Regulators in the EU and UK have recognized the need for greater collaboration, publishing new legislation that echoes the USA PATRIOT Act’s information sharing privileges. Our report, Financial Crime Insights: Europe, found challenges remain, and concerns about competition are an obstacle to implementation.

USA PATRIOT Act: Pioneering Information Sharing

The USA PATRIOT Act provides an example of the power of information sharing for institutions and their customers. Enacted in 2001, Section 314(b) of the Act created a safe harbor for banks to engage in private-to-private information sharing. This enabled a wide range of effective new approaches to anti-financial crime, including:

- Bank-to-bank messaging services.

- Joint investigations.

- Adverse incident alerting.

- Public-private information sharing investigations.

- Joint reporting to law enforcement.

These privileges have enabled the US financial industry to efficiently investigate suspicious activity and combat financial crimes spanning multiple institutions.

Regulatory bodies in the EU and UK have introduced similar rules removing barriers to information sharing, but many institutions still have reservations about making use of these new permissions in their financial crime management programs.

The UK ECCTA: A Step Change in Financial Crime Management

The UK’s Economic Crime and Corporate Transparency Act (ECCTA) aims to help institutions prevent, investigate and detect scams related to money laundering, terrorist financing, sanctions and tax evasion, market abuse and fraud. Coming into force in early 2024, the regulation disapplies civil liability for private-to-private information sharing.

Guidance on the ECCTA from UK Home Office also highlights the potential for banks and other regulated firms to leverage technology platforms and consortium data to enhance their efforts to combat financial crime.

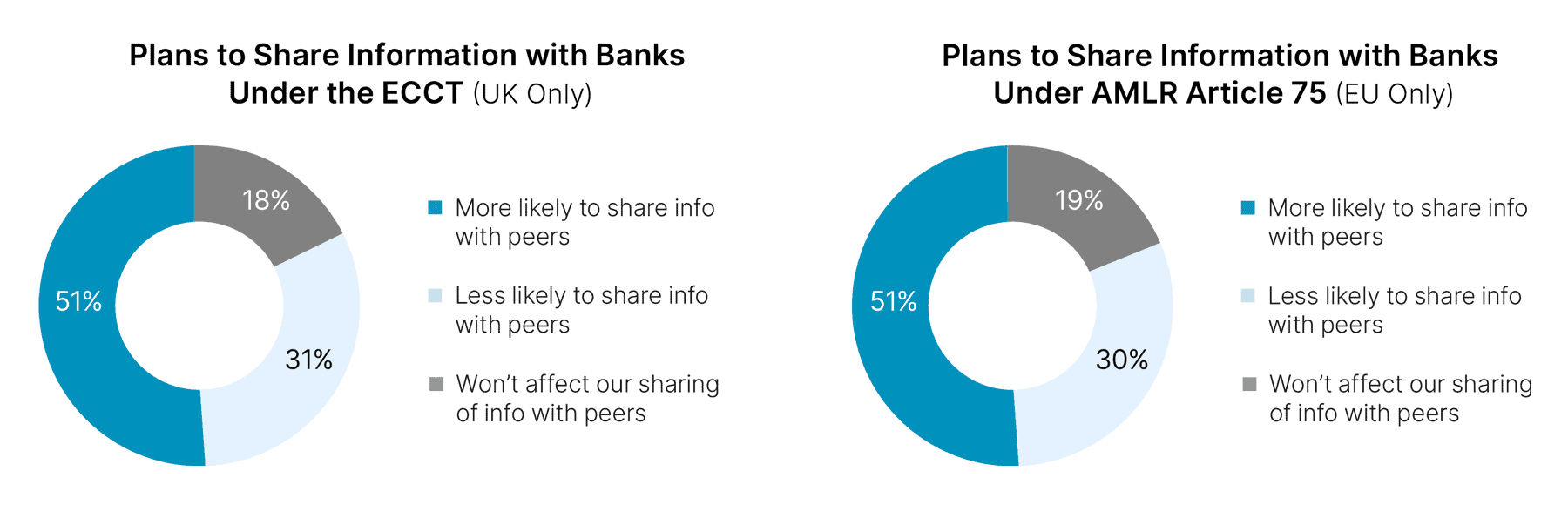

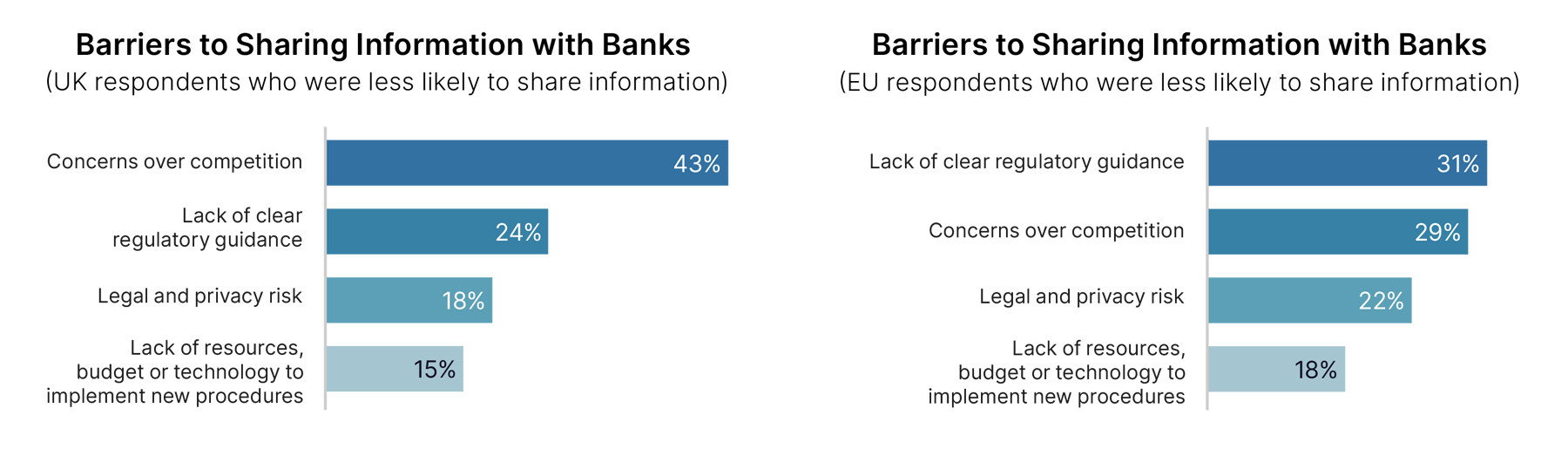

Despite the intent of these measures to provide clarity and promote confidence for financial institutions in sharing information with protection from liability, only 50% of UK respondents were more likely to share information with their peers. Of those who were less likely to share information, concerns about competition were the most-common reason given for their reluctance.

Other reasons include lack of clear regulatory guidance, legal and privacy risk, and lack of resources. Thus, institutions require ongoing support and clarity from industry regulators to fully benefit from this legislation.

AMLR Article 75: Enabling Information Sharing in the EU

Article 75 of the Regulation (EU) 2024/1624 outlines a similar mandate to the UK ECCTA. It empowers financial institutions in EU member states to form cross-border partnerships within the EU in order to improve their AML/CFT programs. These partnerships may also include public sector participants, such as AML/CFT supervisors, financial intelligence units (FIUs) and other competent authorities.

In Nasdaq Verafin’s survey, the same percentage of EU respondents (51%) confirmed a greater likelihood of sharing information with other banks under this legislation.

Of those less likely to share information, concerns over competition were again a large factor, although respondents were slightly more concerned about lack of regulatory guidance (29% and 31%, respectively).

Overall, these results are positive and show institutional intent for improving AML/CFT programs. Greater collaboration across the EU’s public and private sector is a significant opportunity for a step change in anti-financial crime efforts. However, for this change to reach its full potential, institutions need regulatory guidance and education on why information sharing is in their best interest.

Scaling Your Financial Crime Management Program with New Regulations

In the coming years, new information sharing frameworks and tools will help institutions collaborate with each other to combat financial crime and protect the integrity of the financial system. Regulators must continue to provide support and clarity to empower banks to confidently take advantage of this opportunity.

For more insights, download Nasdaq Verafin’s report, Financial Crime Insights: Europe.