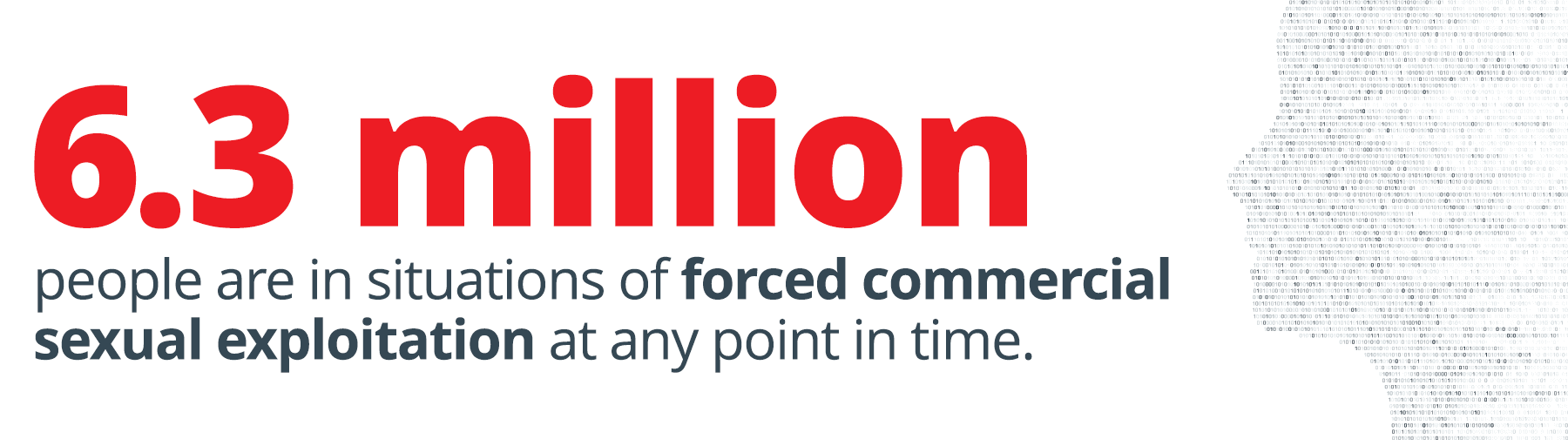

Human trafficking is financially motivated. Described as a “crime that involves other crimes,” human trafficking is typically connected to illicit money flow, corruption, document fraud, trafficking in illicit goods, cybercrime and terrorism. Sexual exploitation remains the most common motive for trafficking – it is estimated 6.3 million people are in situations of forced commercial sexual exploitation at any point in time.

International sex trafficking preys on people who are often looking for a better life outside their country of residence. Global conflicts and climate-related disasters increase potential victims’ vulnerability by acting as a stress multiplier. Criminals lure people through false promises of love, employment, or a better life. Sadly, the people seeking a better life find themselves in situations where they are coerced into the sex trade, abused and made to work under deplorable conditions, with little or no pay.

International sex trafficking preys on people who are often looking for a better life outside their country of residence. Global conflicts and climate-related disasters increase potential victims’ vulnerability by acting as a stress multiplier. Criminals lure people through false promises of love, employment, or a better life. Sadly, the people seeking a better life find themselves in situations where they are coerced into the sex trade, abused and made to work under deplorable conditions, with little or no pay.

“The hard reality of human trafficking is that criminals exploit many aspects of communication, finance, transportation, and commerce that have connected and enriched our global community.”

– Cindy Dyer, Ambassador-at-Large, Office to Monitor and Combat Trafficking in Persons

Human Trafficking Thrives in an Unequal World

International sex trafficking occurs when victims are recruited or compelled under false pretenses, moved outside of their native country and forced into the sex trade. Victims usually do not speak the language of the country they are relocated to and have no contacts or resources to help them escape. Isolated and controlled through psychological manipulation and the threat of violence, they are coerced into sex work, while existing on the bare minimum in terms of food, sleep and personal freedom.

The Money Trail

Criminals yield about $3B a year from trafficking their victims – 79% of that is generated from sex trafficking and is laundered through the financial system, often leaving a series of red flags that provide investigators an opportunity to follow the financial trail.

In the eBook, Human Trafficking: Know the Behavior, Uncover the Crime, Verafin has outlined seven indicators that investigators can use to detect financial activity associated with international sex trafficking:

- 99% of sex trafficking victims are typically aged 14–27 years old.

- Occupations linked to sexual exploitation are higher risk, cash based, and can often require travel involving jobs such as exotic dancer, masseuse, model, server, or hospitality worker.

- Accounts tend to be recently opened or new with limited history.

- Social media accounts of victims tend to offer escort services, sharing information that may be linked to their bank account. Accounts do not portray typical life activities but instead share pictures of cash or show visible tattoos displaying trafficker markings such as bar codes, initials, crowns and roses, and/or currency.

- Investigators may observe changes in day-to-day transaction habits that go from expected activities and switch to transactions that are related to sex trafficking.

- An absence of transactions such as buying groceries, paying rent, receiving payroll, purchasing personal items or entertainment should raise questions. Purchases that show regular travel to other geographic locations, hotel rooms, online ads for escort or personal services, fast food, transportation and internet bills point to sexual exploitation.

- Account balances average at or near zero.

Collaborating to Fight International Sex Trafficking

The theme for the U.S. Department of State’s 2023 Trafficking in Persons Report focuses on partnerships to advance anti-trafficking priorities and goals. Financial institutions and AML investigators have an opportunity to identify and intervene when financial activity facilitates human trafficking operations. Financial transactions can provide actionable intelligence to strengthen law enforcement investigations and offer evidence to supplement a victim’s testimony.

This special blog series focuses on three of the primary forms of human trafficking – domestic sex trafficking, international sex trafficking and forced labor. Next week our series will focus on detecting and preventing forced labor, with key indicators for financial institutions.