On May 18, the Financial Crimes Enforcement Network (FinCEN) released a new Advisory on Medical Scams Related to the Coronavirus Disease 2019 (COVID-19) to alert financial institutions to emerging scams related to the COVID-19 pandemic. This Advisory is the first of several advisories FinCEN plans to release to assist financial institutions combatting COVID-19-related financial crimes.

As a companion to the Advisory, FinCEN also issued a Notice Related to the Coronavirus Disease 2019 (COVID-19) to remind financial institutions of their Bank Secrecy Act (BSA) regulatory obligations during the COVID-19 pandemic. Each upcoming COVID-19-related FinCEN advisory will refer financial institutions to the reporting information included in this Notice.

Detecting COVID-19 Scams with Red Flag Indicators

Drawing on reported BSA data, along with other federal, foreign government, and public information sources, FinCEN highlights several red flag indicators of potentially suspicious activity, “to assist financial institutions in detecting, preventing, and reporting suspicious transactions associated with the COVID-19 pandemic.” The red flags point to transactional and demographic information relating to:

- Medical-related fraud, including fraudulent COVID-19 cures, tests, vaccines and services

- Non-delivery fraud scams relating to medical goods

- Price gouging and hoarding of medical supplies

With these red flags, financial institutions are encouraged to monitor customer accounts, analyze a customer’s historical behavior, and investigate unusual and suspicious transactions.

Verafin’s behavior-based analytical agents evaluate demographic and transactional data against historical patterns of activity to accurately detect anomalous activity. With our immense data set, our analytics can evolve as customer behavior and criminal activity evolves. Verafin has quickly developed and deployed new targeted fraud detection analytics, including COVID-19-Related Wire Fraud Detection and COVID-19-Related Stolen Stimulus Payments Detection solutions. These timely, behavior-based solutions include risk-rated evidence built upon demographic and transactional data, to alert you to potential COVID-19-related fraud.

Identifying Fraud Schemes with Information Sharing

“Information sharing among financial institutions is critical to identifying, reporting, and preventing evolving fraud schemes, including those related to COVID-19.”

– FinCEN Notice Related to the Coronavirus Disease 2019 (COVID-19)

In the Notice, FinCEN encourages financial institutions to enrich financial crime investigations by engaging in information sharing, with civil liability protections afforded to them under the safe harbor authorized by section 314(b) of the USA PATRIOT Act.

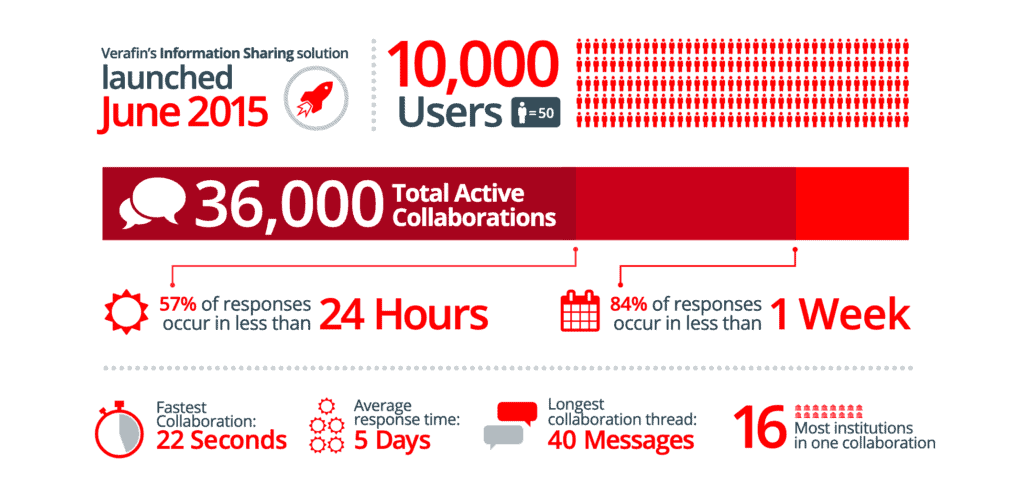

Verafin provides 314(b) Information Sharing technology for more than 2000 institutions that are members of the FRAMLxchange, the industry’s largest network of 314(b)-registered institutions.

Verafin’s secure information sharing platform allows investigators to participate in collaborative investigations with other institutions, securely sharing information to gain valuable insight into potentially suspicious activity spanning multiple institutions. With shared investigative cases, institutions can enhance the information provided to law enforcement to uncover COVID-19-related fraudulent activity.

Source: Infographic Information Sharing: By the Numbers

Reporting COVID-19-Related Fraud Scams

“SAR reporting, in conjunction with effective implementation of due diligence requirements by financial institutions, is crucial to identifying possible financial crimes related to the COVID-19 pandemic, as well as unrelated frauds and financial crimes associated with foreign and domestic political corruption, money laundering, terrorist financing, and other illicit finance.”

– FinCEN Advisory on Medical Scams Related to the Coronavirus Disease 2019 (COVID-19)

FinCEN requires that institutions maintain effective Suspicious Activity Report (SAR) filing procedures by providing detailed SAR narratives, including references to the Advisory and filing the SAR as a fraud type indicating a connection between the reported suspicious activity and COVID-19.

Verafin includes fully integrated Suspicious Activity Reporting and Case Management functionality, helping financial institutions expedite and strengthen their end-to-end investigations, and provide actionable intelligence to law enforcement.

Verafin allows investigators to open an investigative case directly from an alert and easily generate a SAR from the case. Investigators can attach applicable files, link entities and related suspicious activity, fully document and track COVID-19-related investigations — all in one location.

With automated regulatory reporting, Verafin completes all data fields when a SAR is generated and indicates if you are missing required information. Once you complete the narrative section and include references to the FinCEN Advisory and potential COVID-19-related fraud, you can queue your completed SAR for automated overnight e-filing directly with FinCEN.

A Step Ahead of New and Evolving COVID-19-Related Crimes

As fraud evolves and new typologies emerge during this crisis, financial institutions need solutions that keep pace with new financial crime trends and regulatory guidance. Financial crime management solutions must rapidly develop new analytics and provide new functionality to successfully combat the crimes of today.

Verafin delivers a complete platform of financial crime management solutions to detect potentially suspicious activity and prevent evolving and emerging crimes, including COVID-19-related fraud scams.

Leveraging the power of the Cloud, Verafin continues to collaborate with our customer partners to rapidly develop and release targeted analytical agents to ensure our thousands of banking customers are always protected by the latest analytical advances. As fraudulent activity related to the COVID-19 pandemic continues to evolve, Verafin will continue to provide targeted analytics and compliance solutions to help institutions stay a step ahead of financial crime.