Auto loan fraud is a hot topic. Given the potential size of the problem, it is hardly surprising.

At the Barclays Global Financial Services Conference in September 2016, JPMorgan Chase provided insight into the state of auto lending risk. In the first half of 2016,

- 47% of industry auto loan originations were to sub-prime (FICO <680) borrowers, and

- 21% had a Loan-to-Value (LTV) score of greater than 120%.

In November 2016, a Federal Reserve Bank of New York report noted the rise in the delinquency rate of auto loans, stating, “The worsening in the delinquency rate of subprime auto loans is pronounced, with a notable increase during the past few years.” At the time of the report more than 6 million Americans were at least 90 days late on their auto loan repayments. With $1.135 trillion in auto loans outstanding, increasing delinquency rates are worrying for a host of reasons.

What makes this picture more troublesome is the creeping presence of fraud hiding in charge-off activity.

The specter of fraud in loan charge-offs

Net charge-offs of auto loans have been trending upwards since at least 2011 when it was given its own category in the consolidated financial statistics for the U.S. commercial banking industry, collected by the Federal Reserve Bank of New York.

The question is how much of that is legitimate charge-off activity and how much contains fraudulent loan activity?

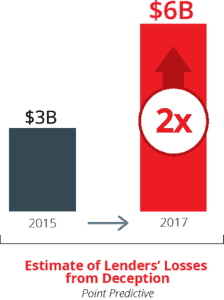

An article published by Bloomberg in May 2017 references a projection by Point Predictive that lenders’ losses from deception could ring in as high as $6 billion in 2017 — a significant increase from the estimated $3 billion in losses in 2015.

Figure 1

In a 2015 Verafin survey of BSA Officers, more than half of the respondents believed 20+ percent of charged-off loans are likely fraudulent. If that estimate is anywhere close to reality, we are dealing with some very large numbers.

Reporting suspicious activity in charged-off loans

In conversations with BSA compliance professionals at FIs across the country, Verafin is hearing that examiners are increasingly asking about the uncovering of fraudulent activity within loans. Given the frequent relation between fraudulently obtained loans and the presence of large scale crime ring activity, often tied to drug trafficking, this is not surprising.

In a recent white paper, Chris Swecker, retired Assistant Director, FBI, stated, “Homegrown United States based fraud rings have perfected conspiracies revolving around mortgage, check, auto loan and investment fraud schemes. Together these criminal enterprises have created a financial crimes tsunami that begs for institutions to adopt new and more effective counter fraud strategies.”

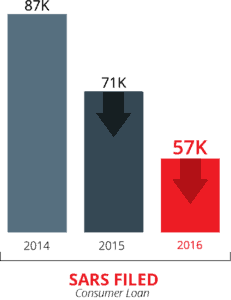

Interestingly, despite the growth in auto loan fraud and the high risk of charge-offs, the number of SARs filed with FinCEN under the category of Consumer Loan has decreased since 2014 (87,688 in 2014, 71,458 in 2015, and 57,556 in 2016 – see Figure 2). This begs the question: is the reporting of fraudulent activity getting missed in loan charge-offs?

Figure 2

Lack of communication between Loan, Collections, and BSA Compliance departments within an institution can create a serious compliance hole. Oftentimes, Collections departments are unaware of BSA reporting requirements, meaning once a loan is charged-off it is a closed file. There is little importance placed on investigating the activity further.

Things to look for in charged-off loans

Reporting the suspicious activity falls to the BSA department but how can it be found if the reason for the charge-off is not communicated? When reviewing charged-off loan activity, here are four key indicators that the loan was potentially fraudulent.

- How much of the loan was paid back?

It is not unusual for criminals to pay a small percentage of a loan, making the first, and possibly second, payment before disappearing. Someone who applied for a loan with the intention of paying it back but later found themselves unable to for honest reasons will normally make more than a single payment. If less than 10% of a loan was paid before charge-off, it is worth investigating further. - How much time elapsed between loan disbursement and charge-off?

Check the longevity of the loan before charge-off. If a loan was disbursed, then charged-off in less than a year, it is worth investigating why Collections decided so quickly that the loan could not be collected. - Was the customer performing activity prior to the charge-off?

Was there any activity on the customer’s account leading up to the loan being charged-off? It is suspicious when a customer stops all account transactions before a charge-off occurs – meaning it can be valuable to check the account activity for at least the month leading up to the charge-off. - Was there a relationship prior to the loan?

Did your institution have a relationship with the customer prior to the loan? New accounts are inherently risky. If the charged-off loan was disbursed soon after the customer opened an account with your institution, the likelihood of suspicious activity is increased.

Unfortunately, loan fraud is not going away. As long as criminals can use it to increase their wealth it will continue to be a problem.

With growing expectations to report fraudulent activity and the positive impact uncovering loan fraud can have in the fight against large scale criminal organizations, BSA compliance professionals are under increased pressure. Considering the four indicators outlined above when digging deeper into charge-offs, and the account(s) of the customer involved, can help to fill a significant reporting gap.