“Financial institutions serve on the frontlines in protecting their older customers’ finances, and can play a critical role in helping to identify, prevent, and report suspected elder financial exploitation. Financial institutions’ vigilance matters. Their reporting matters.”

– Himamauli Das, FinCEN Acting Director

Aging gracefully. Retirement. For 1 in 10 elderly Americans, the dream of enjoying their personal time after a life of hard work is broken by criminals capitalizing on their vulnerability and accumulated wealth — and the threat is increasing. On June 15, 2022, FinCEN released an advisory (FIN-2022-A002) with updated guidance on Elder Financial Exploitation (EFE), calling the crime “rampant” and urging financial institutions “to detect, prevent, and report suspicious financial transactions.”

With seniors accounting for 68% of occurrences and 71% of attempted wire fraud value in Q1 2022, according to a recent analysis of Verafin Cloud trends, it is critical for financial institutions to understand the typologies and financial red flags related to EFE, and how an effective Financial Crime Management platform can protect elderly customers from loss.

Defining EFE: Theft & Scams

FinCEN’s advisory defines EFE as “the illegal or improper use of an older adult’s funds, property, or assets,” with schemes falling into two categories — elder theft, and elder scams.

Elder theft involves a criminal already known to the victim, often a trusted family member or caregiver, who gains access to the seniors’ finances through coercion or deception. In contrast, elder scams are perpetrated by a criminal who is not known to the victim initially. The perpetrator establishes trust through romance, government impersonation or other scams involving a fake persona and an eventual, urgent request for funds, often by wire payment and increasingly, cryptocurrency. In some cases, the elderly victim may even be recruited as an unwitting money mule to facilitate other criminal activity.

Financial institutions can play a crucial role in combating these cruel crimes. As stated in the advisory, “identification of financial red flags of EFE and the associated payments are critical to detecting, preventing, and reporting suspicious activity potentially indicative of EFE.”

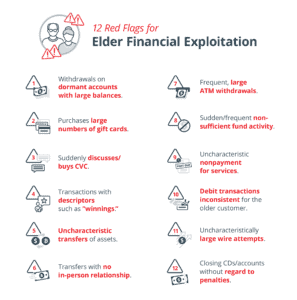

12 Financial Red Flags

FinCEN’s advisory identifies the following 12 financial red flags for EFE. These build on the guidance provided in FinCEN’s previous 2011 advisory (FIN-2011-A003) and are in addition to financial red flags described in Department of Justice and Consumer Financial Protection Bureau notices.

-

- Dormant accounts with large balances begin to show constant withdrawals.

- An older customer purchases large numbers of gift cards or prepaid access cards.

- An older customer suddenly begins discussing and buying CVC.

- An older customer sends multiple checks or wire transfers with descriptors in the memo line such as “tech support services,” “winnings,” or “taxes.”

- Uncharacteristic, sudden, abnormally frequent, or significant withdrawals of cash or transfers of assets from an older customer’s account.

- An older customer receives and transfers money interstate or abroad to recipients with whom they have no in-person relationship, and the explanation seems suspicious or indicative of a scam or money mule scheme.

- Frequent large withdrawals, including daily maximum currency withdrawals from an ATM.

- Sudden or frequent non-sufficient fund activity.

- Uncharacteristic nonpayment for services, which may indicate a loss of funds or of access to funds.

- Debit transactions that are inconsistent for the older customer.

- Uncharacteristic attempts to wire large sums of money.

- Closing of CDs or accounts without regard to penalties.

Considerations for Financial Institutions

EFE is a cruel crime with financially and emotionally devastating consequences for victims. As criminals increase their efforts against America’s elderly, financial institutions need a Financial Crime Management platform that provides robust detection for fraud occurring over payments channels commonly exploited in EFE, such as wire.

Combining the benefits of consortium analytics, cross-channel intelligence, and real-time analysis, Verafin’s Wire Fraud solution allows you to understand the risk associated with a wire sender and the counterparty with whom they are transacting, and stop fraudulent wires before funds are released. Through the power of the Verafin Cloud, you have immediate visibility into suspected money mules identified in real-time, and a deeper understanding of your customers’ interactions across multiple channels, all while reducing false positives.

Verafin’s Information Sharing technology provides you the ability to securely participate in collaborative investigations under the safe harbor authorized by section 314(b) of the USA PATRIOT Act, as encouraged in the FinCEN advisory to fight EFE. As stated in the advisory, “information sharing among financial institutions is critical to identifying, reporting, and preventing EFE, among other illicit activity.”

According to the White House, “it is more vital than ever that we ensure our older adults can age with the dignity, security, and appreciation that every person deserves.” To learn more about how Verafin can help your institution effectively protect your most vulnerable customers from loss, request a custom demo tailored for your institution.