“The CARES Act… together with three related pieces of pandemic relief legislation represent at least $2.4 trillion in aid and presents unparalleled opportunities to assist those in greatest need as well as unmatched prospects for fraud, misuse of the funds, and other criminal conduct.”

– United States Pandemic Response Accountability Committee

Fraud and illicit activity are often exacerbated in times of crisis, and the COVID-19 pandemic is a considerable and historic example. While fraudsters have readily exploited public fear surrounding the emergency with a slew of schemes, the Coronavirus Aid, Relief, and Economic Security (CARES) Act is perhaps their largest and most lucrative opportunity, representing a massive $2.4 trillion in aid. With the first wave of stimulus payments, valued at nearly $160 billion, now being issued by the Internal Revenue Service (IRS) through mailed checks and direct deposits, fraudsters are eyeing a potential windfall of profit to be stolen through scams, phishing attacks and check counterfeiting. Financial institutions must remain on guard for bad actors who seek to intercept or reroute these funds for their own illicit benefit.

Risky Paper Payments

Millions of Americans will receive economic stimulus payments in the form of paper checks — a favorite target for fraud. Consequently, traditional check fraud should be a chief concern for financial institutions as authorities warn of the potential risks from counterfeit checks and stimulus check fraud scams. According to Don Fort, IRS Criminal Investigation Chief, “history has shown that criminals take every opportunity to perpetrate a fraud on unsuspecting victims, especially when a group of people is vulnerable or in a state of need. While you are waiting to hear about your economic impact payment, criminals are working hard to trick you into getting their hands on it.”

As predicted, criminals are once again demonstrating their unwavering commitment to maximizing profits at all costs. Some fraudsters have already taken the initiative, forging and distributing counterfeit checks as early as mid-April, before the first legitimate economic stimulus checks were issued. Others are refining tried and true scams to prey on the fear and desperation surrounding COVID-19, and are targeting those most in need, including vulnerable citizens and seniors. These customers may be more likely to fall victim to confidence scams, where fraudsters offer phony services in exchange for the victim signing over their stimulus check, and overpayment scams where the victim is sent a counterfeit check and convinced to return an overage via gift cards or money transfers.

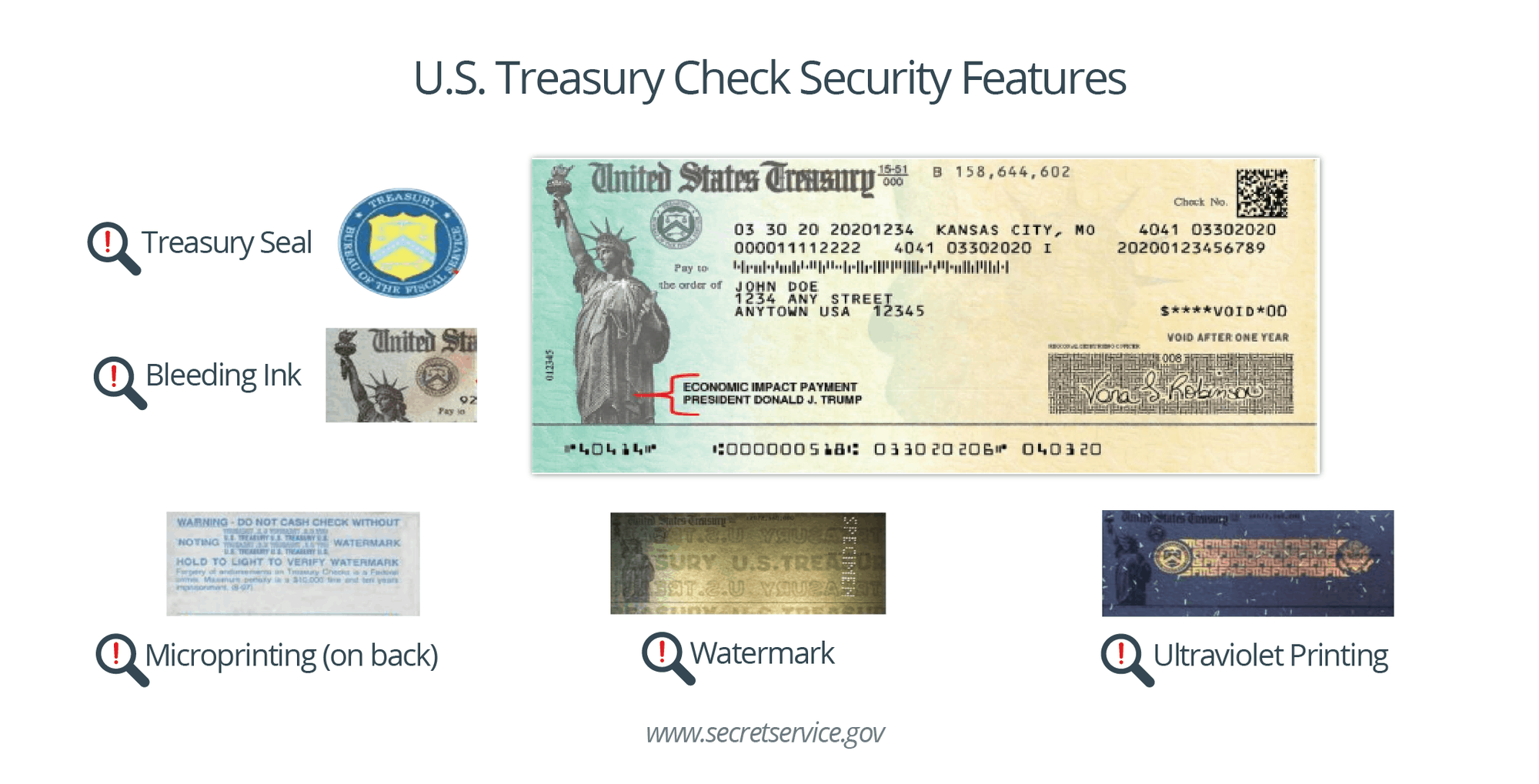

The United States Secret Service has released these quick tips to help financial institutions identify counterfeit U.S. Treasury checks.

With many Americans still sheltering in place and digital transactions rising, financial institutions must diligently monitor for economic stimulus fraud on mobile deposit channels.

Automatic Deposit or Automatic Fraud?

As millions of checks are cut for Americans across the country, many other U.S. citizens will automatically receive stimulus payments by direct deposit. Unfortunately, direct payment does not guarantee protection from fraud, as savvy criminals have learned to scam victims, redirect payments and manipulate the system to intercept stimulus funds for their illicit gain.

In today’s digital society, it is all too easy for criminals to contact victims by telephone, email, text message or social media to obtain the information they need to commit fraud. Commonly, the fraudster will ask to verify personal and financial information, claiming they need these details to accelerate or issue the victim’s stimulus payment.

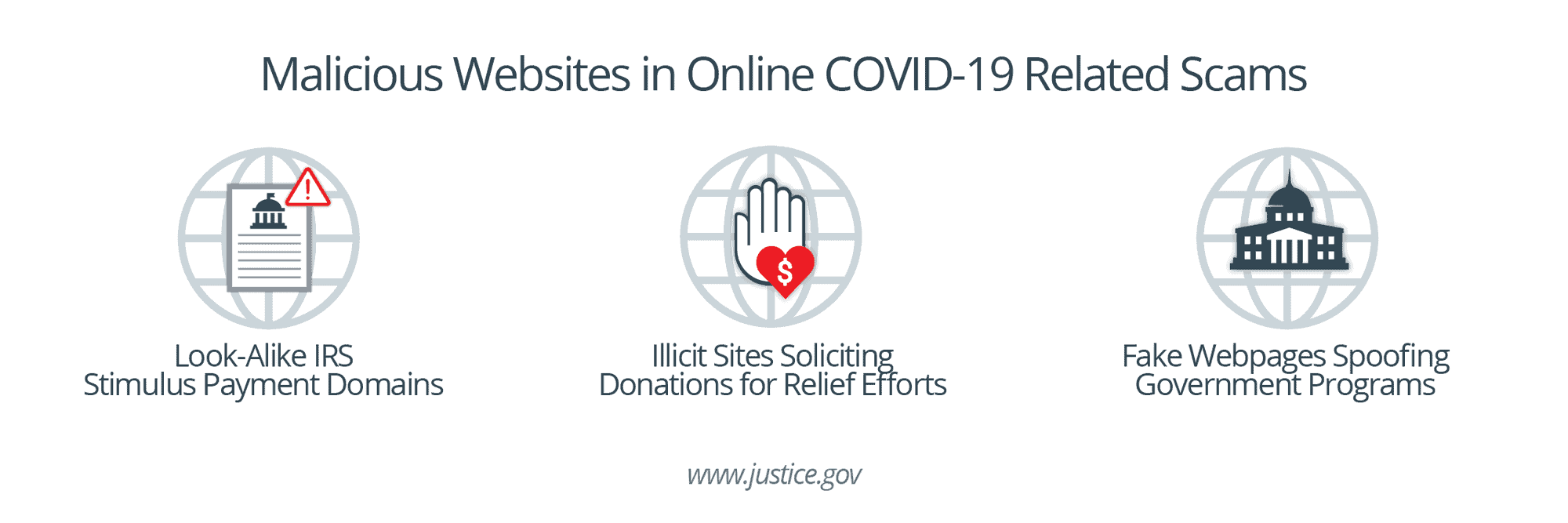

Other, more cunning tactics are also on the rise. The pandemic has caused a surge in phishing attacks, which criminals are combining with malicious websites to further their schemes. These sites spoof legitimate organizations and contain software to harvest personally identifiable information (PII) and financial details. While charities and health organizations are common choices, authorities have reported fraudulent websites mimicking the IRS. Using PII and financial details gathered through phishing attacks and spoofed websites, criminals can execute a scam similar to tax refund fraud, establishing money mule accounts under victims’ names for the purpose of receiving fraudulent payments or rerouting legitimate payments to accounts under their control.

As criminals focus on compromising automated stimulus payments, financial institutions must monitor transactions for potential fraud involving multiple or out of pattern economic stimulus payments, before the funds are withdrawn.

As criminals focus on compromising automated stimulus payments, financial institutions must monitor transactions for potential fraud involving multiple or out of pattern economic stimulus payments, before the funds are withdrawn.

Considerations for Financial Institutions

Criminals are well aware of the unprecedented opportunity that COVID-19 economic stimulus payments represent and are adapting faster than ever to take advantage. Financial institutions need solutions that keep pace with criminal ingenuity by rising to the challenge of emerging trends. Robust and agile financial crime management approaches can protect customers and uncover illicit funds from economic stimulus fraud.

As CARES aid continues and more and more stimulus checks enter circulation, institutions can help prevent losses from scams and fraudulent checks with targeted monitoring for mobile deposit fraud. By leveraging innovative machine learning technology, Verafin’s Fraud Detection and Management solution learns from big data to enhance monitoring and improve detection capabilities.

Monitoring is also needed for potentially fraudulent stimulus payments deposited directly into customer accounts. In collaboration with our customers, Verafin has rapidly developed and released a targeted Stolen Stimulus Payment agent, which alerts investigators to potentially fraudulent deposits initiated through ACH.

With billions of dollars on the line, threatened by economic stimulus fraud, having the right financial crime management solutions in place is more important than ever. Through the power of the Verafin Cloud, we provide weekly software updates to ensure that institutions are always protected by the latest analytical advances. Combining anonymized cloud-based data, user feedback, and advancements in artificial intelligence (AI) and machine learning technology, Verafin develops highly-targeted analytical models that alert financial institutions to the latest criminal trends.

Join us for an upcoming demo or webinar to learn more about emerging crime trends and solutions.