“Every year, one in ten Americans aged 60 and older experiences abuse — and for every case of elder abuse that comes to the attention of authorities, it is estimated that 23 cases are never brought to light.“

– White House, 2021

Criminals will stop at nothing to victimize seniors for their gain, causing significant emotional turmoil and financial loss for those targeted. Fraudsters use a variety of methods to exploit elderly persons — chief sources of loss include Business Email Compromise (BEC) and Email Account Compromise (EAC), sharing almost $169M in loss, typically through wire fraud.

Chronically underreported, a lack of accurate data typically obscures the true extent of elder financial abuse. By analyzing a billion transactions each week in the Verafin Cloud from over 3,000 financial institution customers, including over 15,000 examples of wire fraud of which more than 6,000 involve elder financial abuse, Verafin has uncovered unique insights into the scale of wire fraud targeting seniors to help you stay a step ahead.

Seniors Scammed Frequently, Substantially

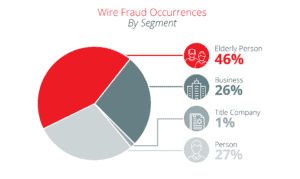

Seniors were extorted, deceived, or otherwise scammed into sending a significant amount (46%) of all fraudulent wires in 2021 to date. These statistics are substantially greater on average compared to non-elderly victims, with non-elderly persons and businesses accounting for 27% and 26% of wire fraud occurrences respectively.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

The threat of wire fraud to consumers is great, with elderly and non-elderly persons targeted more than three times more frequently than businesses.

Considerable Costs & Consequences

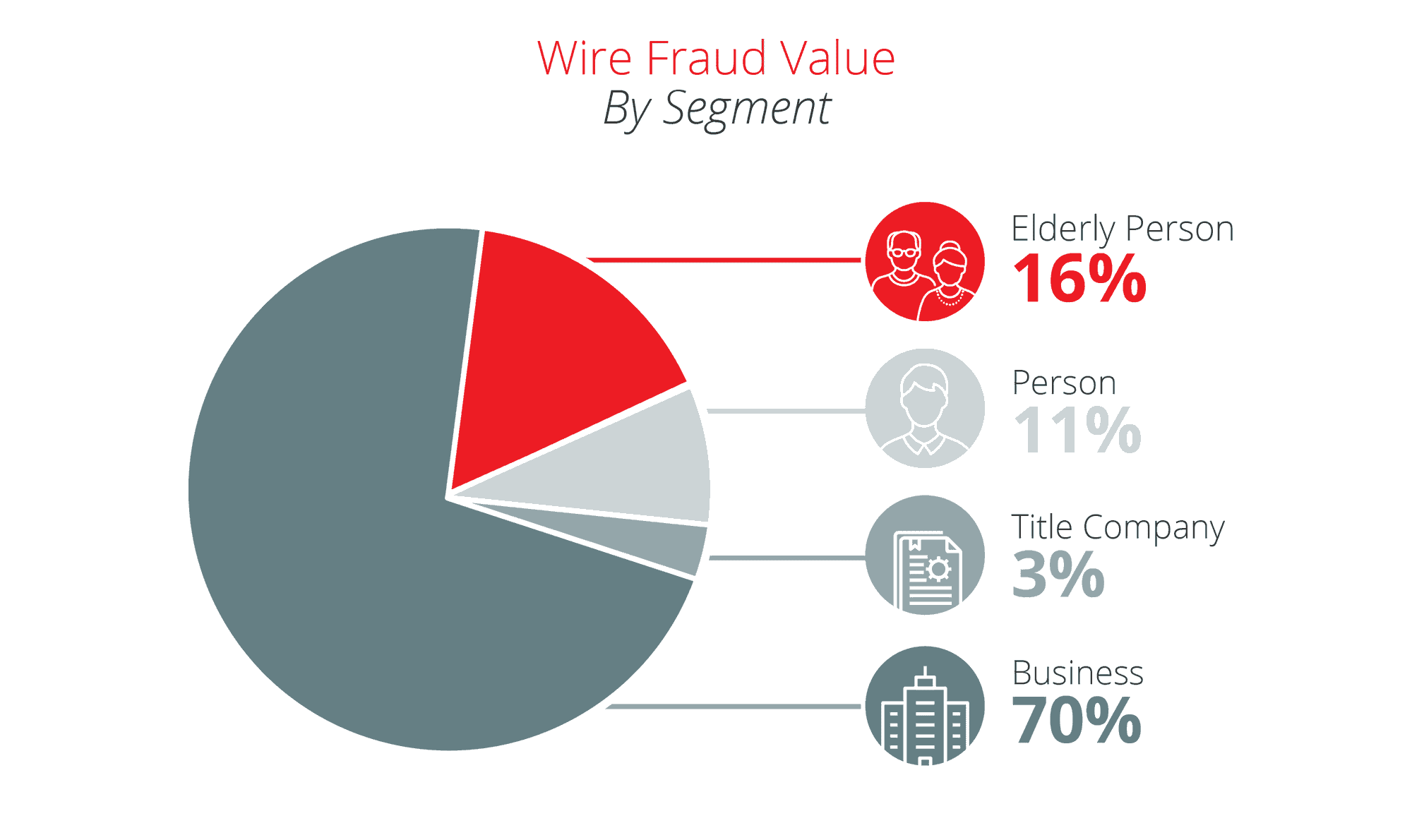

In addition to emotional costs, elderly victims are at a higher risk of losing more money to wire fraud scams. This group accounts for 63% of all people victimized by wire fraud. Elderly persons’ wire fraud losses by value accounted for 16% of total losses in 2021, averaging more than $22,000, with other age groups representing 11% of losses.

Standing with Seniors: Taking Decisive Action

“Fraudsters leverage every vulnerability for their gain, and seniors are at particular risk to these cruel crimes. Relying on traditional methods to flag these scams against elderly persons leave many vulnerable to continued attacks. At Verafin, our cloud-based technology helps financial institutions protect themselves and their customers from falling victim to these attacks.”

– Mauriceo Castanheiro, Product & Industry Expert, Verafin

With big data intelligence in the Verafin Cloud, we have identified elder financial abuse occurring at an alarming rate across the industry. With the scale of these attacks, it is imperative that financial institutions take decisive action, implementing robust controls to protect seniors from financial loss and grief.

Wire transfers are often high value and the funds are irrevocable, thus financial institutions need a robust solution that provides holistic transaction insights and the ability to address suspicious wires in real time. Using intelligently segmented agents, behavior-based analytics and consortium-based payee risk analysis in the Verafin Cloud, our Wire Fraud solution allows you to determine if a payee has a trusted history of activity and stop suspicious wires in real time before funds leave your institution. Using big data intelligence and machine learning, our targeted analytical agents for elder abuse and third-party scams can also alert your institution to red flags of elder financial abuse, allowing you to intervene at the earliest opportunity.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

To learn more about how Verafin’s wire fraud solution can efficiently and effectively protect your most vulnerable customers from financial and emotional damage, request a custom demo tailored for your institution.