Financial institutions face increasing challenges to keep pace with evolving financial crime, and 2021 revealed that fraud is moving faster than ever.

In a year-in-review presentation, we explored the top fraud trends of 2021 identified in the Verafin Cloud, the ongoing challenges of fraud scams and payments fraud, and what actions can be taken to get ahead of illicit activity. Our technology and industry experts also provided insights into emerging threats on the horizon and innovative approaches to prevent fraud in 2022 and beyond.

This article provides a brief overview and highlights the data and key takeaways discussed during the presentation.

Trends Across the Cloud

With an industry leading approach, Verafin analyzes more than a billion transactions each week in its Cloud environment. This unique big data set provides unprecedented insight into new threats and evolving typologies.

The Rise of Mobile Fraud Scams

Deposit schemes continue to be a lucrative target for fraudsters. While the volume of check and deposit fraud transactions are going down, there is still significant fraud in this space.

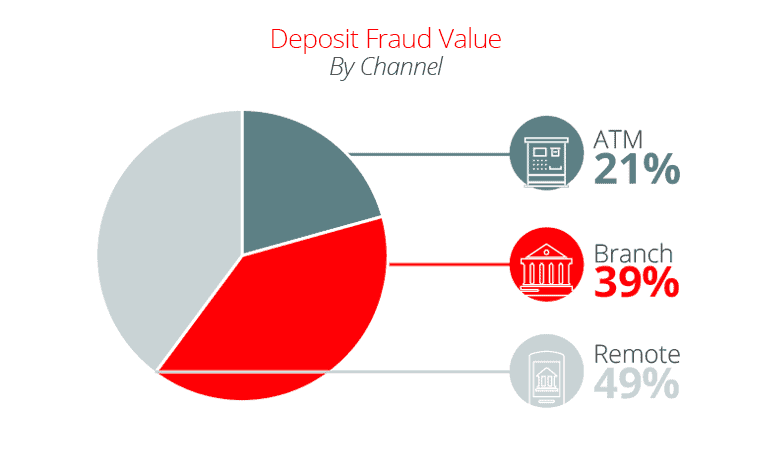

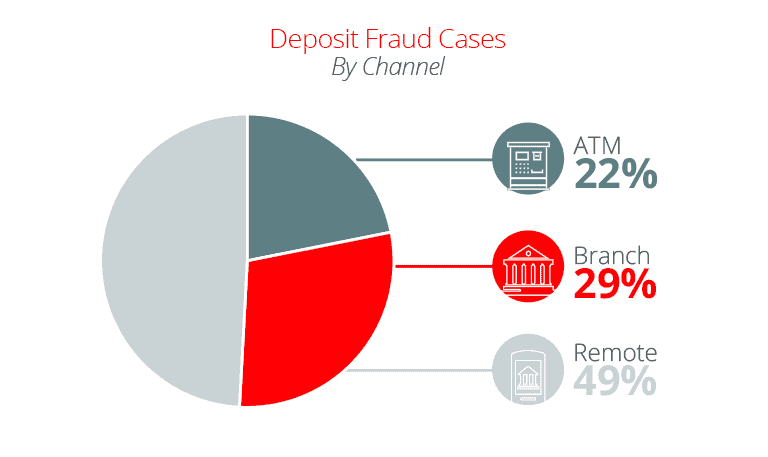

Mobile deposit fraud has become the primary means for scams with nearly half of deposit fraud cases linked to this illicit activity. However, the total loss by value is split evenly between in-branch and mobile fraud. Despite the greater occurrences of mobile fraud, even with fewer in-branch attempts, the average loss per attempt is much higher.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Financial institutions need to have a complete view of fraud across all deposits and robust controls in place to prevent losses across mobile, ATM, and in-branch channels.

Payments Fraud: Growing Risk to Business Customers

This past year has shown a considerable increase in payment channel fraud attacks directed at customers.

As institutions put more focus on controls to protect online accounts and cutting off access to the funds directly — fraudsters are targeting customers with scams to perpetrate fraud on their behalf. In fact, only 4% of wire fraud has associated online account takeover.

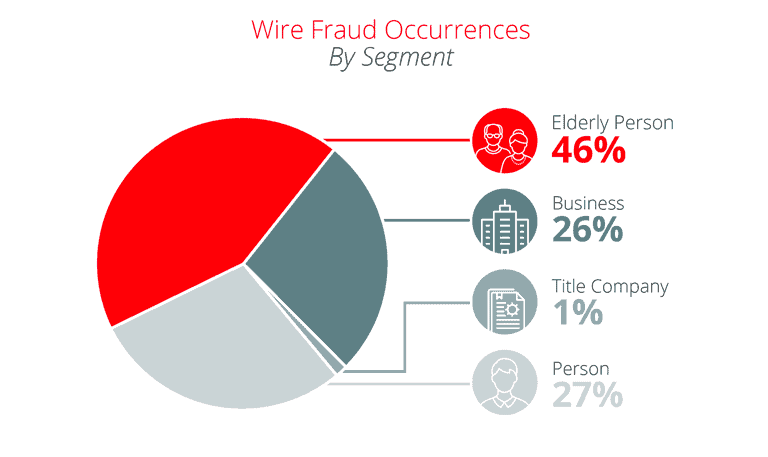

Individual customers make up nearly 75% of fraudulent wire transactions, with nearly half of victims being elderly customers. On average, these customers are losing approximately $20,000 per successful fraud attempt.

However, despite the disproportionate number of occurrences aimed at individuals, business-related entities account for 73% of actual fraud losses linked to Business Email Compromise (BEC). Over the past two years, the average loss to businesses increased from $80,000 to approximately $120,000.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Source: Insights obtained from the Verafin Cloud. Accurate to date of publication.

Financial institutions need to consider how to mitigate losses from wire fraud — with a focus on Business Email Compromise — while minimizing customer friction and managing operational costs.

Businesses targeted via ACH

Fraud continues to grow across payment channels. Insight from our Cloud data shows us that ACH fraud on businesses has increased by 15% since 2019.

As the industry puts greater emphasis on mitigating fraud schemes, fraudsters will adapt and evolve their methods to evade detection. It is critical for financial institutions to enhance detection capabilities for BEC and other scams targeting your customers and monitor all payment channels for new threats.

Big Data Technology to Combat Fraud

As fraud continues to grow and evolve in sophistication, relying on conventional approaches and inefficient processes results in ineffective fraud programs.

Fraud investigations are hindered by the limitations of data from a single institution. Without early protection from emerging fraud threats, deeper insights into customer interactions, or the labeled data necessary for effective machine learning — financial institutions face greater risk of fraud loss.

Financial institutions that embrace innovative and big data approaches can overcome these limitations, ultimately reducing customer friction, preventing losses, and strengthening their overall fraud program.

Managed Analytics in the Cloud

With insights from our consortium data, Verafin can identify fraud trends, then rapidly develop, test, and optimize new analytical agents, before releasing new detection capabilities to all customers in the Cloud — before many institutions experience the fraud. This development approach reduces duplication of effort across the industry, reduces the number of technical FTEs institutions require to build and maintain models or rules, and ensures protection for all institutions from emerging threats.

Machine Learning

Applying a big data machine learning approach helps reduce false positive alerts and provides more efficient and effective results for fraud programs.

Verafin’s aim is to continuously improve analytical performance with machine learning trained on our vast amount of labeled data from thousands of institutions in the Cloud — something incredibly difficult for a single institution to achieve with the limitations of an isolated and restricted data set.

Leveraging more than 100,000 examples of labeled deposit fraud examples in the Cloud, Verafin detects more than 80% of mobile deposit fraud, with 1 in 5 alerts being true fraud, while alerting on less than 1% of all mobile deposits.

Counterparty Analysis

Data lake technology combined with our immense set of rich data of 40 million wires from 7 million unique payee accounts provides Verafin with unprecedented analytical capability for counterparty analysis. This enables us to deploy cross-institutional analytics in the Verafin Cloud to determine the risk associated with a wire sent to a particular receiving account. Verafin can increase the risk of an alert or reduce the risk when a wire is sent to a trusted payee.

With our unique wire payee risk analysis, Verafin reduces wire fraud false positives by up to 75%.

A Look Ahead – Preparing for 2022 and Beyond

Within the scope of financial crime management, the old saying that fraud flows like water, filling new channels and cracks as they appear, will continue to hold true as we look to 2022 and beyond.

Faster Payments — Faster Fraud

As the industry moves to faster payments, innovative big data solutions are more critical.

With The Clearing House – RTP (TCH-RTP), FedNow and other real-time payment solutions in development, these channels are going to change the way customers — and fraudsters — interact with your bank.

The immediate challenge to the industry is the need to start thinking critically about what this will mean from a fraud management perspective.

Considerations for financial institutions:

- Is my payments program prepared to adapt to emerging and evolving fraud typologies on new channels?

- Do we have an accurate picture of the risk of customers’ interactions with counterparties outside our institution?

- How do we reduce false positives and efficiently mitigate and manage fraud risk?

- How can we leverage consortium data to improve detection capabilities today and in the future?

Moving Forward

Financial fraud is ubiquitous. The opportunities for fraudsters to manipulate the financial system can be adapted as quickly as new consumer products are rolled out, however, age-old tactics continue to be a target for scams. Moving forward, financial institutions must look to innovative approaches leveraging consortium data, machine learning, counter party analysis and managed analytical agents to keep a step ahead of fraud.

Verafin’s industry leading Financial Crime Management platform provides institutions with the upper hand to efficiently and effectively respond to fraud schemes that are growing in number and sophistication.