As we move into the next decade, it is critical for financial institutions (FIs) to reflect on recent trends in fraud and compliance, and gauge what potential challenges lay ahead.

In a special year-end presentation, we took a look back at the trends and technology developments from 2019, and offered an overview of what to expect in the near future. The following highlights and resources will provide greater context for FIs in strategically planning, evaluating, and prioritizing investment in financial crime management programs for 2020.

Further Evolution of Fraud Scams

Criminals are showing no signs of abandoning their varied toolbox of scams, staying the course with tried and true approaches and innovating within existing typologies to continue exploiting FIs and their customers.

Business Email Compromise (BEC) Fraud

In an updated 2019 advisory, FinCEN highlighted the role of BEC in criminal money laundering networks, and encouraged FIs to employ information sharing as a means of identifying and preventing financial crime. With data trends showing BEC fraudsters are now favoring industries such as construction and real estate, FIs must consider how cross-institutional collaborative investigations can strengthen their defense against BEC fraud and crime ring activity in 2020.

ACH Payroll Diversion

Payroll diversion schemes are proving to be a mainstay of criminals’ fraud repertoires. With many online payment systems now more strongly protected against hijacked payroll scenarios, cybercriminals are targeting employees with phishing emails in one-to-one compromise schemes to capture payroll deposit information and then direct ACH deposits to accounts they control. FIs must improve fraud controls to detect the nuances in new methodologies of payroll scams, such as altered or new payees, and changes in contact information.

Check Fraud

Despite the rise in fraud over digital channels, it appears that conventional check fraud is here to stay. Criminals have pushed check counterfeiting to new heights by exploiting mailbox fishing, online reconnaissance and social engineering. It will be more important than ever for FIs to counter fraudsters’ efforts by shifting toward fraud mitigation programs with improved in-clearing and on-us check fraud detection capabilities that leverage innovative, predictive technologies.

Optimizing AML Alerts & Investigations

There is enormous pressure on FIs to uncover potential money laundering, even as BSA professionals face challenges to keep pace with compliance tasks. In this context, false positive reduction and targeted detection are crucial.

False Positive Reduction

The industry-wide problem of false positive alerts continues to cost AML investigators significant time and resources that would be better invested in examining truly suspicious cases. Machine learning solutions will play a key role in improving alert precision for investigators that adopt Artificial Intelligence (AI) approaches for financial crime management.

Targeted Detection

Broad approaches to AML transaction monitoring further perpetuate the challenge of false positives. By deploying targeted detection scenarios based on real-life money laundering typologies, compliance programs will benefit from higher-quality alerts, expedited investigations, and richer, more detailed reporting to law enforcement.

Managing & Mitigating Risks for Higher-Risk Customers

From identification and segmentation to ongoing monitoring and Enhanced Due Diligence (EDD) reviews, managing customers in higher-risk categories, including Marijuana-Related Businesses (MRBs), Private ATM Owners, Money Services Businesses (MSBs), and Non-Governmental Organizations (NGOs), remains a manual, resource-intensive process for many compliance professionals. To break down this potential barrier to business growth and regulatory adherence, FIs should evaluate their approaches to facilitate effective end-to-end high-risk customer management.

Identification & Segmentation of Higher-Risk Customers

With mergers and acquisitions, new product offerings and the simple fact that customer activity changes over time, FIs are exposed to increased AML risks from unidentified higher-risk customers. In 2020 and beyond, FIs should evaluate whether their due diligence programs can efficiently and effectively identify and segment high-risk customers.

Stratified, Risk-Based Approach

Managing due diligence requirements and reviews for high-risk customers may be the most significant challenge facing compliance programs today. By moving away from broad risk models, and adopting a stratified risk approach, FIs can address how risk differs within each high-risk category of customers. FIs should also consider how a stratified and tailored risk approach can help them configure risk scoring to align with their risk appetites and due diligence policies, and provide added confidence during exams with greater visibility into their true risk profile.

Applying AI Technologies to Financial Crime Management

Across the industry, BSA/AML and fraud professionals are under intense pressure to uphold increasing regulatory standards and a strong financial crime defense with limited time and resources. Encouraged by federal regulatory agencies, more and more FIs are looking to AI technologies to help them improve the efficiency and effectiveness of their anti-financial crime programs.

Robotic Process Automation (RPA)

For compliance and fraud programs, RPA can reliably automate workflows, regulatory report completion and filing, and suspicious activity alert triage. By automating manual, repetitive tasks RPA can help investigators shift their focus from manual work to examining potentially suspicious activity.

Machine Learning

More and more FIs are incorporating machine learning technology into their financial crime management programs to significantly reduce false positive alerts, improve analytical performance, and increase detection rates. Given the significant benefit to FIs this adoption will only continue, with the use of AI and machine learning for fraud detection expected to triple by 2021.

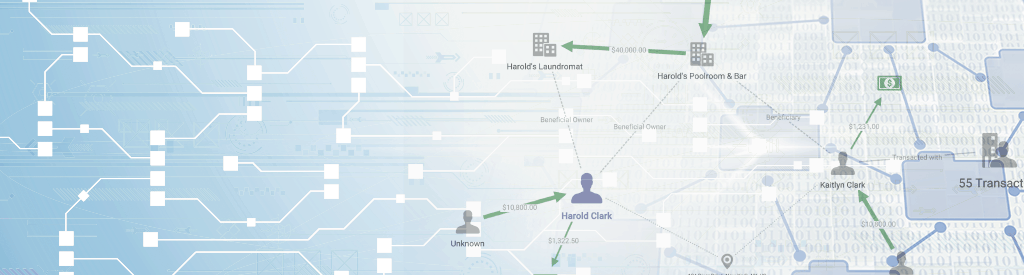

Collaborative Investigations to Combat Crime Rings

The need for effective information sharing and collaboration in financial crime investigations has never been clearer. Based on trend analysis in the Verafin Cloud, it is estimated that there are more than 100 active crime rings operating in the U.S. today. Uncovering these networks of bad actors, often implicated in many illicit activities spanning multiple FIs, is impossible without collaboration. Continued adoption of private-private information sharing will be critical to strengthen investigations that span multiple FIs and get a step ahead of organized criminal activity.

Future Considerations for FIs

It is imperative for all fraud and compliance professionals to stay abreast of recent industry developments, key trends, and technology developments. FIs should consider how these trends impact operational efficiencies, mitigation efforts, and regulatory compliance today, and tomorrow. The future will be defined by growing complexity for FIs, both in the nature of financial crime, and rapid development and deployment of solutions to combat it.