Financial crime has proven to be a serious and growing challenge during the COVID-19 crisis. Fraudsters have promptly exploited the pandemic for their gain; with many financial institutions closed or limiting branch access and large numbers of citizens still sheltering in place, sweeping changes in daily operations and customer behavior are complicating financial crime management. Institutions must adapt to the new normal of the industry, and should consider how a cloud-based approach can identify and address current challenges without delay.

Flexibility & Speed in Response to Trends

Adapting to emerging criminal patterns and the new trends of customer behavior will require partnerships and technology that respond to threats with speed and innovation. At Verafin, our longstanding commitment to a customer-driven development process has been particularly successful in addressing the unprecedented challenges arising from the pandemic. With the COVID-19 crisis creating historic possibilities for crime, institutions can no longer afford delays in product updates or platforms that cannot release urgently required protections, today.

Verafin has always recognized that it is essential to provide financial institutions with solutions that scale quickly. By partnering with our customers in our customer-driven development process, we rapidly deliver new functionality that arms customers with the strongest safeguards against crime at the earliest opportunity. Through the power of the Verafin Cloud, customer partnerships, and big data intelligence, we are continuing to track financial crime trends, including those related to COVID-19, and release software enhancements to protect our customers from emerging illicit activity.

Protecting Customers’ Online Accounts

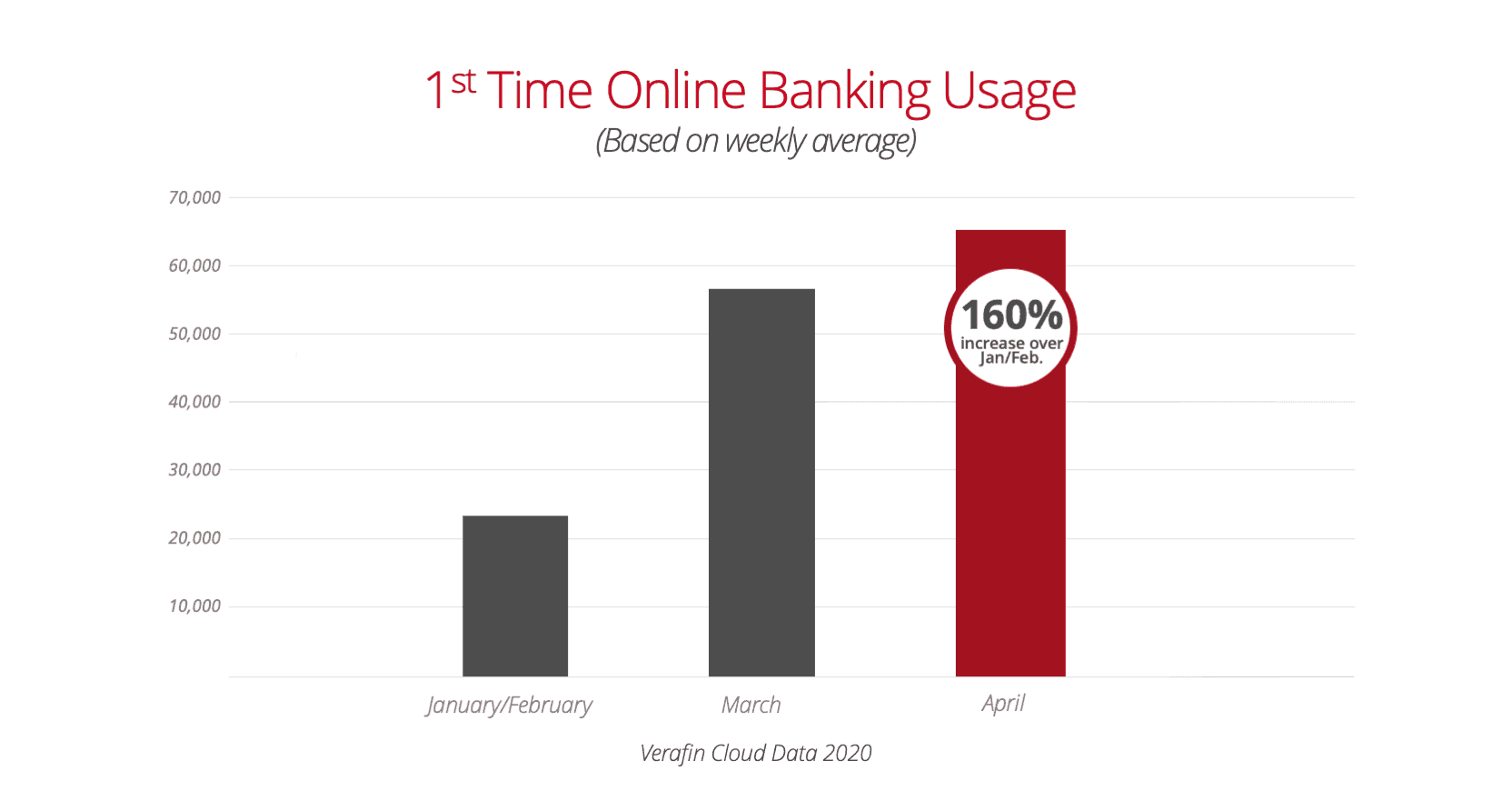

Across the country, industry authorities have issued warnings as criminals leverage the COVID-19 crisis for tried and true scams, including phishing attacks. Bad actors are eyeing the recent surge in new online banking customers, harvesting credit card numbers and compromising other personally identifiable information (PII) in preparation to compromise accounts. In April, the average number of weekly new online banking setups in the Verafin Cloud surged by over 160%, as customers — and criminals — migrate to digital banking. Financial institutions need a solution that provides deep insights into online account activity, proactively identifying risky actions and fraud.

Verafin’s Online Account Takeover solution profiles customers’ online activities, including location, device and IP address, and alerts investigators to potentially suspicious activity, such as risky account set-ups and unusual logins. By creating a case directly in Verafin, you can investigate alerts in detail and mark the activity as a COVID-19-related scam to monitor trends and impacts over time.

Verafin’s Online Account Takeover solution profiles customers’ online activities, including location, device and IP address, and alerts investigators to potentially suspicious activity, such as risky account set-ups and unusual logins. By creating a case directly in Verafin, you can investigate alerts in detail and mark the activity as a COVID-19-related scam to monitor trends and impacts over time.

Preventing Fraud from COVID-19-Related Wires

At a time when industry authorities are warning of increased Business Email Compromise (BEC) attacks, we have also observed an increase in wire payments with descriptions related to COVID-19, such as personal protective equipment and rent relief. Such scams can be extremely damaging, and financial institutions must carefully oversee wire activity for potentially risky transfers related to COVID-19.

In response to the growing need to monitor for fraudulent wires and BEC related to the pandemic, Verafin has rapidly developed an enhancement to our Wire Fraud solution that detects when outgoing wires to a new payee contain COVID-19 keywords. With wire payee confidence in the Verafin Cloud, you also gain reassurance that recipients of wires sent from your institution have a trusted history.

Monitoring & Managing Customer Behavior

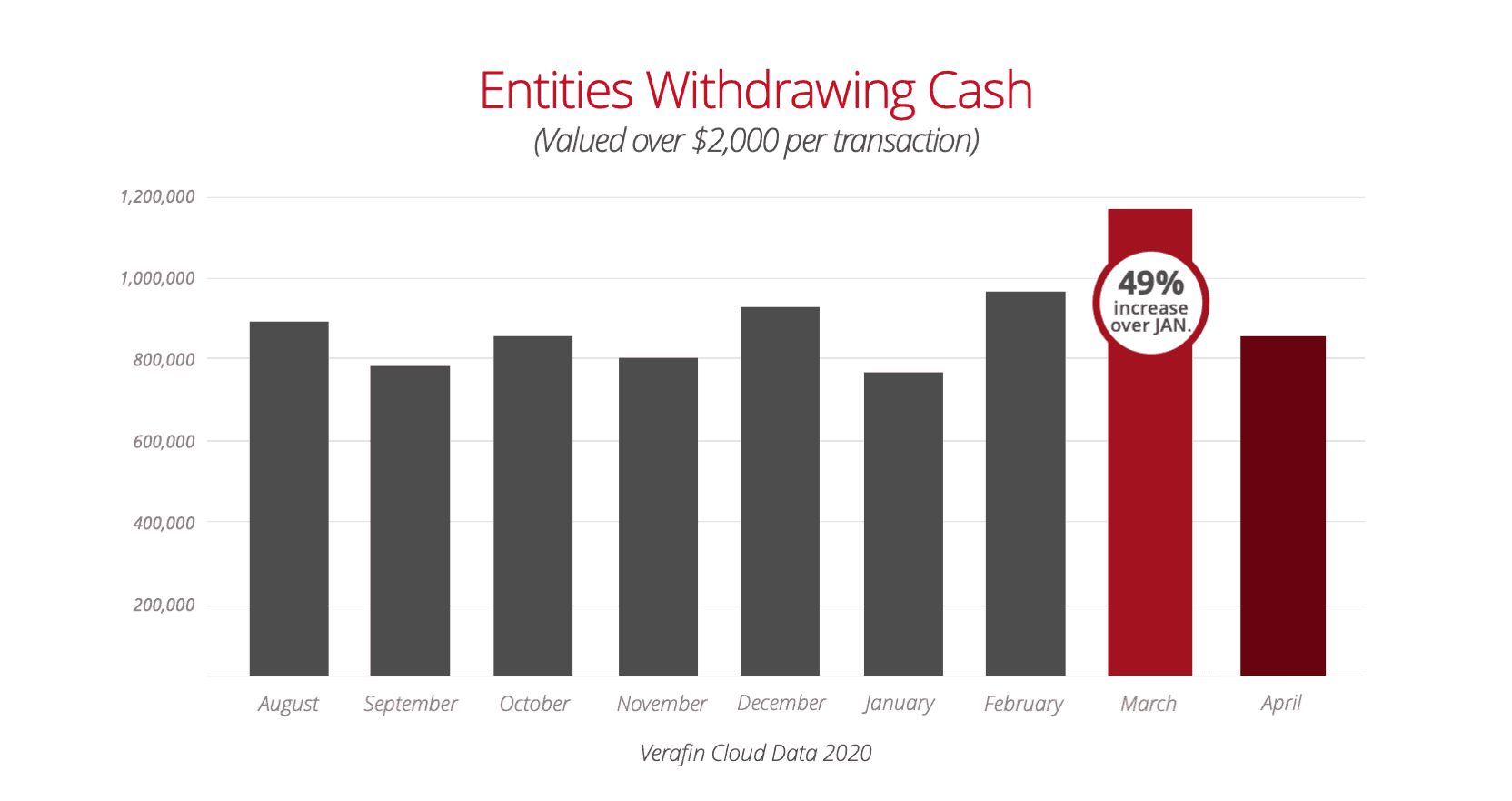

COVID-19 has disrupted everyday life, and historical patterns of criminal and customer activities are now far less reliable as predictors of future behavior. At the onset of the pandemic in March, we saw evidence of mattress banking — when customers react to a crisis by withdrawing cash from their accounts — as the number of entities withdrawing $2000 or more in a single cash transaction surged nearly 50% over January of this year. For conventional systems with static rules, this change in activity can obscure potentially suspicious activity and cause high volumes of alerts.

Through our behavior-based approach, Verafin allows institutions to easily adapt anti-money laundering (AML) monitoring to changing trends in activity. With this flexibility, our BSA/AML Compliance and Management solution can dynamically adapt to this newly-defined baseline of customer behavior, efficiently managing alert workloads and providing added confidence for suspicious activity detection.

Through our behavior-based approach, Verafin allows institutions to easily adapt anti-money laundering (AML) monitoring to changing trends in activity. With this flexibility, our BSA/AML Compliance and Management solution can dynamically adapt to this newly-defined baseline of customer behavior, efficiently managing alert workloads and providing added confidence for suspicious activity detection.

Fighting Mobile Check Scams

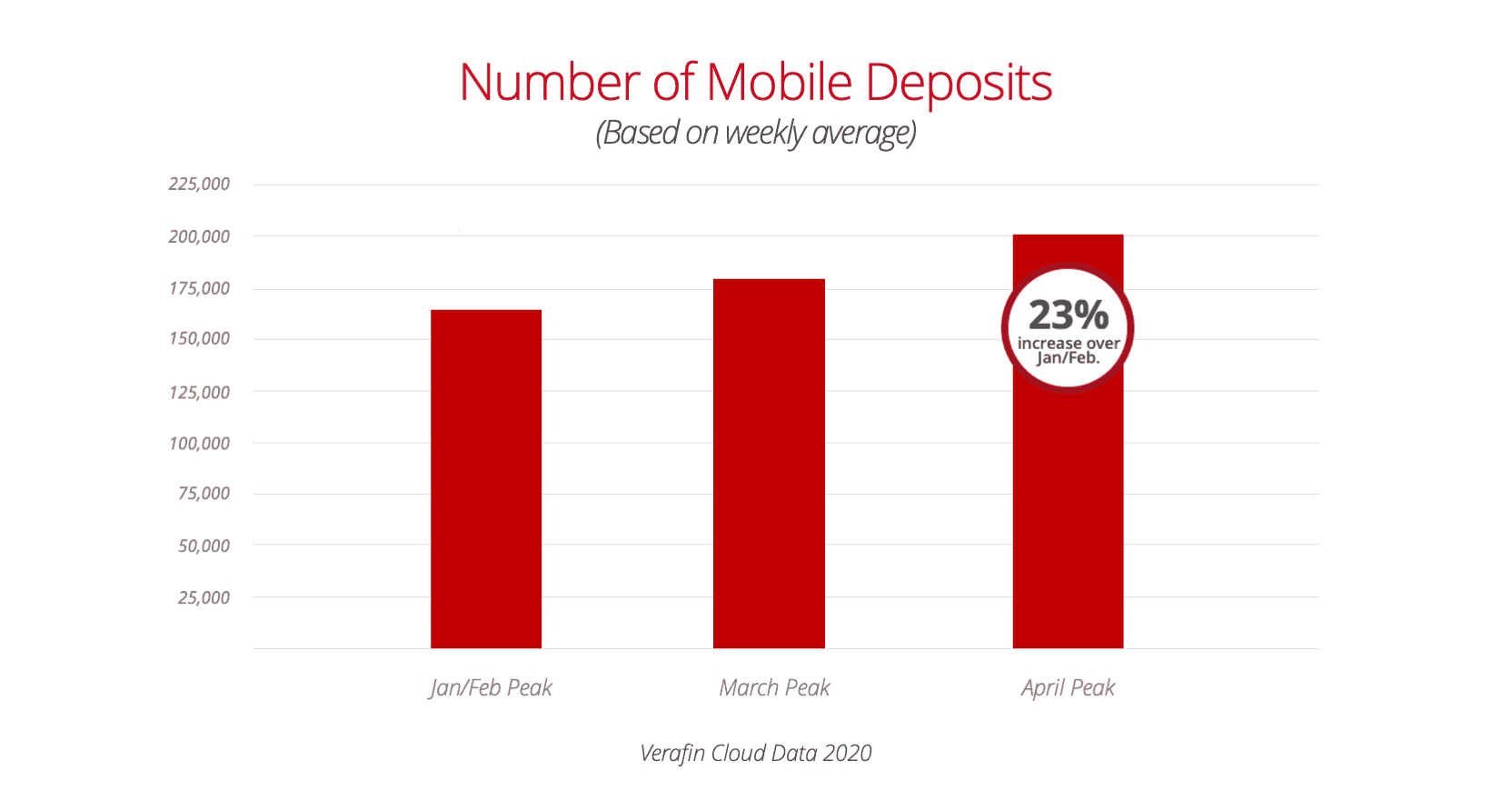

While some customers are withdrawing high volumes of cash, others are shifting to mobile and digital transfers. Weekly peak mobile deposits in the Cloud increased by 23% in April, highlighting that mobile check deposit scams — a favorite vehicle for fraudsters — should be a top concern for financial institutions. This is amplified by the potential risks from schemes and counterfeiting involving economic stimulus check payments — as millions of U.S. citizens will receive aid in the form of paper checks. Financial institutions must be prepared to detect variations on established scams, such as advance fee scams and schemes funded with overpayment, as criminals seek illicit profits and vie for these payments.

Using big data and machine learning capabilities, Verafin’s Deposit Fraud solution detects emerging scam typologies, including evolving mobile deposit fraud methods, and automatically learns from examples of true COVID-19 fraud to anticipate future trends.

Using big data and machine learning capabilities, Verafin’s Deposit Fraud solution detects emerging scam typologies, including evolving mobile deposit fraud methods, and automatically learns from examples of true COVID-19 fraud to anticipate future trends.

Stimulus Payment Fraud

Benefits fraud is all too common during times of crisis, and agencies are already releasing red flags and warnings as criminals set their sights on economic stimulus payments. It is critical to keep ahead of fraudsters and their cunning tactics, such as the current trend of using stolen identities to reroute the funds from the intended recipient to an account under the fraudster’s control.

By collaborating with our partners through our customer-driven development process, we have rapidly developed and released a Stolen Stimulus Payment agent to detect this criminal activity. This analytic incorporates demographic and transactional red flags into analysis to identify potentially suspicious payments and alert you to illicit activity that might otherwise go unnoticed.

Responsive When You Need it Most

Vast differences in customer behavior, diverse criminal schemes, and the frenetic pace of change are creating formidable challenges for financial institutions that must rely on conventional transaction monitoring systems. In these uncertain times, a responsive, cloud-based solution that decisively counters emerging financial crime is key to adapting to the industry’s new normal with speed and confidence.

Join us for an upcoming demo or webinar to learn more about emerging trends from COVID-19-related crime and the latest solutions from Verafin’s highly responsive development team and collaborating customer partners.