The need for greater effectiveness and efficiency in BSA/AML programs is acute.

Financial institutions must navigate the ever-changing landscape of regulatory compliance while simultaneously adapting to evolving criminal activity. But many institutions are limited to their own siloed data set – this siloed approach results in limited, fragmented views of criminal activity, leaving institutions vulnerable to complex money laundering challenges.

Institutions preparing for impending guidance from the AML Act of 2020 and aligning BSA/AML programs with the AML/CFT National Priorities and the 2022 National Risk Assessments should consider innovative approaches to AML that can empower BSA/AML teams to efficiently and effectively fight financial crime.

Considerations for Financial Institutions: AML/CFT National Priorities

The Priorities highlight money laundering and associated predicate crimes that generate illicit proceeds that may move through the financial system. When preparing to align financial crime management programs to the Priorities, financial institutions should consider:

Evolving AML/CFT Typologies

Financial crime typologies continue to evolve as criminals leverage new tactics to evade money laundering detection. For example, terrorist financing activity includes both complex schemes supporting logistical networks, and lone actors using small amounts of money to self-fund attacks.

The Complexity of Sanctions

The current geopolitical environment has increased the need for effective Expansive economic sanctions against the Russian government, elites and oligarchs have increased pressure on sanctions compliance and AML programs.

The Illicit Use of Cryptocurrency

Consumers are increasing using convertible virtual currencies (CVCs) as a transaction channel, as are bad actors, terrorist financiers and illicit networks. Criminals exploit the anonymity of virtual currencies, such as cryptocurrency, to disguise the source of illicit funds, evade sanctions, enable cybercrime, and move criminal proceeds through the financial system.

The Intersection of Scams, Money Mules, and Professional Money Laundering

The National Money Laundering Risk Assessment (NMLRA) warns that fraud continues to be “the largest driver of money laundering, both in the scope of activity and magnitude of illicit proceeds,” generating billions of dollars annually. Proceeds from online scams such as romance scams and BEC may move through offshore legal entities, to accounts, debit cards or digital wallets controlled by cyber actors or money mules.

The FBI warns “criminals recruit money mules to help launder proceeds derived from frauds or crimes like human trafficking and drug trafficking. Money mules add layers of distance between crime victims and criminals, which makes it harder for law enforcement to accurately trace money trails.”

Limitations of Conventional Approaches

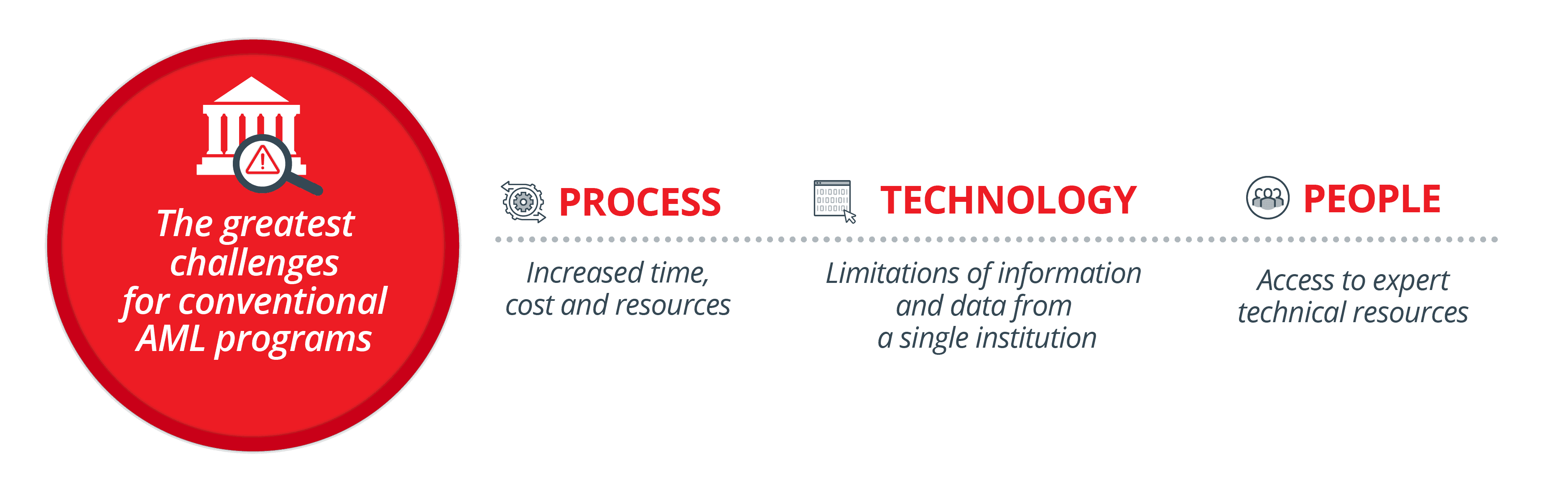

In collaboration with our customer partners from over 3500 financial institutions, Verafin has identified three areas that provide the greatest challenge for conventional AML programs – process, people and technology.

Process

Financial institutions who rely on legacy and disparate systems across channels often struggle with a significant amount of false positive alerts, along with wasted time and resources dedicated to managing those alerts. Model development also demands a great deal of attention, requiring human resources, software development and institutional rules for transaction monitoring. When institutions develop solutions in siloes for their own enterprises, spending countless hours devoted to model tuning and maintenance, the result is a tremendous amount of duplicated effort across the industry.

People

The number of highly skilled individuals needed to develop and maintain models is rapidly increasing. These specialized resources require knowledge of the BSA/AML landscape, model development, and data science. In high demand and at a high cost, these resources are difficult to find, difficult to attract, and even more difficult to keep.

Technology

Analyzing information and data from a single institution can limit your ability to proactively identify trends and evolving threats, leaving you with a limited view of customer interactions and relationships outside of the walls of your institution.

Preparing BSA/AML Programs

Financial institutions should consider innovative anti-financial crime solutions that can rapidly adapt to evolving financial crime threats, keep pace with regulatory change and ensure operational efficiency and proven effectiveness. Institutions should consider how a consortium-based solution can offer a proactive and collaborative approach to financial crime management to enhance money laundering detection, strengthen investigations, and effectively fight financial crime.

To learn more about how Verafin is helping thousands of institutions like yours to keep pace in the fight against financial crime, download our Financial Crime Management Brochure.