In the fight against financial crime, change is perhaps the only constant. As financial institutions implement more robust controls against schemes such as wire fraud, criminals respond by evolving their tactics and increasing efforts against more vulnerable customer segments.

In Verafin’s new Quarterly Cloud Insights: Wire Fraud Benchmarking Report for Q2 2022, we analyzed our consortium-based data set, representing $4T in collective assets from 2100 financial institutions, to uncover industry-leading insights into wire fraud trends. Our findings show that, among other threats, wire fraud scams against seniors continue to rise – and more than ever, financial institutions must be prepared to effectively combat wire fraud.

Wire Fraud Trends Uncovered

Trends Overview – Seniors at Risk

- From Q2 2020 to Q4 2021, the number of ACH and wire counterparty profiles in the Verafin Cloud grew from 118.4M to 230.4M.

- Elderly persons saw the most significant volume of attempted wire fraud occurrences in Q4 2021 (54%), and by value, attempts against elderly persons increased significantly from Q4 2020 (21%) to Q4 2021 (36%).

- For business and title companies combined, attempts by value decreased from Q4 2020 (70%) to Q4 2021 (55%).

Business Wire Fraud – Higher-Risk Industries Identified

- In Q4 2021, the median value for attempted business wire fraud increased from Q2 2020, from $34.2K to $36.1K.

- Finance and Insurance (25%) and Wholesale and Retail Trade (14%) led attempts by occurrence, while Construction (24%) and Professional Services (21%) led value.

Personal Wire Fraud – Growing Risk for the Elderly

- In Q4 2021, the median value for attempted wire fraud against persons was $6.4K, up significantly from $5.8K in Q2 2020.

- Elderly persons (people aged 55 or older) are preferred victims for wire fraud, accounting for 71% of occurrences and 82% of attempted wire fraud value in Q4 2021.

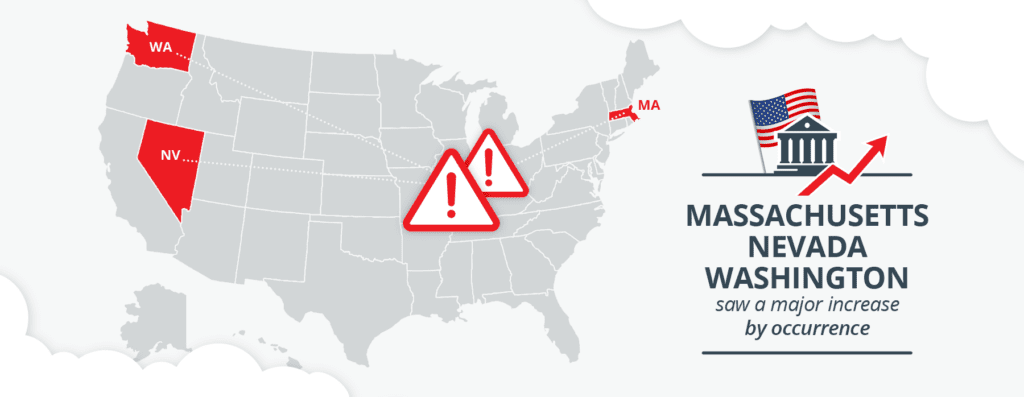

Domestic Wire Fraud – New Trends for Massachusetts, Nevada, and Washington

- In Q4 2021, the median value of a domestic wire fraud attempt was $12.5K, up from $7.5K in Q2 2020.

- Three states outside of the top ten saw major increases by occurrence from Q3 to Q4 2021: Massachusetts, Nevada, and Washington. Nevada also saw a major increase by value from Q3 to Q4 2021.

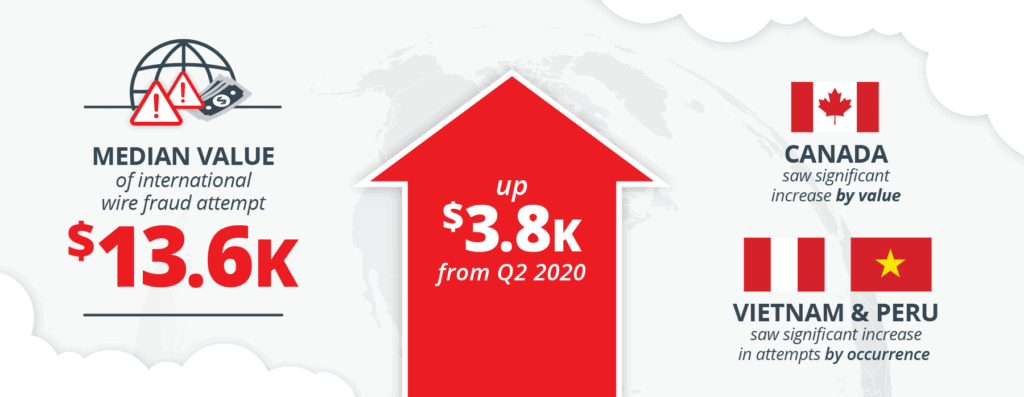

International Wire Fraud – Canada, Peru, and Vietnam see New Trends

- In Q4 2021, the median value of an international wire fraud attempt was $13.6K, up from $9.8K in Q2 2020.

- Canada saw a significant increase from Q3 to Q4 2021 by value, while Peru and Vietnam saw significantly increased attempts by occurrence from Q3 to Q4 2021.

- Given the current geopolitical climate, trends related to Russia may evolve considerably in future analyses.

Protecting the Vulnerable with Consortium-Based Data

Wire fraud is constantly evolving. By leveraging big data analysis in the Verafin Cloud, our experts have identified criminals increasingly targeting seniors and specific industry segments. These unique insights may be valuable as financial institutions combat evolving wire fraud schemes and scams.

As fraudsters continue to change tactics, financial institutions must consider financial crime management solutions built with consortium-based data, machine learning, and counterparty analysis for enhanced fraud detection.

For further wire fraud statistics, emerging trends, and key insights for your institution, download our Quarterly Cloud Insights: Wire Fraud Benchmarking Report for Q2 2022.