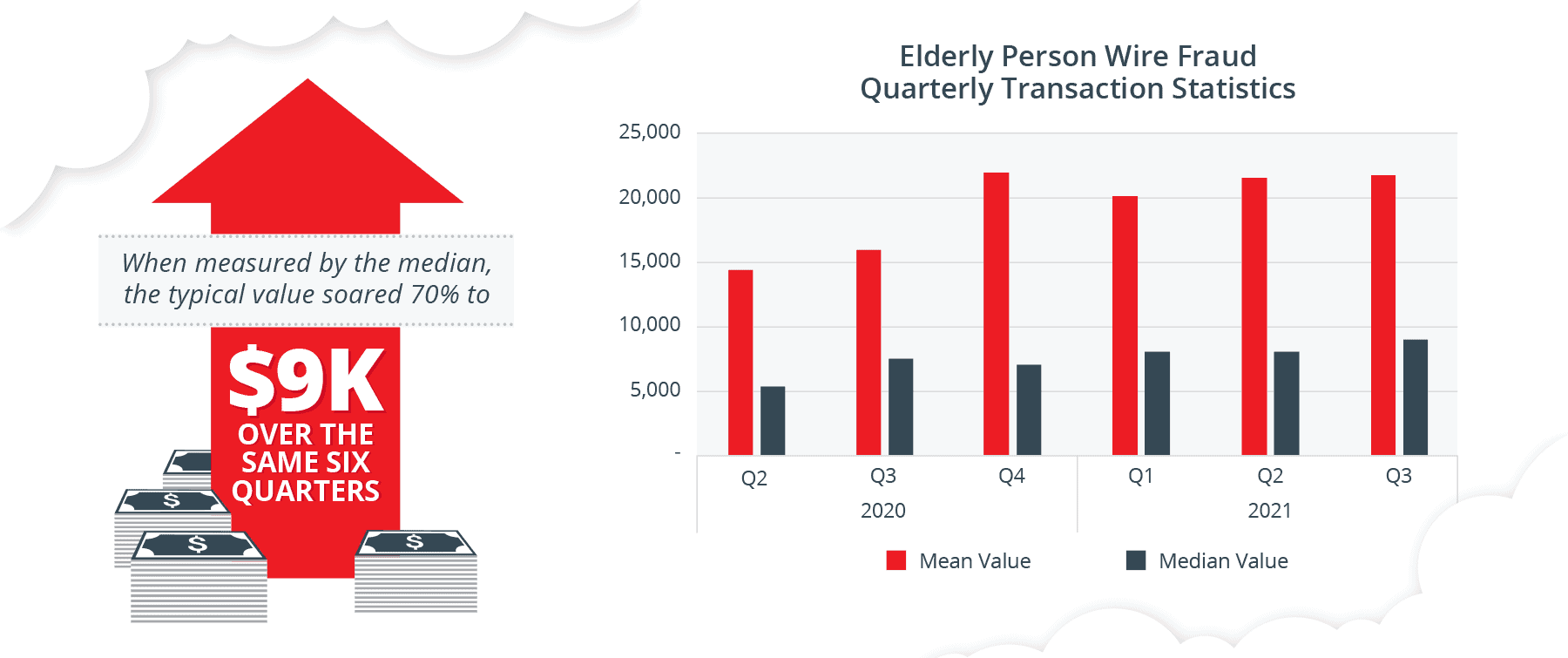

Growing Greed: Value Soars

Wire fraudsters are becoming more aggressive against seniors, with increasingly higher value wire fraud attempts. When measured by the mean, the typical value of attempted wire fraud against a senior rose 51% to $21.7K from Q2 2020 to Q3 2021. When measured by the median, the typical value soared 70% to $9K over the same six quarters. As institutions implement enhanced controls against Business Email Compromise (BEC), wire fraudsters may be shifting toward seniors to increase profits through more frequent, relatively smaller frauds.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

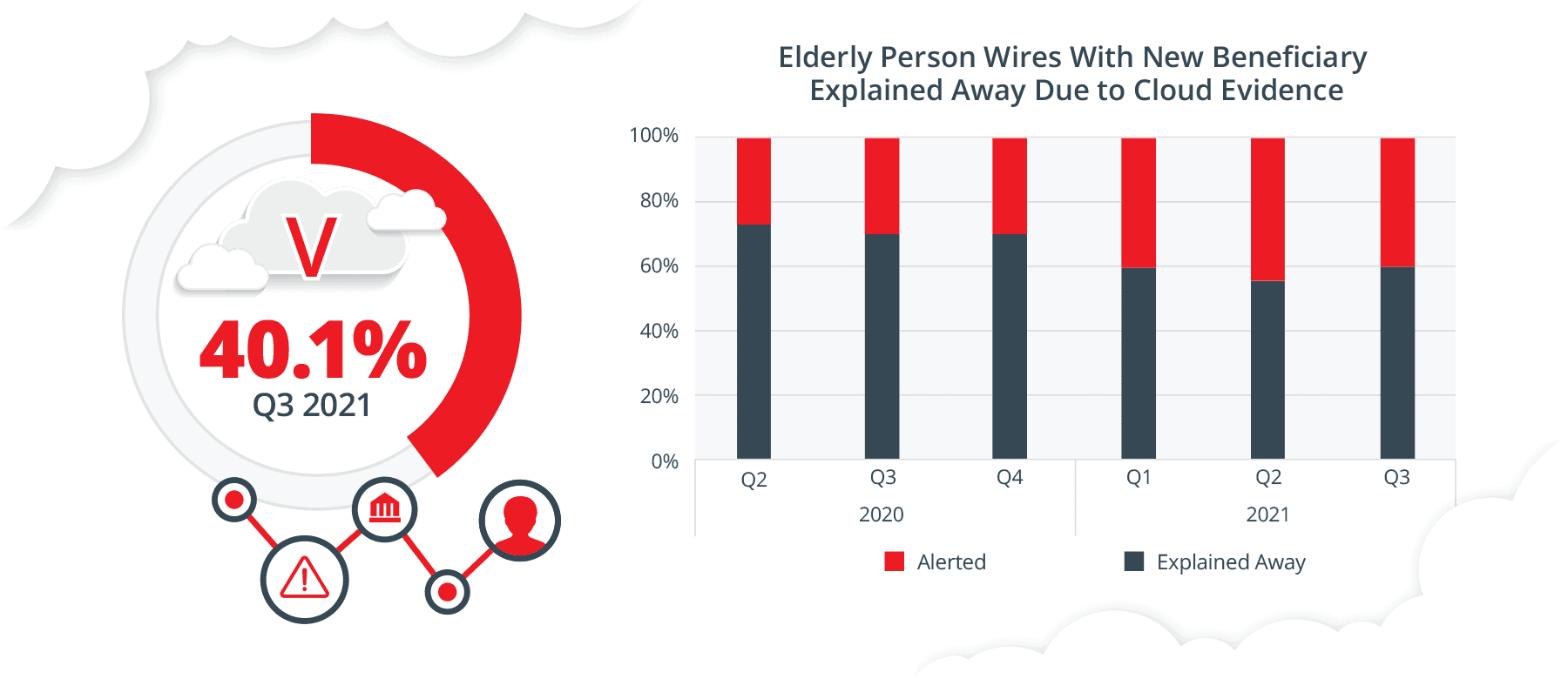

Benefits of Cloud-Based Evidence

While potentially devastating to seniors, whose livelihood may rely on pensions or other modest sources of income, the value of wire fraud attempts against this segment are typically too small to reliably detect with conventional rules or approaches that rely on the wire recipient being a new beneficiary.

Leveraging our immense data set in the Cloud, Verafin’s behavior-based Wire Fraud solution offers efficient and effective detection and significantly reduces alert volumes. From Q2 2020 to Q3 2021, our analytics significantly reduced the number of alerts requiring review — in other words, explained away these alerts — where the payee was a new beneficiary. The result was a 40.1% reduction in Q3 2021.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Preparing for Continued Threats

Our comprehensive analysis of Verafin Cloud data has highlighted wire fraud as a serious threat to seniors — and we anticipate further growth in this crime moving forward. Financial institutions must be prepared to take decisive action with behavior-based solutions leveraging machine learning and consortium-based data for enhanced detection. With targeted agents intelligently segmented by sender type, payee risk analysis in the Verafin Cloud and the ability to stop fraudulent wires in real time, Verafin can help protect your customers from loss — including vulnerable seniors.

For further wire fraud statistics, emerging trends, and key insights for your institution, download our Cloud Insights: Wire Fraud Benchmarking Report for Q1 2022.