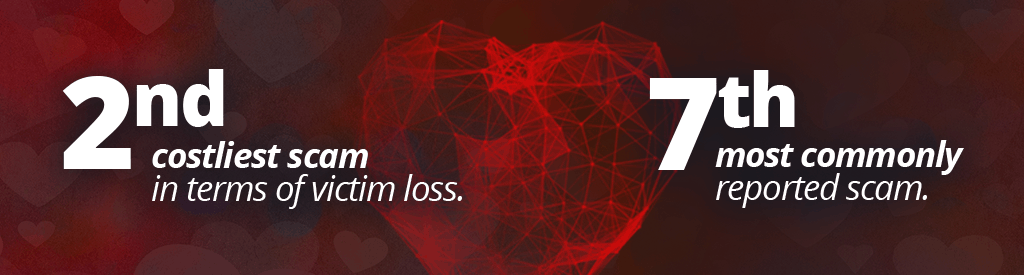

“In 2018, confidence/romance fraud was the seventh most commonly reported scam to the [Internet Crime Complaint Centre (IC3)] based on the number of complaints received, and the second costliest scam in terms of victim loss.”

– IC3 Public Service Announcement

When love is in the air, the euphoria of a potential relationship can blind us to dangers lurking online. Fraudsters have sadly taken this tactic to heart in romance schemes, an especially egregious scam that has grown in favor across criminal networks since our previous blog. In fact, the IC3 reported more than $362 million in losses to such schemes in 2018 – up a drastic 70% from 2017. With a Federal Trade Commission (FTC) article echoing a near 150% increase in instances from 2015 to 2018, it is clear that criminal greed knows no bounds, and romance schemes remain a faithful threat to financial institutions and their customers.

Broad Typology, Aging Victimology

While scammers continue to evolve their strategies to commit fraud, there is only one constant across romance schemes: criminal profits. While heartless actors will exploit anyone for their gain, they are increasingly targeting older demographics and defrauding seniors. People 40 to 69 fell for romance schemes twice as often as 20-year-olds, and shockingly, seniors aged 70 or older bore the financial and emotional brunt of these damaging attacks with losses typically amounting to $10,000 per victim. In some cases, criminals have even impersonated friends and family in a broader typology the IC3 terms “confidence schemes.”

After gaining a victim’s trust in a romance or confidence scheme, criminals initiate and escalate requests for funds. According to the FTC report, these funds are usually wired, but criminals are increasingly preferring payment through other fast, irreversible and anonymous means like gift cards. Stolen finances often end up overseas, and sometimes in the hands of criminal networks, such as in one recent case where the Department of Justice indicted 80 Nigerian nationals for conspiring to channel $40 million in proceeds from romance scams and other schemes through U.S. money mules.

With criminals gaining momentum through collaboration and boldly defrauding vulnerable customers, institutions must consider how their anti-fraud programs can rise to the current and significant challenge of romance schemes.

Considerations for Financial Institutions

Real-time Analysis

Romance schemes develop over time, incurring mounting losses to victims who may be too ashamed to come forward. Fast, inline detection for wire transfers and other channels exploited for romance schemes can help institutions intervene to prevent losses and emotional anguish for their customers at the earliest opportunity, and without relying on firsthand reports.

By applying cross-institutional analysis to big data in the Cloud, and integrating with wire transfer systems, Verafin’s real-time fraud detection gives you confidence that a receiving account has a trusted history and the ability to halt fraudulent transactions before release.

Money Mule Detection

More than ever, romance fraudsters are exploiting their victims as money mules who unknowingly transmit illegal funds. To effectively intervene in these cases and shut down suspicious transfers, institutions need detection that examines both the wire sender and the payee.

Verafin’s advanced wire fraud detection leverages the power of the Cloud to look across thousands of institutions, identifying risky wire transfers emanating from a new payer and displaying alerts with visually intuitive, rich wire information. The end result is expedited decision making, and improved investigations into unusual wire activity.

Online Account Takeover Detection

Romance scam perpetrators may convince victims to divulge their online account details with a plan to gain access to the account. By detecting compromised accounts before the funds are transferred, financial institutions can prevent significant losses and further heartbreak for their customers.

Verafin’s online account takeover solution gives a more complete picture of accounts, which prevented a fraudulent transfer at Community First Credit Union after a customer shared their account information with a scam artist. As Fraud Prevention Manager Ryan Fuhriman reported, “we saved John from having a potential $10,000 loss over his head. It was hard to convince him that the woman was not really his girlfriend — he wanted it so badly to be real. Thankfully, I think he’s beginning to understand.”

Preventing Heartache in Disguise

Romance schemes are a cruel financial crime that cause victims emotional distress in addition to monetary losses. A strong fraud and anti-money laundering solution that can provide real-time analysis for commonly abused channels such as wire transfers, money mule detection, and suspicious online account activity is a critical defense for financial institutions and a strong step toward protecting customers from heartbreak.