Crime prevention is regularly focused on statistics and numbers. High dollar losses make for eye-catching headlines, sometimes making it easy to forget that fraud has a very human impact. If there is one thing we know about criminals, it’s that profit supersedes any concern about the feelings of others.

While all financial crime can claim victims, romance fraud scams are one form of fraudulent activity that is particularly heartbreaking. “Romance scams are particularly heinous in that they prey upon a person’s need for companionship, and can damage a victim on emotional and financial levels,” said Captain Chris Cahhal of the Los Angeles Sheriff’s Department’s Fraud and Cyber Crimes Bureau.

What is a Romance Scam?

Romance scams target victims, who may be emotionally vulnerable, with companionship and friendship. The goal of the criminal(s) perpetrating the crime is to get the victim to send them funds, which they claim are for a wide range of necessities such as travel, medical care, or a business opportunity.

How does it happen?

The fraudster, who is often located internationally but portrays themselves as American, will contact the victim through social media networks, online forums, or dating sites. After making contact, the fraudster will attempt to develop a deeper relationship with the victim.

The Internet is fertile ground for this scam. FBI Special Agent Christine Beining, a financial fraud investigator in the FBI’s Houston Division points to the advantage fraudsters gain from the inherent anonymity of the web. “The Internet makes this type of crime easy because you can pretend to be anybody you want to be. You can be anywhere in the world and victimize people.” Beining also notes how the web provides a fraudster with an ocean of potential victims, “The perpetrators will reach out to a lot of people on various networking sites to find somebody who may be a good target. Then they use what the victims have on their profile pages and try to work those relationships and see which ones develop.”

Romance scams are an emotionally devastating crime that impact victims far beyond monetary damages.

While the fraudster may attempt to quickly deepen the relationship, it can also develop over months as the fraudster works to build the victim’s trust. At some point in the “relationship” the fraudster will make a financial request. Any number of reasons may be used, but the fraudster will claim to need the money for:

- funds to cover the cost of traveling to see the victim;

- emergency medical expenses for the fraudster or a family member — typically a child; or

- a business opportunity that will allow them to live together comfortably.

In the beginning, the amount of money requested will often be small but increases as the fraudster becomes more and more successful in building the “relationship” and tricking the victim.

Who is targeted?

While men can be targets, the victims of romance scams tend to be women over the age of 50. The criminals tend to target widows, retirees, divorcees, or single women. Very often victims are emotionally vulnerable.

In early 2017, Scott Augenbaum, a special agent with the FBI in Nashville, TN, described the typical victim targeted in his state, “There’s been a lot of women between the ages of 50 to 60 years old, divorced, and really involved with their church.” Augenbaum also touched on the emotional damage inherent in the crime, “The people are humiliated, and they’re embarrassed, because besides losing money, they actually believed that they were in love, and when they find out the person is a West African cybercriminal, it’s very, very embarrassing.”

The size of the problem?

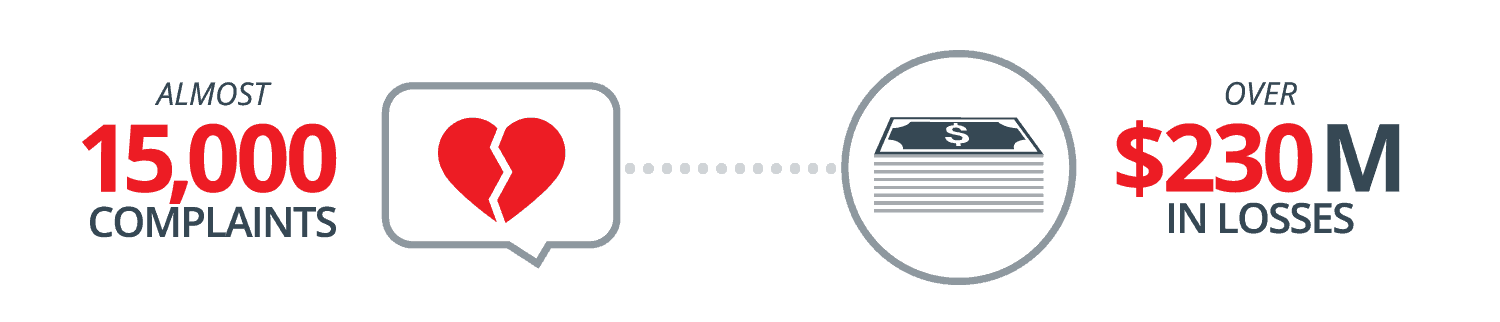

There were almost 15,000 complaints categorized as romance scams/confidence fraud reported to the FBI’s Internet Crime Compliant Center (IC3) in 2016, with the victims suffering over $230M in losses.

However, this may represent only a portion of the actual victims. The United States Attorney’s Office Western District of Washington published a web page on fraud victimization in which it stated that only an estimated 15% of U.S. fraud victims report crimes to law enforcement. A separate report on financial fraud by the Stanford Center on Longevity and the FINRA Investor Education Foundation indicates older adults are less likely to report being victimized due to a tendency to minimize emotionally negative experiences and the shame, embarrassment, or belief they are to blame for falling for a scam.

In terms of location, California, Texas, Florida, New York, and Pennsylvania made up the top five states by victim count.

A real-world example

In February 2017, the FBI published an article on the dangers of romance scams that included the story of a Texas woman who lost everything to a scammer named “Charlie”. In an emotionally abusive relationship at the time, the woman met Charlie through Facebook. What came next is sadly all-to-familiar.

Before long Charlie was asking for financial help with a construction job he was finishing in California. An initial wire of $30,000 turned into multiple new requests for money over the next two years, which the woman sent willingly believing they were in love.

Only after an intervention by her financial advisor did she contact the FBI. By that time, she had lost $2 million and suffered significant emotional damage.

Five key indicators of a romance scam

The following are five key indicators fraud investigators can look for to discover a customer who is potentially being victimized by a romance scam:

- Large funds transfer not typical for the customer.

- Funds transfers to international locations.

- Large ATM withdrawals.

- Large purchases at locations that process funds transfers (big box stores, international wire processors).

- Customer using lines of credit or pulling from investments, which is out of character

Strategies for uncovering romance scams

The following are two strategies that can help your institution quickly identify a potential romance scam victim and take action to protect them:

- Training for staff to identify escalating fund transfers to a relatively new recipient where the amounts are increasing — especially to overseas locations.

- Detection systems that profile both sending and receiving accounts of a funds transfer to ensure the activity is typical for both parties.

Romance scams are an emotionally devastating crime that impact victims far beyond monetary damages.

By monitoring your customers’ activity closely for unusual transactional behavior, such as the five key indicators listed above, you can play a leading role in protecting the emotionally vulnerable from merciless predators looking to inflict monetary damage and long-lasting psychological turmoil.

To learn more about common fraud scams including online loan, employment, lottery and BEC fraud, download our eBook, Understanding Fraud Schemes and Scams. Or find out more about how Verafin can help your institution protect its customers from exploitation at the hands of fraudsters.