In a recent year-end presentation, we explored the unrelenting challenges of 2020, the trends and technology developments throughout the year, and offered an overview of how recent industry threats may continue into the future. The following highlights and related resources will provide context for institutions when strategically planning, evaluating, and prioritizing investment in financial crime management programs for the year ahead.

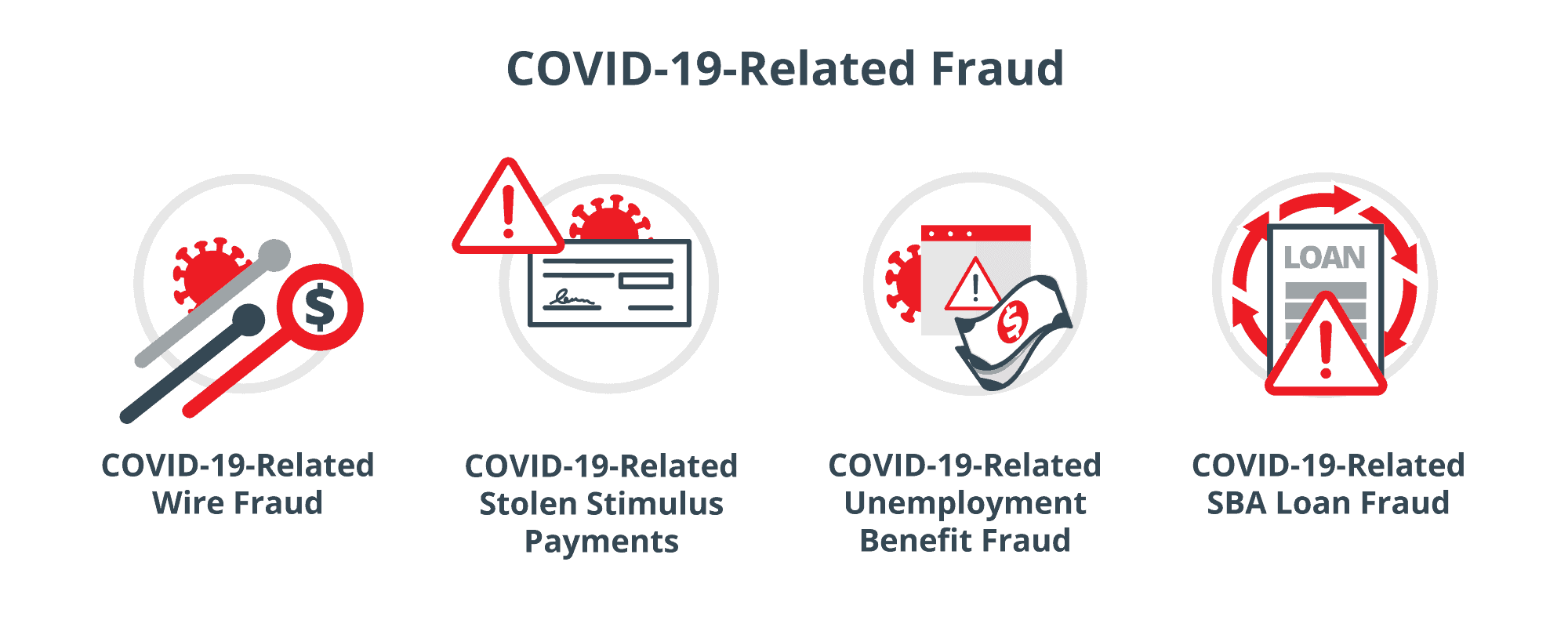

COVID-19-Related Fraud

The COVID-19 pandemic has created the perfect storm for financial crime. Many institutions have closed or limited access to brick-and-mortar branches, and large numbers of citizens are under shelter-in-place orders, forcing consumers to change their banking behavior. Institutions are facing tremendous changes in their daily operations, from staff working from home with limited resources, to consumers moving to new transaction channels.

In the midst of this uncertainty, the Coronavirus Aid, Relief, and Economic Security (CARES) Act offered over $2 trillion in economic aid to U.S. citizens and businesses. However, industry authorities issued warnings as criminals leveraged the COVID-19 crisis for tried and true scams, and fraudsters targeted economic stimulus payments.

COVID-19-Related Wire Fraud

Wire fraud, including Business Email Compromise (BEC), has been a continuing threat during the COVID-19 crisis as criminals exploit disrupted business processes and cloud-based email services, and prey on consumer fear — we have observed an increase in wire payments with descriptions related to COVID-19, such as personal protective equipment and rent relief.

COVID-19-Related Stolen Stimulus Payments

The CARES Act provided the largest economic stimulus package in U.S. history — a goldmine for criminals seeking to intercept and reroute direct deposits. Under the guise of COVID-19-related payments, criminals have relied upon known fraud typologies such as check fraud, tax fraud or phishing attacks, enabled by stolen personally identifiable information (PII), to target relief funds.

COVID-19-Related Unemployment Benefit Fraud

With businesses closed and citizens sheltering in place, the COVID-19 pandemic caused a major economic downturn forcing millions of Americans to file for unemployment benefits. With claims systems strained by historic and accelerated volumes of applications, criminals seized the opportunity to target unemployment benefit claims payments for their gain.

COVID-19-Related SBA Loan Fraud

U.S. Small Business Administration (SBA) loans have become prime targets for criminals eager to profit from CARES Act stimulus payments. With millions of dollars at stake, the SBA warned businesses to monitor for cases of loan fraud and phishing attacks.

Combating Crime with Cloud-Based Technology and Information Sharing

As the COVID-19 crisis continues to impact the way financial institutions identify, report and stop financial crime, the adaptability of automated financial crime management solutions is imperative. Large, cross-institutional data sets are necessary to detect and identify changing customer behaviors, emerging criminal trends, and strengthen investigations with enriched, actionable intelligence for law enforcement.

Rapid Release of New Analytical Agents

With a cloud-based solution, analytical agents can be improved through the targeted analysis of known fraud and money laundering cases, and product enhancements can seamlessly and automatically be deployed to institutions each week. Fraud is constantly evolving — cloud-based solutions that adapt to emerging criminal patterns and the new trends of customer behavior offer rapid response to threats with speed and innovation.

At Verafin, our longstanding commitment to a customer-driven development process enabled us to successfully address the unprecedented challenges arising from the pandemic. As new fraud trends began to surface, Verafin released solutions, such as COVID-19-Related Wire Fraud Detection, COVID-19-Related Stolen Stimulus Payment Detection, COVID-19-Related Unemployment Benefit Fraud Detection, and COVID-19-Related SBA Loan Fraud Detection, to protect our customers from emerging illicit activity.

Wire Payee Confidence

Wire transfers are inherently risky. Cloud-based solutions can offer reassurance that recipients of wires sent from your institution have an established and trusted history. Cross-institutional data can boost confidence in wire transfers, minimize risk, and greatly reduce false positive alerts, with evidence that the receiving account of an outgoing wire transfer has previously received trusted wire transfers from other institutions. When a wire payee is new to your customer or new to your institution, we use our consortium of financial institution customers across the Verafin Cloud to ensure the payee has an established history of receiving wires and a low-risk customer account.

Verafin’s approach to wire payee confidence is made possible through our consortium of financial institution customers, which enables us to deploy cross-institutional analytics in the Verafin Cloud to determine the risk associated with a wire transfer. Verafin analyzes the previous wires sent to the account, previous fraudulent wire activity, the account age and account type, transaction history, the account holder name, and more. Verafin’s wire payee confidence analysis offers unique insights about the receivers of your outgoing wires, reducing false positive alerts by up to 50% to efficiently and effectively fight fraud.

Working Together: A Consortium Approach

With a consortium of financial institution customers across the Cloud, Verafin offers a proactive approach to collaborative investigations and information sharing, enabling institutions to work together and share actionable intelligence with law enforcement — efficiently and effectively fighting crime.

The Future of AML

2020 saw renewed calls to modernize the BSA/AML regime, from the Financial Crimes Enforcement Network (FinCEN) Advanced Notice of Proposed Rulemaking seeking comments on regulatory amendments, including “the reporting of information with a high degree of usefulness to government authorities,” to the United States Government Accountability Office (GAO) report addressing the costs and usefulness of BSA reports.

Calls to Modernize the BSA/AML Regime, SARs

This call to action would see the financial industry move beyond checkbox compliance to crimefighting. Financial crime management programs need to offer Suspicious Activity Reports (SARs) with a high degree of usefulness; beyond simply filing regulatory reports, institutions need to provide law enforcement with strategic information. The usefulness of a SAR is not subjective; institutions and law enforcement agencies must collaborate and provide feedback to strengthen and enrich regulatory reports.

BSA/AML compliance programs can be further strengthened by targeted AML analytics detecting potentially suspicious transactional activity. Machine learning agents are only useful when applied to well-defined typologies, and few money laundering typologies are clearly defined — financial institutions and law enforcement must work together to develop and strengthen money laundering typologies to ensure more effective and efficient AML programs. In the future, cross-institutional AML team investigations with suspicious transaction interdiction may become the new norm.

Risk-Based Approach

In the 2020 National Strategy for Combating Terrorist Financing and Other Illicit Financing, the Department of the Treasury reiterated that a risk-based approach is central to the U.S. AML/CFT framework. Institutions of all asset sizes may face challenges when planning to reduce costs and improve efficiencies of their Customer Due Diligence/Enhanced Due Diligence (CDD/EDD) programs. Institutions should implement risk-based CDD/EDD policies, procedures and processes that are commensurate with their risk profiles, with increased focus on high-risk customers. With a risk-based approach, the proper identification and assessment of customer risk allows for effective and efficient CDD/EDD reviews, and for institutions to assess their high-risk customer strategy to evolve programs over time, based upon their unique risk profile.

A Look Ahead: Trends and Technology for 2021

2020 saw significant changes in customer behavior, such as increased use of online and mobile banking channels, and this trend is likely to continue. While digital banking channels are convenient for customers, they are also easy targets for fraudsters, and institutions must be prepared to protect themselves and their most vulnerable customers in the coming year.

With further economic relief on the way, criminals are likely to continue capitalizing on opportunities for fraud. Known criminal typologies such as loan fraud, check fraud, and BEC will continue under the guise of COVID-19 activity. Institutions must actively monitor ACH, wire and other payments to identify signs of potentially suspicious activity, such as COVID-19-related keywords.

Financial institutions need to find the right balance between providing convenient and accessible services to their customers, while protecting their institutions and customers from emerging financial crimes. 2020 has created a new status quo in the level of support customers require from their financial institutions, resulting in increased demands on fraud and BSA/AML programs. Institutions must have the right technology in place to protect themselves, and their customers, from financial loss.

As we move into the new year, Verafin is developing new approaches to connect cross-channel data sources, leveraging technology to deliver the benefits of an aggregated dataset to financial crime management. Financial crime is always changing, and your technology solution must evolve to stay a step ahead. Financial institutions should consider financial crime management solutions that can quickly and seamlessly evolve with changing customer behavior and criminal trends, effectively and efficiently providing the right technology to protect your institutions and customers today and tomorrow. With our consortium of financial institution customers across the Cloud, the Verafin Financial Crime Management platform can help your institution confidently transition into 2021 by successfully predicting emerging criminal trends, helping your institution stay compliant, and effectively and efficiently combating financial crime.