Check fraud is often viewed as an outdated crime — but these scams are in fact becoming highly sophisticated and causing significant losses. In 2023, there was $21B in check fraud losses in the Americas, representing nearly 80% of total check fraud losses globally. As check fraud evolves, a multi-faceted approach that uses traditional methods of detection together with machine learning and consortium insights is essential to ensure your institution stays a step ahead.

Complex Check Fraud

Traditional methods of detection such as image and Magnetic Ink Character Recognition (MICR) analysis and positive pay are effective for detecting less complex forms of check fraud (e.g. out of sequence and duplicate checks) — but financial institutions cannot rely on traditional detection methods alone. These approaches cannot identify more sophisticated scenarios such as counterfeit, altered, or forged checks, due to a lack of account information on the deposit side of the check. At the same time, conventional solutions often create overwhelming numbers of false positives and do not provide the holistic insights into risk that are needed for effective prevention.

Effective Check Fraud Solutions: Machine Learning & Consortium Analytics

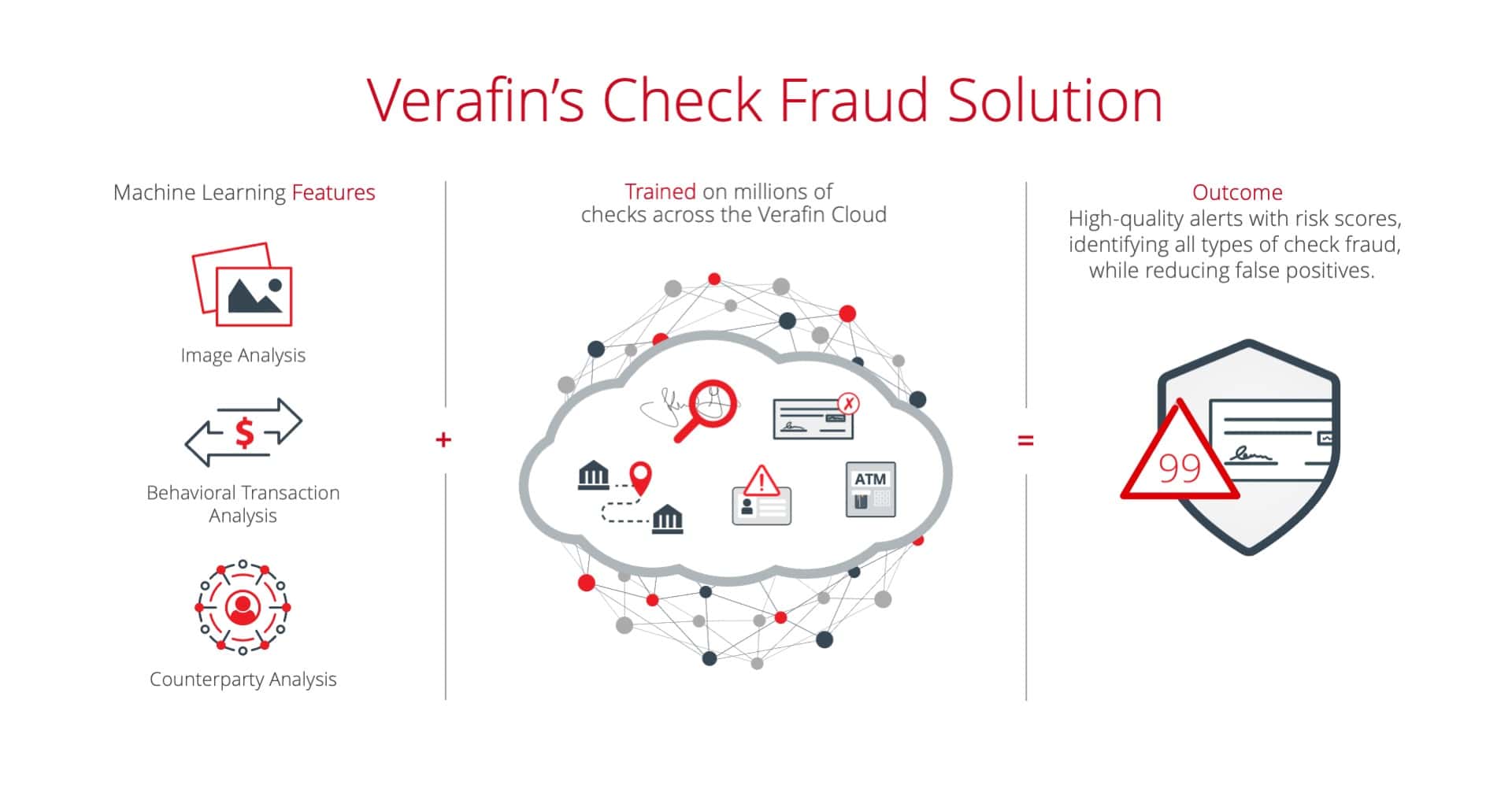

Verafin’s holistic approach to check fraud combines image and MICR analysis and behavioral analytics together with machine learning and consortium insights for a step change in check fraud prevention. Our massive consortium data set, comprised of 575M counterparties and 28B check images from 2500 financial institutions, enables effective detection for complex check fraud. We leverage this massive data set to train machine learning analytics that continuously improve based on industry trends, providing higher-quality alerts, and robust prevention against complex check fraud scenarios, all while reducing false positives.

Harnessing the power of our consortium, Verafin’s Check Fraud Consortium Analytics also provide insight into the in-clearing and deposit sides of a check transaction — crucial when combating more complex forms of check fraud where fulsome insight into payment risk is crucial. With this approach, our solution considers the risk of deposit fraud for this account at the bank of first deposit, and uses that information as part of the overall risk assessment when the check arrives at the in-clearing institution.

The Need for a Holistic Solution

As check fraud becomes increasingly prevalent, financial institutions need a solution that offers effective detection for all forms of check fraud, regardless of their complexity. Verafin allows your institution to holistically combat check fraud by combining behavioral evidence with consortium insights. Customer-driven and machine learning analytics greatly enhance the efficiency of your check fraud investigations, while consortium analytics offer insights into transactional risk. The result is a holistic check fraud solution that allows you to combat traditional and complex check fraud more efficiently – preventing losses for your customers and your institution.

Visit our Check Fraud page to learn more.

About the Author:

COLIN PARSONS

Associate Vice President — Head of Fraud Product Strategy at Verafin, a Nasdaq Company

Colin Parsons spearheads the strategic development of technology solutions to combat fraud at Nasdaq Verafin. Throughout his time with the company, Colin has worked as a development team lead, software developer and in product marketing. Applying the knowledge gained through his roles and experiences, Colin is focused on using technology to solve the hard problems that are persistent within the fraud space.