In the eyes of a criminal, fraud is just a money game. But for the countless American businesses targeted each year by bad actors and Business Email Compromise (BEC) scams, the impact is far greater, from lost livelihoods to reputational damage — and the threat is growing. Across 2400 financial institutions and 575M counterparties in the Cloud, our experts have identified concerning patterns for business-related wire fraud that echo warnings from industry authorities — the threat of fraud against your business customers may be greater than ever.

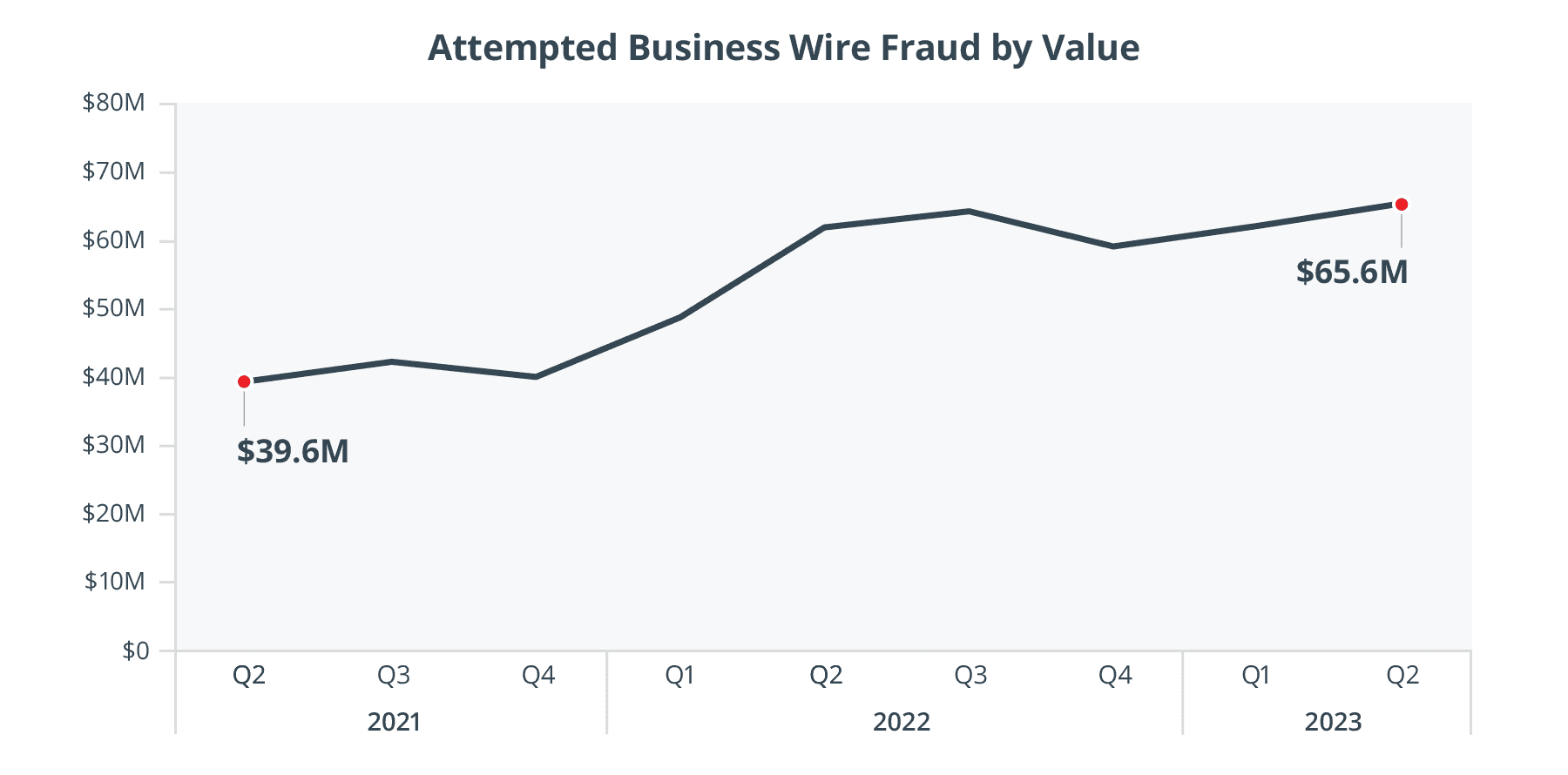

$26M Surge Underscores Growing Threat

The value of business-related wire fraud attempts has surged 65% or $26M in just two years, reaching $65M as of Q2 2023. Basis points for business wire fraud attempts by value doubled from 0.31 in Q2 2021 to 0.67 in Q2 2023, reinforcing that the value of attempts is on the rise. This growth may be driven by the near ubiquitous challenge of BEC, which has proliferated across the globe between October 2013 and December 2022. While no business is immune to fraud, from local stores to major corporations, one sector is receiving a great deal of unwanted attention — real estate.

Fraudsters Close in on Real Estate

Our analysis uncovered a major increase in wire fraud attempts against the real estate sector — 20% by value from Q2 2021 to Q2 2023. Real estate transactions often involve high-value payments and frequent communications, creating an attractive target for BEC. As highlighted in our recent case study, fraudsters can target any participant in a real estate transaction and will strategically time their request, often for a wire. When funds are transferred internationally, they are typically directed to three major destinations — Hong Kong, China, or Mexico. Fraudsters who engage in real estate BEC often launder the proceeds through money mules to disguise their activities from law enforcement.

Bound for Hong Kong, China or Mexico

By value, we found that most wire fraud attempts were directed to Hong Kong (62%), China (8%), or Mexico (6%). These locations have been identified by FinCEN and the Internet Crime Complaint Center (IC3) as the primary international destinations for fraudulent transactions related to BEC and real estate related BEC. As a financial hub, Hong Kong is an ideal junction for fraudulent transfers — criminals can direct payments to the city with less scrutiny, then transfer the funds onward to mainland China, where they are harder to recover.

Taking Decisive Action

As the industry wrestles a growing business fraud problem, financial institutions can play a key role in protecting payments and combating fraud scams against their business customers, such as BEC. A consortium approach to combating payments fraud can help you take decisive action against fraud across commonly exploited channels, such as wire.

Combining behavioral evidence with consortium insights from over 575M counterparty profiles, Verafin’s payment fraud approach allows you to truly understand the risk associated with a payor and payees who do not bank at your institution — while reducing false positives for wire fraud by 40%.

To learn more about Verafin’s consortium approach to combating payments fraud, download our Payments Fraud Brochure.