Wire fraud is evolving across the financial industry — and today, Business Email Compromise (BEC), targeted consumer scams, and the financial exploitation of elderly persons are of particular concern. With fraudsters circumventing the enhanced authentication controls of many digital platforms with payments fraud scenarios, understanding the latest wire fraud trends and challenges is essential.

Verafin recently released the Cloud Insights: Wire Fraud Benchmarking Report for Q1 2022, examining emerging wire fraud trends from Q2 2020 to Q3 2021 in the most comprehensive analysis of Verafin Cloud data ever published. In this blog, we discuss key highlights from this report for key wire fraud segments and benchmarking metrics.

Unprecedented Trend Analysis

Representing $4T in collective assets from 2100 financial institutions, the Verafin Cloud allows for unparalleled insights into financial crime threats. From 2020 to 2021 we grew our Cloud data set considerably, with increases in wire and ACH volume by count and value, as well as significant gains in the number of identified counterparty profiles for enhanced detection of fraudulent payments and mule accounts.

In the new report, our experts leveraged this immense consortium-based data set, including rich wire transactions via FedWire and SWIFT as well as cases of identified true fraud, to unveil unparalleled insights into evolving wire fraud concerns.

Wire Fraud Trends Unveiled

Trends Overview

- The report found that the typical amount of attempted wire fraud increased from $7.8K in Q2 2020 to $10K in Q3 2021.

- The analysis also found that elderly persons were the most common victim of attempted wire fraud, but the highest value attempts were related to businesses.

- The report also found that wire fraud attempted domestically was more common than international attempts.

- Conventional fraud detection approaches often focus on new beneficiaries as evidence, resulting in a large volume of false positive alerts and increased call-backs and friction for customers.

- Verafin’s Wire Fraud solution leverages the Cloud to look beyond the four walls of your institution and determine if a wire recipient is truly a new beneficiary for the sender.

- This unique approach drastically reduced alert volumes across all segments in our analysis.

Business Wire Fraud: Ten High-Risk Segments

- In Q3 2021, the typical value for attempted business wire fraud was $32.9K, down from $38.8K in Q2 2020.

- The data showed that ten industry segments accounted for the majority of wire fraud by occurrence and value, with Finance and Insurance, and Professional Services being the top two for both measures.

Personal Wire Fraud: Seniors at Risk

- The report found that, in absolute terms, wire fraud against individuals increased in value and occurrence.

- Our data found that in Q3 2021, the typical value for attempted wire fraud against persons was $5.9K, up slightly from $5.37K in Q2 2020.

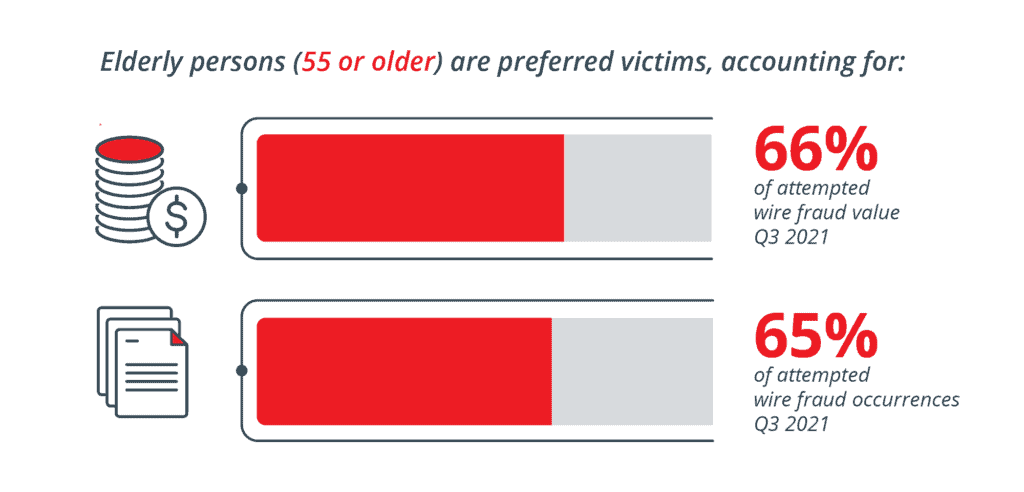

- Elderly persons (people aged 55 or older) are preferred victims, accounting for 65% of attempted occurrences and 66% of attempted wire fraud value in Q3 2021.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Domestic Wire Fraud: Four States Form Majority

- Our analysis found that, in absolute terms, domestic wire fraud decreased in value and occurrence.

- In Q3, the typical value of a domestic wire fraud attempt was $9.9K, up from $7.5K in Q2 2020.

- In the same time frame, the top destination states for attempted wire fraud by occurrence and value were California, New York, Florida, and Texas.

International Wire Fraud: Hong Kong, Thailand Top Lists

- Similar to trends found in domestic wire fraud, our analysis found that, in absolute terms, attempted international wire fraud decreased in value and occurrence.

- In Q3, the typical value of an international wire fraud attempt was $11.8K, up from $9K in Q2 2020.

- The top destination for attempted wire fraud by occurrence was Thailand, while Hong Kong was first by value.

Next Steps in the Fight Against Wire Fraud

Wire fraud is continuously evolving — as fraudsters pivot between target segments and innovate with new tactics, financial institutions should consider financial crime management solutions built with consortium-based data, machine learning, and counterparty analysis for enhanced fraud detection.

For further wire fraud statistics, emerging trends, and key insights for your institution, download our Cloud Insights: Wire Fraud Benchmarking Report for Q1 2022.