Generating an estimated $150 billion per year, human trafficking is one of the most profitable and heinous international crimes. Human trafficking and human smuggling was identified in the AML/CFT National Priorities as one of eight “predicate crimes that generate illicit proceeds that illicit actors may launder through the financial system.”

Financial institutions aligning BSA/AML programs to the National Priorities and the 2022 National Risk Assessments should consider innovative financial crime management solutions that support risk-based BSA/AML programs, detect human trafficking and human smuggling activity, enable efficient investigations, and empower investigators to provide actionable intelligence to law enforcement.

A Predicate Crime

“Financial activity from human trafficking and human smuggling activities can intersect with the formal financial system at any point during the trafficking or smuggling process.”

– AML/CFT National Priorities

Criminals involved in human trafficking and human smuggling rely on multiple typologies for money laundering activity. Institutions should monitor their customer base for potentially suspicious activity, including the Red Flags highlighted in FinCEN’s 2014 Advisory and 2020 Supplemental Advisory.

Financial institutions are in a unique position to detect potentially suspicious activity and provide actionable intelligence to law enforcement. Investigators can play a critical role in the fight against human trafficking and protect potential victims from this heinous crime.

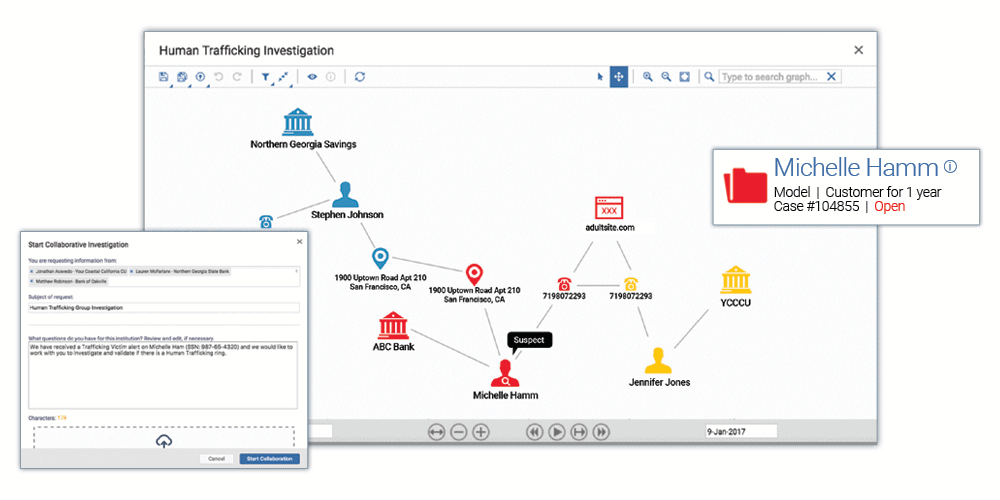

Empowering Investigators

Working with over 3500 customer partners, Verafin has developed, refined and tuned our behavior-based human trafficking analytics over many years. Verafin imports and analyzes an immense data set from multiple sources, including core data, financial systems data, and open-source data such as adult online classifieds, in the Verafin Cloud. We incorporate this cloud-based data set, along with expert feedback and industry advisories to develop highly targeted human trafficking analytics that identify and alert you to potential traffickers, victims, front companies, and human smuggling payments.

Our consolidated financial crime management platform presents investigators with risk-rated alerts based on cross-channel analysis in the Cloud. Visual storytelling tools such as geographic maps, balance charts, link analysis and relationship graphs maximize the effectiveness and efficiency of investigations, offering all the information you need – all in one place.

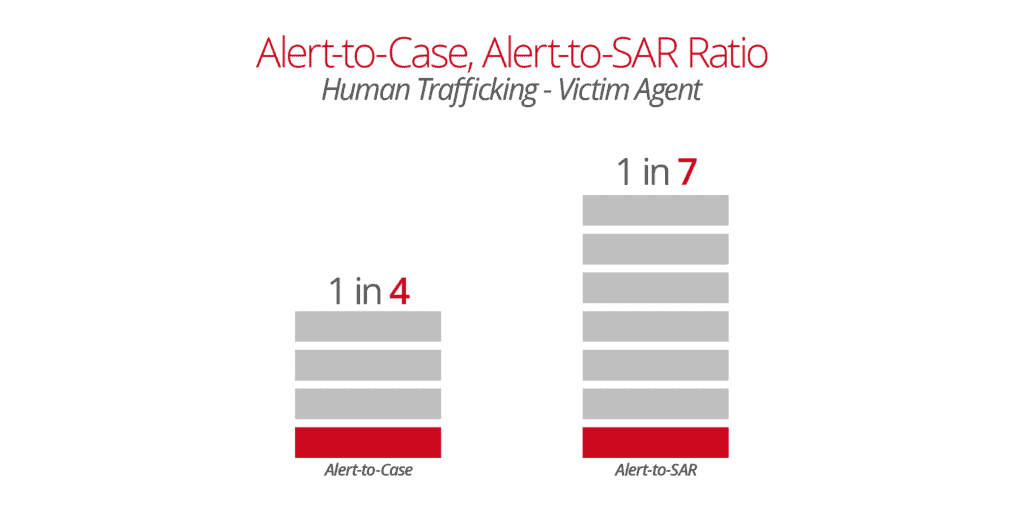

Verafin’s human trafficking analytical agents significantly reduce false positive alerts by analyzing a wide range of data to create a more accurate picture of true risk, with exceptional results: our Human Trafficking – Victim agent produces an Alert-to-Case ratio of 1 in 4, and an Alert-to-SAR ratio of 1 in 7. With more accurate alerts, investigators can detect potential human trafficking activity and quickly provide actionable information to law enforcement.

With continuous improvement of well-defined human trafficking typologies, leveraging consortium-based data to identify high-risk activity and information sharing to help investigators uncover important connections that can exist across multiple institutions, Verafin empowers financial crime investigators to detect potential human trafficking activity and provide actionable intelligence to law enforcement.

To learn more about how Verafin can help your financial institution fight this complex and heinous crime, download our Human Trafficking Brochure.