In today’s digital age, the old saying, “a picture is worth a thousand words,” takes on new meaning, especially in the realm of check fraud detection. Fraud investigators recognize checks as the payment method most susceptible to exploitation — and digital advancements in printing, graphic design and access to specialized materials continue to breathe new life into fraud schemes targeting this legacy payment channel. Image analysis, a powerful tool leveraging advanced technologies, has become a cornerstone in the fight against counterfeit checks.

Capture – Copy – Revise – Replicate

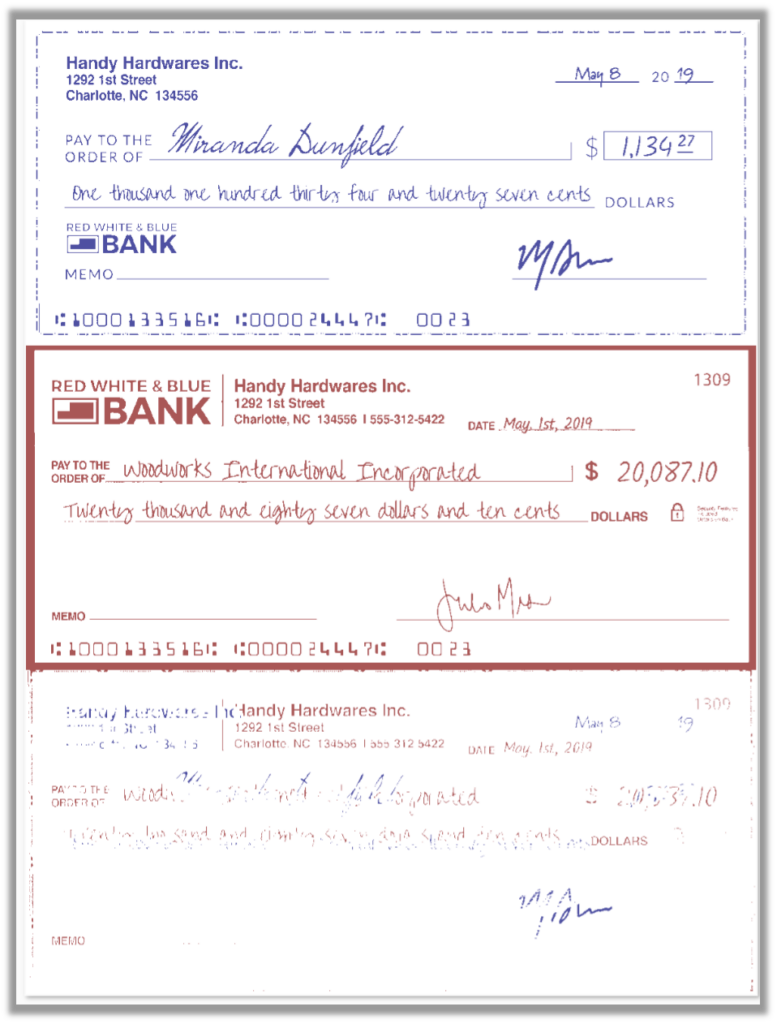

Counterfeit check fraud is a pervasive issue that affects financial institutions and businesses worldwide. The process often begins when a genuine check is intercepted and stolen. This stolen check is then used as a template to create a replica, which is passed off as legitimate.

In their recent Financial Trend Analysis on Mail Theft-Related Check Fraud spanning a 6-month review period in 2023, FinCEN received 15,417 BSA reports involving 841 financial institutions linked to checks stolen from the mail.

These stolen checks were grouped into three significant fraudulent check typologies:

- 44 percent were altered and deposited

- 26 percent were used as templates to create counterfeit checks

- 20 percent were fraudulently signed and deposited

While altered and forged endorsements represent a higher percentage of fraudulent incidents, they tend to be single use cases, where once deposited, the check cannot be used again for fraud. However, checks stolen and used as templates for counterfeits are a higher threat risk to financial institutions. Endless numbers of checks can be created from counterfeit templates, sold on the dark web, and used to target financial institutions across jurisdictions. This is further compounded by the counterfeiters’ ability to set the amount payable to any number they wish.

Examine the entire check with several views: single check image, side-by-side, or aggregate comparisons.

Image Analysis – Countering Counterfeit Checks

Traditional methods of check verification are often insufficient to detect and prevent sophisticated fraud typologies such as counterfeit checks, requiring more advanced solutions.

Image analysis involves the extraction of meaningful information from check images using intersecting techniques and technologies like Optical Character Recognition (OCR), image processing, machine learning, and signature verification. These approaches work together to scrutinize check images, identifying discrepancies and anomalies that may indicate fraud.

Two Sides to Every Story – The Back of a Check

An essential element of counterfeit check detection is ensuring the complete story of a check is told. While fraudsters may replicate the front of the check with high accuracy, they often neglect the back, which contains critical security features and patterns. By examining the back of the check, fraud investigators can identify inconsistencies that are often overlooked.

A Complete Picture of Check Fraud Risk

Image analysis is a vital tool in the fight against counterfeit check fraud. By leveraging advanced technologies such as OCR, image processing, and machine learning, that consider both the front and back of a check, financial institutions can significantly enhance their fraud detection capabilities.

Nasdaq Verafin provides financial institutions with a holistic check fraud solution that enhances detection for the most challenging typologies. By combining known customer information and behaviors with deposit-side risk analysis, our check fraud solution ensures fewer false positives, superior detection, and allows for an enhanced investigation within a single application. To learn more, read our Check Fraud Detection feature sheet.