Today’s payments ecosystem is rapidly evolving, driven by customer demand for greater speed and convenience, and the financial industry’s digital transformation.

This change has also presented opportunities for financial crime — fraudsters are exploiting wire payments with Business Email Compromise (BEC) attacks aimed directly at your consumer and corporate customers. These lucrative scams permeate the financial industry and Verafin Cloud insights suggest they are a significant fraud threat.

Verafin recently published an unparalleled Wire Fraud Benchmarking Report, offering insights into wire fraud trends from a massive consortium-based data set in the Verafin Cloud. This blog highlights key findings from this report regarding attempted business wire fraud trends from Q2 2020 to Q3 2021.

Considerable Potential for Loss

BEC continues to be a primary attack vector used by fraudsters — and the potential for loss is considerable.

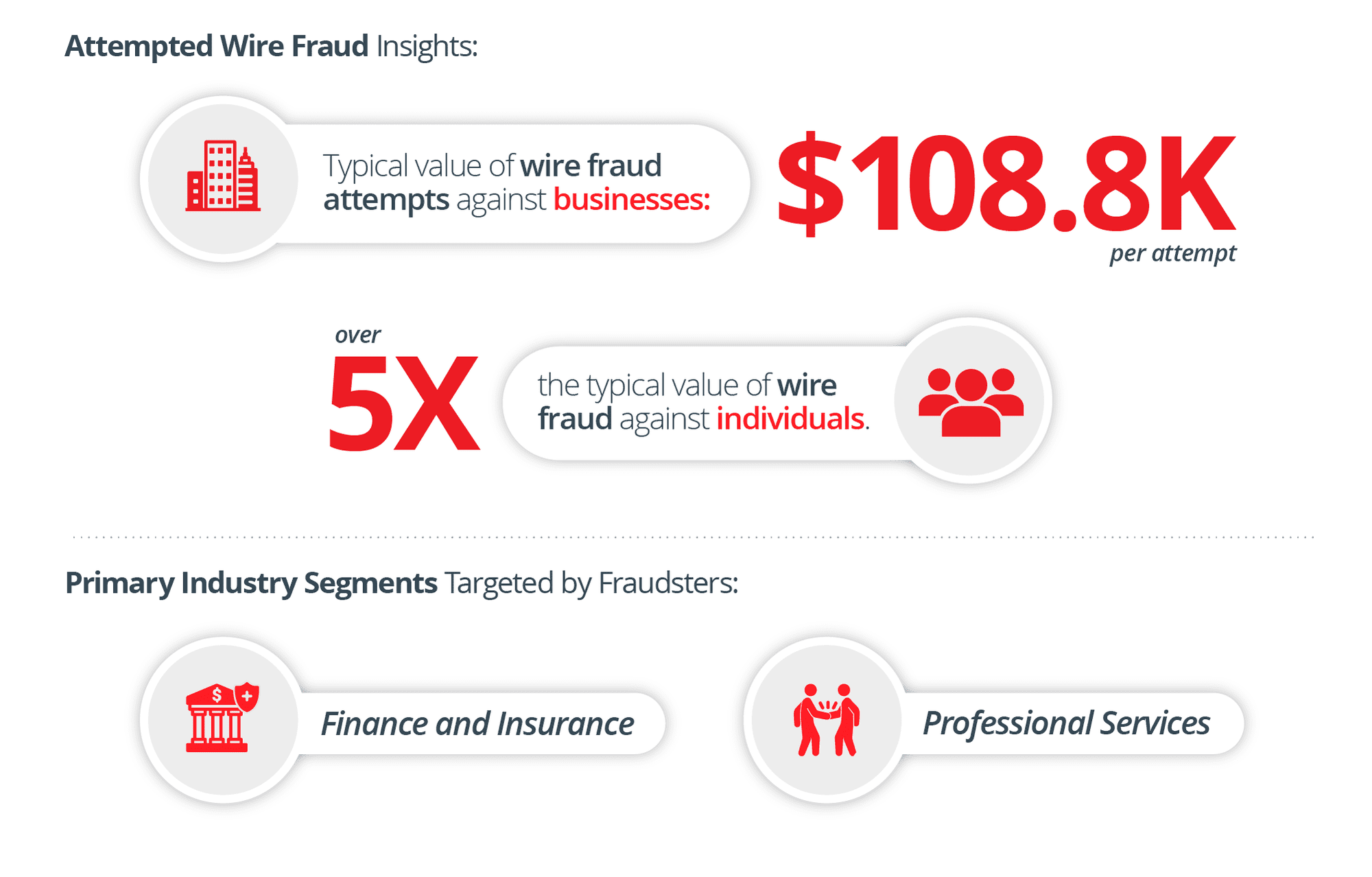

In Q3 2021, individual consumers accounted for 75% of attempted wire fraud occurrences, yet businesses represented the majority of attempted wire fraud by value (67%). In the same quarter, the typical value of a wire fraud attempt against a business was $108.8K — over five times the typical value of wire fraud against individuals. Fraudsters also focused their efforts on two industry segments – Finance and Insurance, and Professional Services – which saw the most attempts by occurrence, and value.

Our analysis shows that businesses are targeted less often than individuals, but for a significantly higher value. With BEC schemes a continuing concern, financial institutions need a solution that provides robust detection beyond the capabilities of conventional approaches.

Benefits of Behaviour-based Analytics

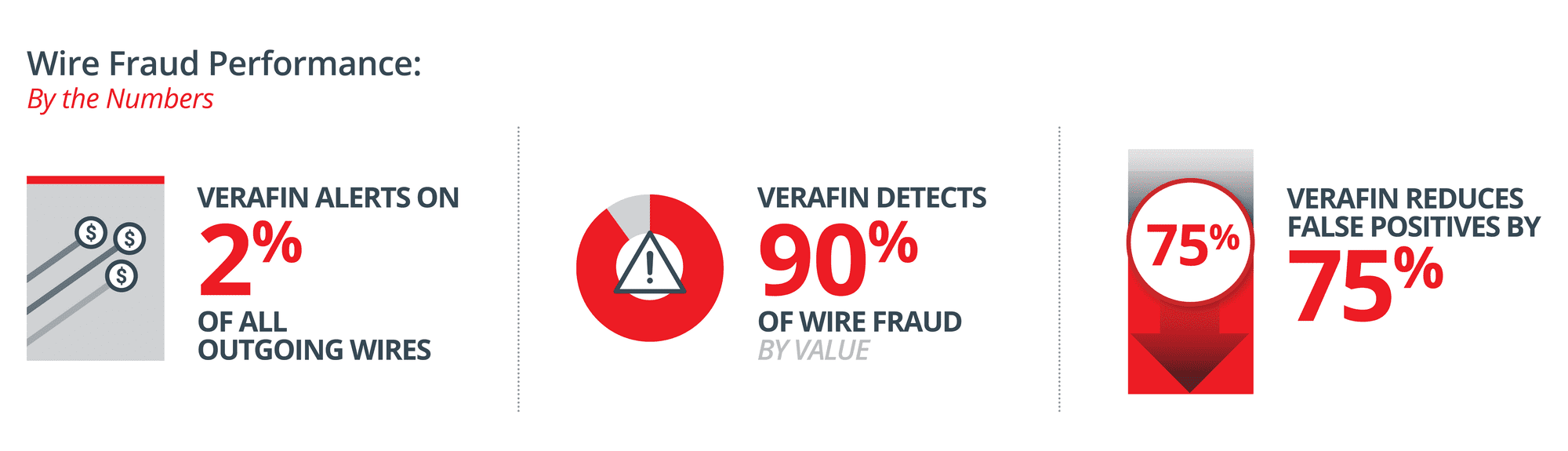

Wire fraud schemes have become too sophisticated for institutions to combat with rules-based monitoring systems. Too often, these conventional approaches inundate investigators with false positive alerts and only provide a siloed view of wire transactions. More than ever, fraudsters are evolving nuanced BEC tactics that may be impossible to detect without behavior-based analytics and consortium-based solution.

As highlighted in the case study in our Benchmarking Report, a solution that provides a cross-institutional counterparty analysis is essential for assessing wire payee risk. The case study shows how a business nearly fell victim to a major BEC scam after a legitimate email address was compromised. Verafin recognized the receiver as a mule account involved in fraudulent activity at another institution, and the transaction was stopped before losses occurred.

Proactive Defence Against Wire Fraud

Wire fraud continues to be a concern for the financial industry as BEC and other schemes targeting your consumer and corporate customers have the potential to cause significant losses.

Leveraging unique payee risk analysis capabilities combined with intelligently segmented agents and real-time detection, Verafin keeps pace with the everchanging payments ecosystem and fraudsters’ exploitative efforts. Our industry-leading solution effectively identifies scams and mule accounts, reduces false positive alerts, and allows you to stop fraudulent wires before the funds leave your institution.

For further wire fraud statistics, emerging trends, and key insights for your institution, download our Cloud Insights: Wire Fraud Benchmarking Report for Q1 2022.