ANTI-FINANCIAL CRIME

Stolen Checks

A Journey Interrupted

Global check fraud is a $26.6 billion problem.

With 80%, or $21 billion, occurring in the Americas.

Source: Nasdaq 2024 Global Financial Crime Report

Check fraud introduces a diverse set of criminal typologies, distinct from fraud targeting other channels:

Check fraud introduces a diverse set of criminal typologies, distinct from fraud targeting other channels:

The Department of Treasury’s 2024 National Money Laundering Risk Assessment placed a special focus on check fraud within the U.S.

“While the use of checks in the financial system has declined, check fraud over the last few years has boomed due to the limited capability of financial institutions to verify the legitimacy of checks in a timely manner, the lack of self-verification systems built into checks, the prevalence of remote capture technology, and the ability to directly access all funds within a specified account through a single check.”

The Journey of a Check

A check’s legitimate journey should be very short:

However, if a check is stolen, it provides fraudsters with many options to commit a crime and defraud a customer.

According to FinCEN’s Financial Trend Analysis on Mail Theft-Related Check Fraud, based upon data collected from a review of 15,417 BSA reports, stolen checks fall into three significant fraud typologies.

washed or altered and deposited

used as templates to create counterfeit checks

fraudulently endorsed and deposited

Source: FinCEN’s Financial Trend Analysis on Mail Theft-Related Check Fraud

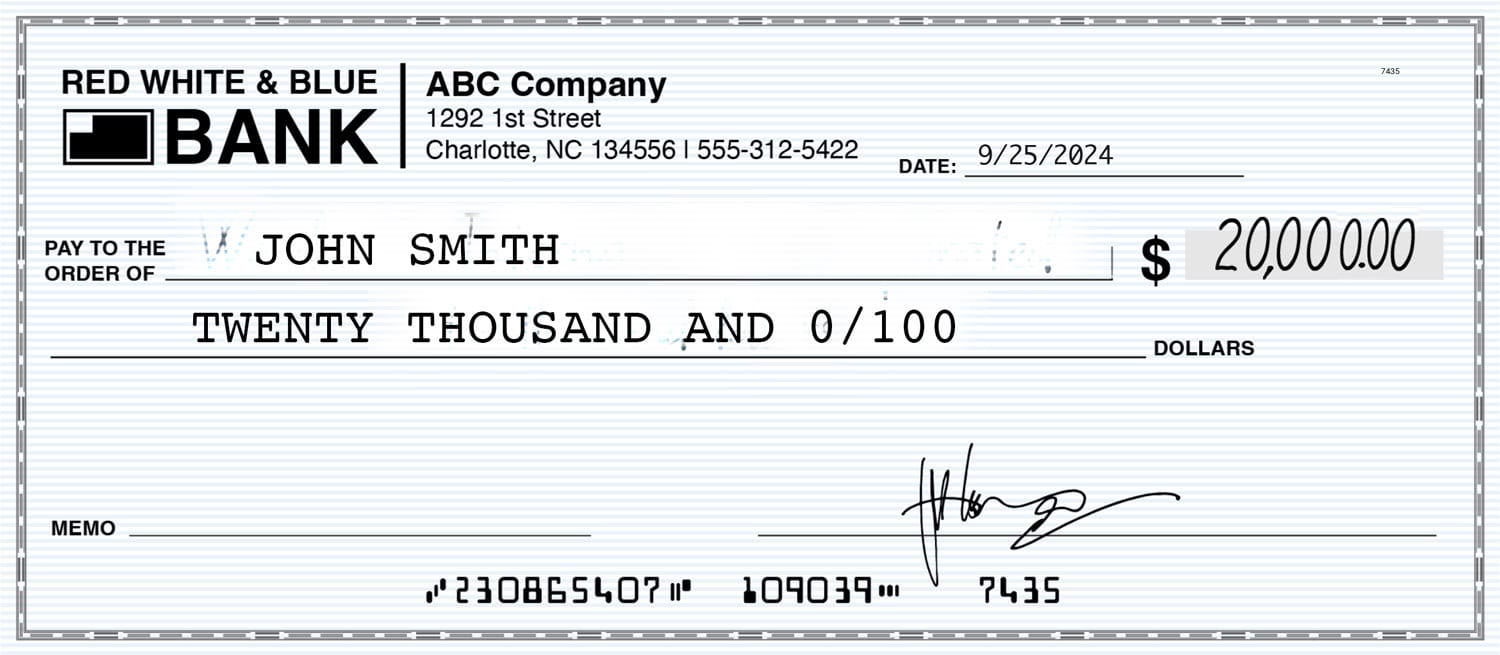

Altered Checks

Altered and washed checks can have few indicators of fraud.

Criminals scrub checks using chemicals to remove the original information and re-write their own — often changing the payee’s name, date and dollar value.

Slide to compare:

Red Flag Indicators of Altered or Washed Checks:

Physical

• Ink inconsistencies

• Erasure marks

• Torn or cut edges

• Paper quality

Signature & Endorsement

• Inconsistencies

• Irregularities

Layout & Printing

• Misaligned printing

• Font inconsistencies

• Missing or altered security features

Other Red Flags

• Unusual or missing date

• Large or rounded amounts

• Multiple checks with similar characteristics

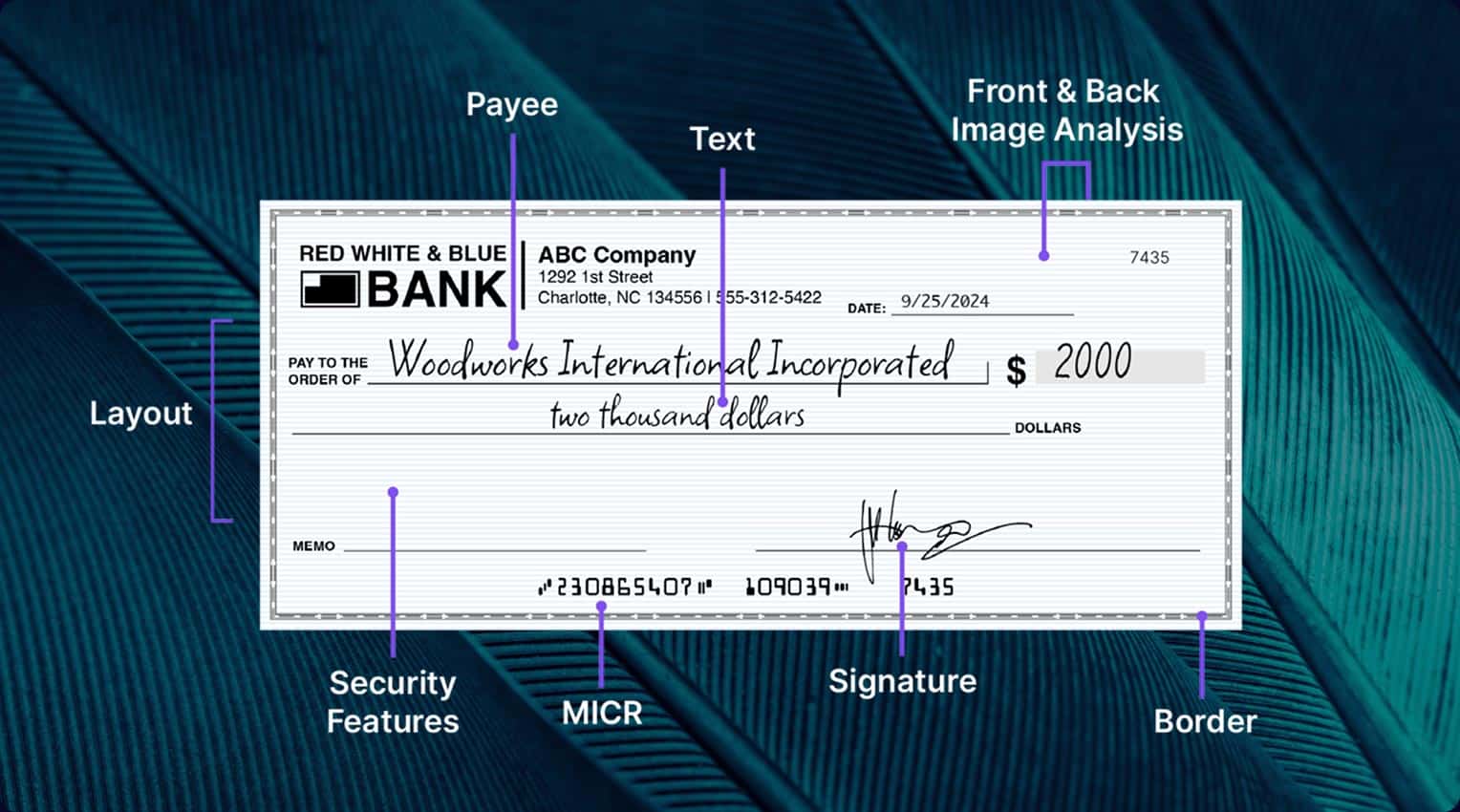

Counterfeit Checks

Checks stolen and used as templates for counterfeits are a high threat risk to financial institutions.

Endless numbers of checks can be created from counterfeit templates, sold on the dark web, and used to target financial institutions across jurisdictions.

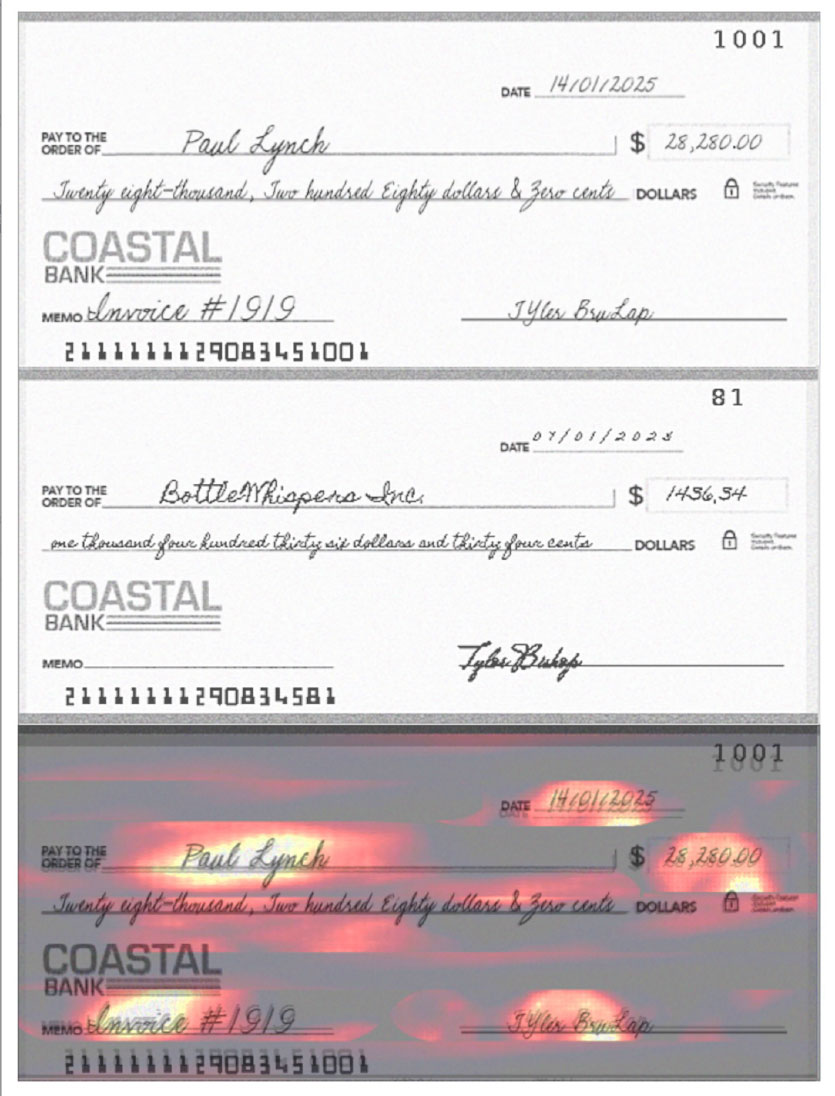

Heat Maps

Heat Maps can display differences between a suspicious check and previously cleared checks.

The Back of a Check

Fraudsters may replicate the front of the check with high accuracy, but often neglect the back, which contains critical security features and patterns. By examining the back of the check, fraud investigators can identify inconsistencies that are often overlooked.

Heat Maps

Heat Maps can display differences between a suspicious check and previously cleared checks.

The Back of a Check

Fraudsters may replicate the front of the check with high accuracy, but often neglect the back, which contains critical security features and patterns. By examining the back of the check, fraud investigators can identify inconsistencies that are often overlooked.

Red Flag Indicators of Counterfeit Checks:

Visual Cues

• Paper quality

• Printing quality

• Security features

• Logo and branding

• Check and routing number

Back of Check

• Missing or irregular security features

Non-Visual Cues

• Account holder verification

• Transaction history

• Check clearing patterns

• Internal alerts

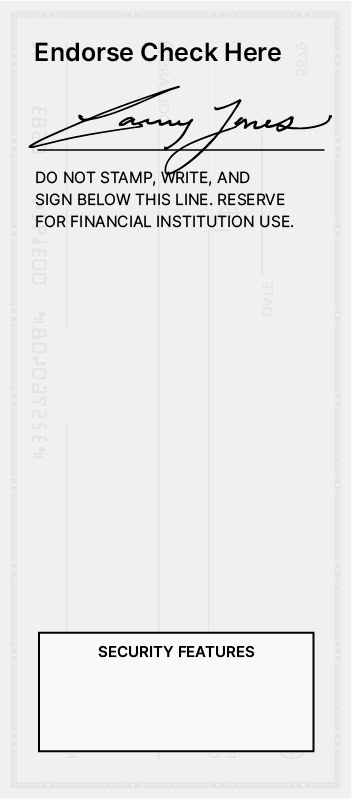

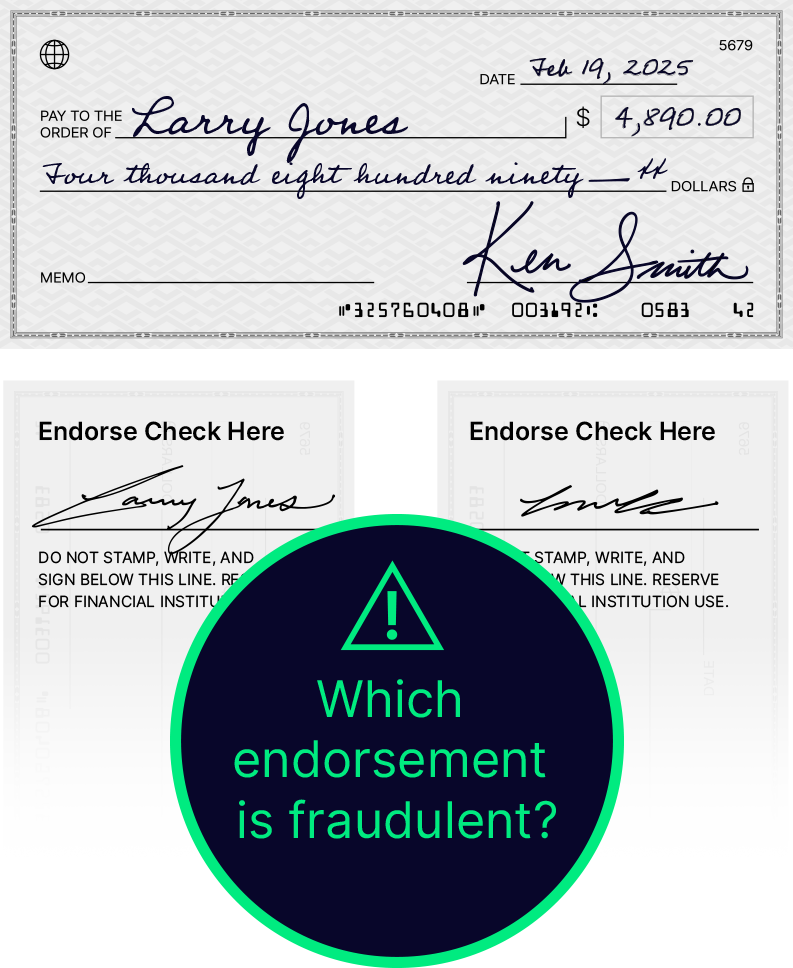

Fraudulent Endorsement

An unsophisticated methodology, stolen checks deposited with a forged signature are incredibly difficult to identify.

A fraudulently endorsed check is a legitimate check, drafted and issued by the payor. Its identifiers such as the MICR line information and sequence numbers are unchanged, and even the endorsed signature on the back matches the payee’s name on the front.

Red Flag Indicators of Forged/Fraudulently Endorsed Checks:

Visual Cues

• Signature inconsistencies

• Endorsement irregularities such as dates

• Alterations or erasures

Other Red Flags

• Large or unusual transactions

• Multiple endorsements

• Endorsements from unknown individuals

Non-Visual Cues

• Account holder verification

• Transaction history

• Endorsement patterns

• Customer complaints

Nasdaq Verafin examines the customer account, transaction, check factors, and counterparty to provide a more holistic insight into risk, from deposit to in-clearing.

Our solution deploys machine learning and AI to analyze a wide range of risk factors, helping determine counterparty risk and in-clearing activity.

A Holistic Picture of Check Fraud Risk

Nasdaq Verafin provides financial institutions with a holistic check fraud solution that combines known customer behaviors with image and counterparty risk analysis.

Powered by a massive consortium data set comprised of:

Powered by a massive consortium data set comprised of:

Delivering a holistic solution to help institutions catch more fraud, while reducing false positives.

Learn more with these resources: