In February 2019, the Consumer Financial Protection Bureau (CFPB) released a study on elder financial abuse, Suspicious Activity Reports on Elder Financial Exploitation: Issues and Trends. The study utilizes information from Suspicious Activity Reports (SARs) to identify emerging trends in financial crime, and calls upon financial institutions to proactively monitor and report suspicious activities to law enforcement and adult protective services, in an effort to protect senior and vulnerable consumers.

Exploitation of Vulnerable and Elderly Consumers

The CFPB reports that:

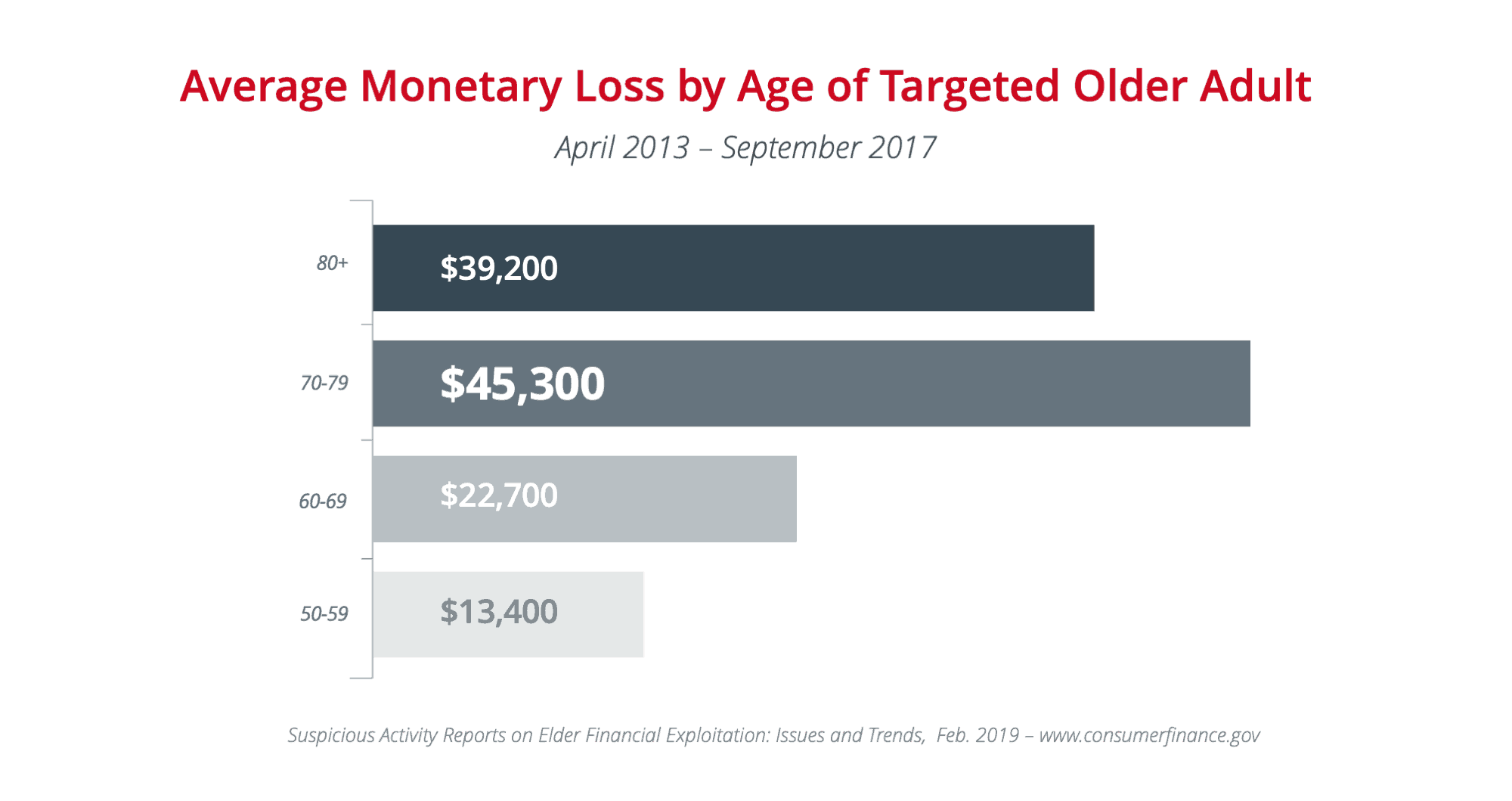

Since 2013, financial institutions have reported to the federal government over 180,000 suspicious activities targeting older adults, involving a total of more than $6 billion. These reports indicate that financial exploitation of older adults by scammers, family members, caregivers, and others is widespread in the United States.

Elder financial exploitation SARs quadrupled from 2013 to 2017, but these SARs “likely represent a tiny fraction of actual incidents of elder financial exploitation.”

Elder financial abuse often occurs through fraudulent schemes such as romance, lottery or employment scams, where a victim may transfer money from a bank account, or provide their banking credentials, directly to a fraudster. Money mule scams can lead vulnerable customers to transfer or wire money to a “person in need,” or a fraudster in disguise. Seniors may also be exploited by family members or caregivers through credit or debit card thefts, online account takeovers, or stolen checks.

Early Detection of Elder Financial Exploitation

As noted by FinCEN in the 2011 advisory on Elder Financial Exploitation, financial institutions can play a key role in addressing elder financial exploitation due to the nature of the client relationship.

The CFPB has several recommendations to help financial institutions and law enforcement uncover elder financial abuse. Financial institutions can play a more active role, with targeted technologies to identify and monitor risky activity:

Depository institutions could prevent or limit losses by improving fraud detection technology to reflect transaction patterns most prevalent when older account holders become victims and by using machine learning to obtain specific and timely information indicating fraudulent activity.

Innovative technologies, including artificial intelligence and targeted machine learning agents, can help financial institutions proactively protect vulnerable consumers and proactively prevent financial loss. Instead of relying on broad rules-based approaches, or reviews of manual reports to identify unusual behavior, innovative technologies can provide automated, targeted crime detection and prevention for financial institutions and their senior customers.

Timely Reporting of Abuse

When compiling and filing SARs to FinCEN, financial institutions have an opportunity to report potentially suspicious activity to law enforcement or adult protective services, while performing standard regulatory compliance processes. The CFPB warns that when an institution “is not reporting to adult protective services, law enforcement or other authorities, this is a missed opportunity to strengthen prevention” and “robust reporting to [adult protective services] can increase the likelihood that victims will receive appropriate services.”

Timely reporting of suspicious activity targeting elderly consumers can prevent further abuse and further financial loss, and ensure victims receive the valuable services and interventions required for recovery.

Solutions for Financial Institutions

Verafin’s consolidated Financial Crime Management platform can help financial institutions with early detection and timely reporting of suspected elder financial abuse:

- Unusual Activity Referral: Within Verafin, your frontline staff can easily complete an unusual activity form that immediately alerts you when potentially suspicious activity is spotted on seniors’ accounts. Customer and activity details are included in the form and alert, keeping the important information centralized within Verafin and easily available if you need to generate a SAR.

- Innovative Fraud Detection Solutions: Using big data intelligence with machine learning technology, Verafin’s Fraud Detection solutions identify out-of-pattern and potentially suspicious activity on elderly accounts quickly and effectively:

- Targeted Alerts for Elder Abuse: With targeted analysis, Verafin alerts you to red flags that may indicate excessive spending on elderly accounts, such as a decrease in the individual’s balance, relationship additions to the account, new transaction methods, spending changes, and more.

- Targeted Alerts for Third-Party Scams: Verafin includes cross-channel transaction monitoring to identify fraudsters targeting your elderly customers with specific schemes, including business email compromise, online loan fraud, work-from-home schemes, and romance scams.

- Automated Regulatory Reporting: Fully integrated SAR creation functionality allows users to generate a pre-populated SAR straight from an Elder Abuse case, for fully trackable overnight e-filing directly with FinCEN, expediting and improving the information provided to law enforcement.

With real-time fraud analytics and end-to-end solutions, Verafin’s Fraud Detection and Management helps financial institutions prevent fraud losses and protect vulnerable customers from the damaging effects of financial exploitation.

Learn more in our on-demand Archived Webinar where we discuss the scale of Elder Financial Exploitation and outline key considerations from industry publications and guidance, including red flag indicators and best practices for reporting.