From savings accounts and credit cards to online banking and P2P payments such as Zelle, today’s financial institutions offer more products and services than ever before. There are dozens of product lines and service providers, and each product may require its own financial data system and data model.

Within a single institution, investigators must navigate dozens of siloed, complex data pipelines to compile and analyze huge amounts of disparate information for AML investigations. Often investigation teams do not have access to these data sources and must request spreadsheets, check images, or other error-prone, manual documentation from other parts of the business – it can take days to receive and compile this information. With so much data coming from so many systems, financial crime investigations are complicated, tedious, and inefficient.

With so many siloed datasets, AML investigators are presented with an incomplete and fragmented view of customer activity and must spend valuable time and resources managing and manipulating the data required to open an investigation. Unresolved entities complicate these challenges even further.

Duplicate Data – Unresolved Entities

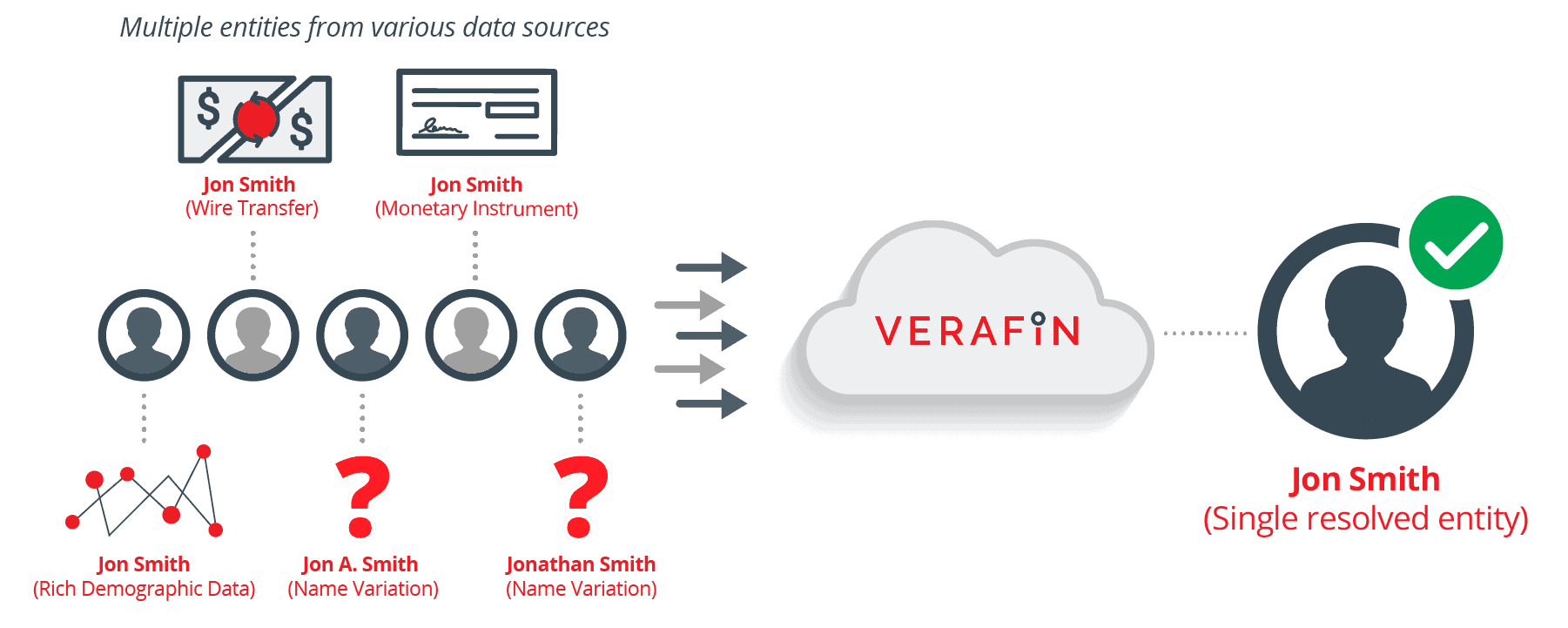

A single individual or business entity may be present within your institution but appear several times within your institution’s dataset. For example, a single entity may be input from several different financial data systems; the “Jon Smith” appearing as a transactor in your wire data may be the same “Jon Smith” purchasing monetary instruments. Similarly, variations in customer names may result in a single entity appearing as multiple entities – Jon Smith, Jonathan Smith, and Jon W. Smith, may be a single entity represented several times in your data. Beyond these transactional data sources, Jon Smith may also appear within rich demographic data sources such as loan platforms, account opening questionnaire (AOQ) information, or risk-based Customer Due Diligence/Enhanced Due Diligence (CDD/EDD) monitoring systems.

To understand customer activity and the true risk to your institution, AML investigators need access to rich demographic and transactional data from a wide variety of financial data systems. Without automated entity resolution, investigators are often forced to manually compile a complete view of their customers’ activity, switching between multiple data systems, piecing together transactions and entities, and wasting valuable time.

Enhanced Entity Resolution

With deep domain expertise in data integration and standardization, Verafin integrates and resolves demographic and rich data from dozens of financial data systems to present you with a holistic view of your customers and their activity.

Verafin automatically resolves entities with greater precision and accuracy than legacy approaches –resolving customer data with 99.97% precision – ensuring investigators are presented with unique entities and counterparties for more efficient investigations. Verafin’s entity resolution process combines data from a dozen types of financial systems, from core data and payment channels to online banking and teller platforms, extracting the relevant information from each system to provide a single holistic view of your customer. With over twenty years of financial data integration and standardization expertise, Verafin has integrated with hundreds of systems, thousands of times.

With a purpose-built anti-financial crime investigation platform, Verafin simplifies your data and presents you with a complete picture of customer risk, allowing investigators to focus on meaningful investigative work and quickly provide actionable intelligence to law enforcement.