Fraud never sleeps, and neither should financial institutions. As digital technology continues to develop new and faster ways to move money throughout the financial system, fraudsters are evolving to find new ways to intercept that money and commit their nefarious acts. Financial institutions must find ways to respond to new and emerging threats and scale to meet the needs of both today and tomorrow.

In a recent year in review webinar, we took a deep dive into the fraud trends of 2023 and expectations for the coming year.

Authorized Push Payments Fraud

In 2023, fraudsters continued to evolve their tactics to Authorized Push Payment (APP) scams — moving their focus from targeting financial institutions to your customers.

These scams, which use a variety of social engineering tactics and age-old schemes, have rendered traditional monitoring solutions ineffective, increasing customer friction and operational costs.

Business Email Compromise (BEC) continued to be significant vector for fraud. The Internet Crime Complaint Center (IC3) announced that since 2013, domestic and international exposed dollar losses attributed directly to BEC surpassed $50B, representing a nearly 6300% increase in stolen funds.

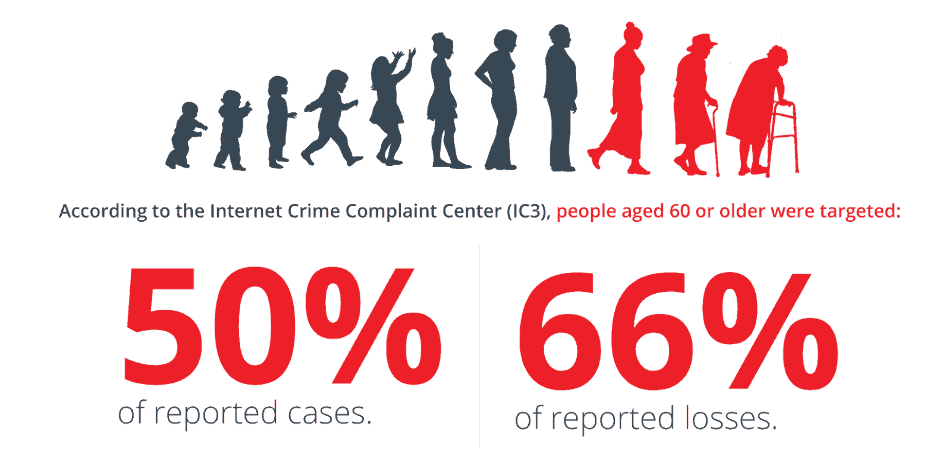

In 2023, elderly customers continued to be at greater risk as fraudsters targeted seniors with an emerging and sophisticated scheme known as a Phantom Hacker scam. From January to June, $542M was stolen from America’s elderly through this type of scam — people aged 60 or older were targeted in nearly half of reported cases and shouldered 66% of losses, often their entire life savings.

Financial grooming or relationship-investment fraud was also on the rise. This scam based on trust-enablement, uses social engineering where bad actors develop relationships and build trust with their victims, convincing them to invest money before defrauding them.

This new spin on an old scam is also known by the more heartless term “pig butchering”. This scam has created significant financial and emotional harm for countless victims of financial grooming around the world, with criminals defrauding victims of more than $2 billion USD in 2022.

What to Expect in 2024

As scams leveraging social engineering become increasingly prevalent, many financial institutions are struggling with ineffective detection, overwhelming volumes of false positive alerts, and an inability to truly understand customer activity.

ACH Fraud

In 2023, ACH fraud saw concerning growth. As wire fraud solutions were strengthened, criminals shifted to more social engineering scams to target ACH payments — from benefits fraud, payroll diversion and BEC, ACH transfers are at risk for fraud.

“The increased focus on ACH transactions suggests that fraudsters are acquiring more sophisticated techniques when targeting organizations.”

2020 AFP Payments and Controls Survey

Faster Payments

The faster era of payments is underway, bringing great opportunity with TCH RTP and FedNow Service, but also significant risk — particularly with respect to fraud. As these channels continue to grow in the coming years, the potential transaction volumes and use cases have yet to be realized. ACI Worldwide suggests that faster payments transactions will grow from 3.9B to 13B in 2027. Ill-prepared institutions will fail to keep pace with the level of speed of faster payments and the sheer volume of false positives that will follow in their wake. It is essential for financial institutions to scale to prevail when it comes to faster payments.

Considerations Moving Forward

Financial institutions should consider a unified approach that enables collective intelligence using standardized, consortium-level data to develop anti-financial crime analytics that provide a more complete picture of risk across the financial system.

Collaborative frameworks enable financial institutions to deploy solutions that leverage consortium data, shared intelligence or responsible information sharing technology in concert with each other to optimize their anti-financial crime efforts and gain comprehensive insight into customer activity.

To prepare for 2024, financial institutions should consider solutions that adopt a cloud-based consortium approach using real-time analysis and interdiction. A consortium approach enables greater insight into customers and the counterparties they interact with. Layers of rich demographic and transactional information in the consortium data set are leveraged to profile accounts and entities outside the consortium to identify low-and high-risk counterparties. This approach helps effectively identify and interdict on potentially suspicious payments before the funds leave your institution, while permitting legitimate transfers to proceed uninterrupted, thereby lowering false positives and improving the overall effectiveness and efficiency of your fraud program for 2024 and beyond.

To learn more, visit Verafin’s Fraud Detection and Management solution page: