Keeping pace with the changing landscape of BSA/AML is a significant challenge for financial institutions. In our year-end presentation we explored industry-wide AML trends and the specific challenges facing compliance programs today — including the recent passing of the AML Act of 2020 (AMLA) — highlighting the need for solutions to improve the efficiency and effectiveness of BSA/AML programs. These trends inform both the challenges and the solutions that institutions can implement to help combat AML and other financial crimes in 2022 and beyond.

The AML Act of 2020: Much Needed Change

One of the most significant developments that continues to impact BSA/AML programs was the passing of the AML Act of 2020.

The AMLA broadens the mission or purpose of the BSA to include national security, while at the same time:

- Formalizing a risk-based approach for financial institutions’ compliance programs

- Aligning regulatory agencies’ supervision and examination priorities with the expanded purposes of the BSA

- Increasing civil and criminal penalties for violations of the BSA

- Prioritizing information sharing

- Encouraging innovation to keep pace with reporting requirements and compliance

As FinCEN begins the process of modernizing the BSA and AML/CFT regime, this will have direct and rippling effects on programs for years to come, such as: Customer Due Diligence (CDD) programs will be impacted through beneficial ownership changes; approaches to transaction monitoring will evolve through a renewed focus on innovation; and an increased emphasis on information sharing will enable greater collaboration. Industry must be ready to innovate, collaborate, and align with evolving rules and regulatory requirements.

National Priorities for AML and CFT: Casting a Wider Net

On June 30, 2021, pursuant to the AMLA, FinCEN released the first government-wide list of priorities for AML and CFT:

- Corruption

- Cybercrime, including relevant cybersecurity and virtual currency considerations

- Foreign and domestic terrorist financing

- Fraud

- Transnational criminal organization activity

- Drug trafficking organization activity

- Human trafficking and human smuggling

- Proliferation financing

These priorities will assist all covered institutions in their efforts to meet their obligations under laws and regulations designed to combat money laundering and counter both domestic and international terrorist financing.

Institutions should prepare their AML/CFT programs by evaluating transaction monitoring systems and other compliance processes, to ensure they can adapt and align with potential guidance and meet obligations for new priorities. Innovative solutions through advanced technologies such as artificial intelligence, machine learning, and behavior-based analytics, are one way in which institutions can rise to the AML/CFT challenges of today and effectively prepare for this new era of the BSA/AML regime.

Virtual Currency: Here To Stay

This past year has shown us that virtual currency is becoming mainstream and financial institutions must be prepared. Recent trends show how these new payment channels have started to gain a foothold within the industry:

- Major retailers and payment networks consider plans to accept cryptocurrency payments

- El Salvador accepts Bitcoin as legal tender, with other countries — particularly in Latin America — aiming to follow suit

- Countries across the globe are at various stages of designing, researching, and piloting Central Bank Digital Currencies

- Cryptocurrencies are a regulatory, legislative, and/or law enforcement priority in many countries

The challenge of keeping pace with new ways of moving money and adapting to changing customer behavior is immense. Having the ability to identify these transactions and service providers — from both an AML and customer due diligence perspective — for a truer picture of your institution’s risk profile will be essential as more and more of these new payment channels become adopted by the mainstream.

Sanctions Complexity Extends to Cybercrime & Virtual Currency

2021 also saw the rise of ransomware as a major tool for cybercriminals. The Office of Foreign Assets Control (OFAC) advanced its efforts to thwart these cybercriminals by designating numerous malicious cyber actors under its sanctions programs. This action comes in response to aggressive and harmful malicious cyber activities by actors targeting U.S. government and private sector networks. On September 21, 2021, OFAC released an updated advisory regarding cyber-related crimes including adding the SUEX crypto exchange to the Specially Designated Nationals (SDN) list for its part in facilitating ransomware payments.

With the steady increase of sanctions and their growing complexity, it is vital that financial institutions have efficient and effective sanctions programs that can keep pace with continuous change.

Challenges and Solutions

The Elephant in The Room: Inefficiency in BSA/AML

One of the biggest industry challenges in BSA/AML is inefficiency. As such, on December 14, 2021 FinCEN issued a request for information to the industry on “ways to streamline, modernize, and update BSA regulations and guidance so that they, on a continuing basis, protect U.S. national security in a cost-effective and efficient manner.”

As bad actors seek new ways to move their ill-gotten gains and circumvent changing regulatory requirements, they are further increasing the burden on strained compliance programs.

First generation systems produce large volumes of false positives and increase time spent on alert triage and management. Institutions need solutions that streamline processes and deliver higher quality alerts to focus valuable resources where they are needed most.

Developing, deploying and maintaining effective solutions to detect money laundering activity is one of the greatest challenges for any single financial institution, largely due to insufficient data and lack of clear definitions for AML typologies.

Verafin develops and delivers targeted analytical agents to all customers in the Cloud as part of our proven library of Managed Analytical Agents. Leveraging our big data set, we continuously tune and improve these agents to ensure optimal performance through reduced false positives and delivery of higher quality alerts. Our unique development approach reduces strain on internal resources to adapt to new and evolving AML typologies and improves overall effectiveness of your anti-financial crime efforts.

Applying AI to Mitigate Sanctions Risk

Maintaining a strong and compliant sanctions program as requirements grow in complexity is a significant challenge for financial institutions. Whether it is sectoral sanctions, cyber-crime intersecting with virtual currency, or keeping pace with changing requirements — programs must be ready to adapt to change.

Complexity increases when specific regions are added to a sanctions list as opposed to targeted countries. By embracing innovative approaches, financial institutions can overcome the challenges of complex sanctions screening and management.

Conventional approaches result in institutions targeting an entire country or the surrounding area, rather than a specific region. This causes increased error rates in matching, higher volumes of false positive alerts, and leads to inefficient processes and inevitable higher compliance costs — and, as a result, an ineffective sanctions compliance program.

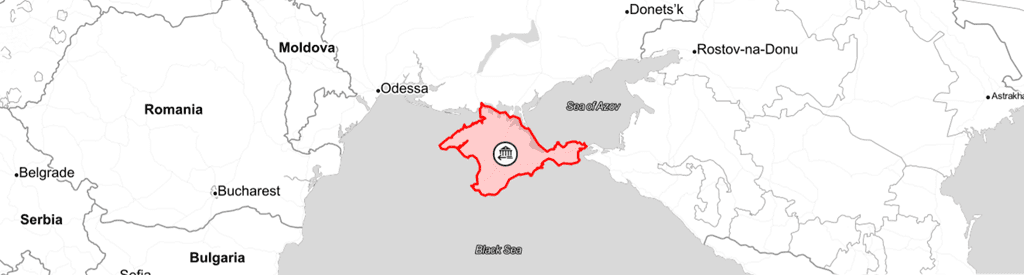

An example of this is screening for the sanctioned region of Crimea. By leveraging a data science technique known as Geofencing, Verafin creates a virtual boundary around Crimea, which limits analysis of payments specifically to that geographic region, opposed to analyzing all of Russia and/or the Ukraine. This provides institutions more accurate and efficient results and less false positives for added confidence in their sanctions compliance program.

V Verafin Alert Detail: Smart Evidence – Geographic Map

Verafin Alert Detail: Smart Evidence – Geographic Map

Understanding Customer Relationships to Reduce EDD Reviews

As noted in Jim Richard’s Blog Series on Renewing the BSA, according to the AML Act of 2020, “AML and CFT programs should be… risk-based, including that more attention and resources of financial institutions should be directed toward higher-risk customers and activities, consistent with the risk profile of a financial institution, rather than toward lower-risk customers and activities.”

However, current approaches to managing higher-risk customers are ripe with inefficiencies. Customer segmentation is also a challenge as many high-risk customer approaches paint each customer with the same brush, however not all high-risk customers are created equal. This can easily lead to more unnecessary reviews at a higher frequency.

When institutions properly identify individual risk, it allows their high-risk customer strategy to evolve towards a more efficient and effective approach, based on their own unique risk profile.

With cross-institutional analysis of counterparty data in the Cloud, Verafin provides insights into the relationships and interactions of your customers. Our big data set helps to resolve and develop a more complete profile of each counterparty that your customers interact with — of which there are nearly 300 million in the Verafin Cloud. With a more complete and accurate profile of risk for your customer, based on their trusted relationships in the Cloud, you gain added confidence in their activity since your last EDD review — significantly reducing the time spent on unnecessary reviews. Allowing your institution to focus their time and effort on entities, relationships and activities that require further scrutiny and pose the greatest risk.

A Look Ahead – Clarity on The Horizon in 2022

Looking ahead to 2022, further changes as a result of the AMLA are expected, including new guidance and greater clarification on how institutions can be more effective in aligning programs with the changing expectations and national priorities.

Considerations for financial institutions moving forward:

- Is your program prepared to adapt quickly to new and changing AML priorities?

- How will your institution manage and mitigate risk associated with virtual currency?

- How will you manage an efficient and effective sanctions screening program to ensure compliance?

- Do you have a complete picture of your customer relationships for EDD reviews?

- How can your institution leverage technology and innovation to improve your effectiveness and efficiency overall?

It is critical that institutions strive towards effectiveness and efficiency — assessing the systems and processes that increase operational costs. These inefficiencies take valuable time and resources from important and high-value activity such as investigations and providing quality, actionable intelligence in reports to law enforcement.

Verafin’s industry leading Financial Crime Management platform provides a complete picture of customer activity and innovative solutions to strengthen BSA/AML programs with consortium data and our managed agent approach.